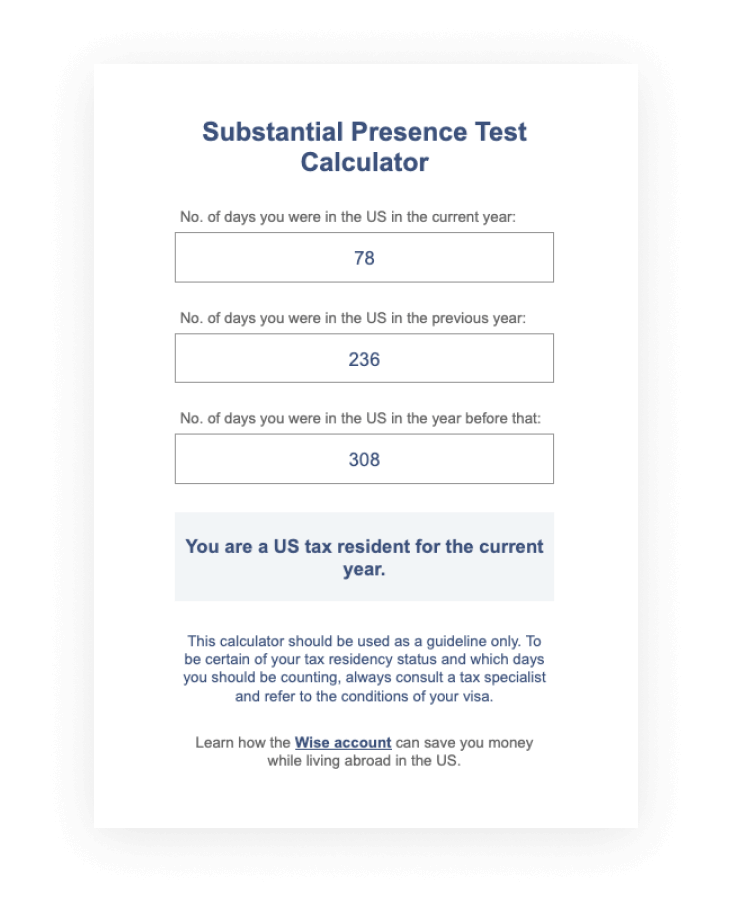

Substantial Presence Test Calculator Wise - First, there is the general exception to the substantial presence test available to all aliens under i.r.c. Once you meet the substantial presence test, you are considered a resident alien for the entire tax year, including periods when you were a nonresident. Completing form 8843 requires providing personal information, details of presence in the u.s., and submitting it by the. You should also read this: Witness Parvo Test

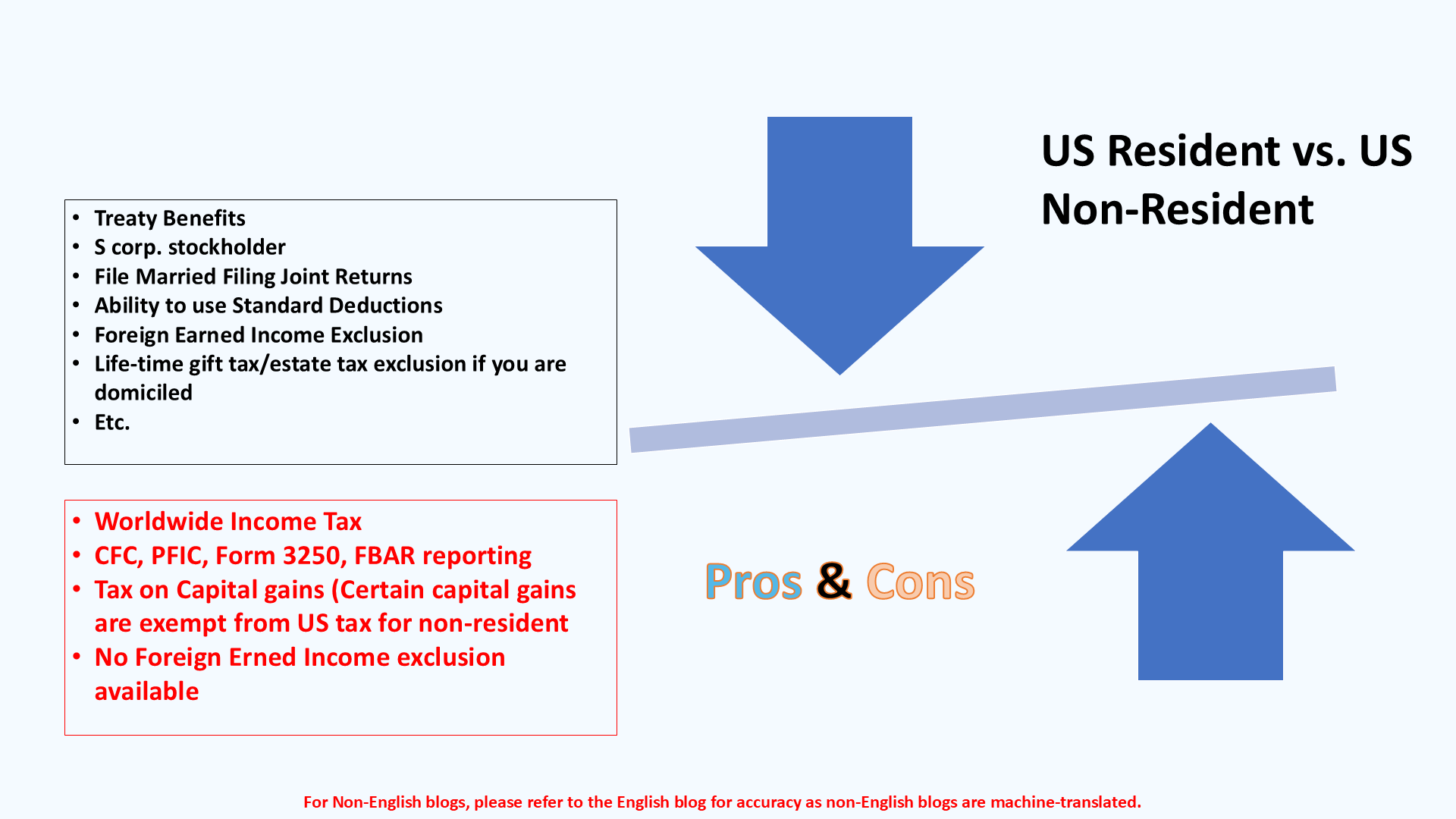

Substantial Presence Test Calculator And Guide - The green card test determines that you are a resident for tax purposes automatically the day when you become a lawful permanent resident. This test is a critical determinant used by the internal revenue service (irs) to assess tax liability. Learn how to determine your us tax residency status with our guide to the substantial presence test. To determine if. You should also read this: Battery Tester For Aa And Aaa Batteries

A Comprehensive Guide to the IRS Substantial Presence Test - The green card test determines that you are a resident for tax purposes automatically the day when you become a lawful permanent resident. Once you meet the substantial presence test, you are considered a resident alien for the entire tax year, including periods when you were a nonresident. Completing form 8843 requires providing personal information, details of presence in the. You should also read this: Will Lidocaine Show Up In A Drug Test

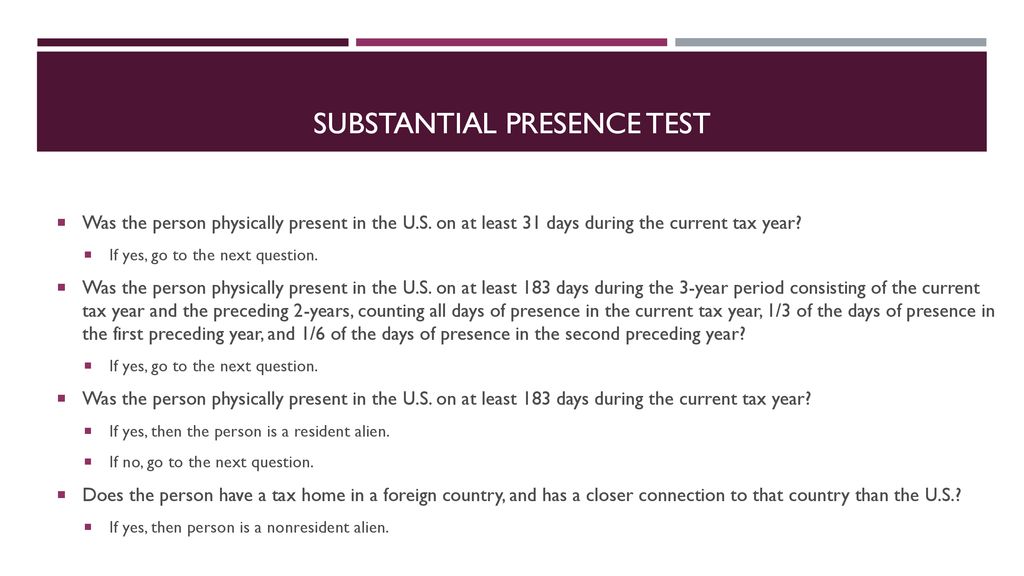

Unique filing status and exemption situations ppt download - To meet this test, you must be physically present in the united states (u.s.) on at least: The green card test and the substantial presence test an alien may become a resident alien by passing either the green card test or the substantial presence test as explained below. The substantial presence test (spt) is a. Once you meet the substantial. You should also read this: Complete Mobile Drug Testing Greenfield Wi

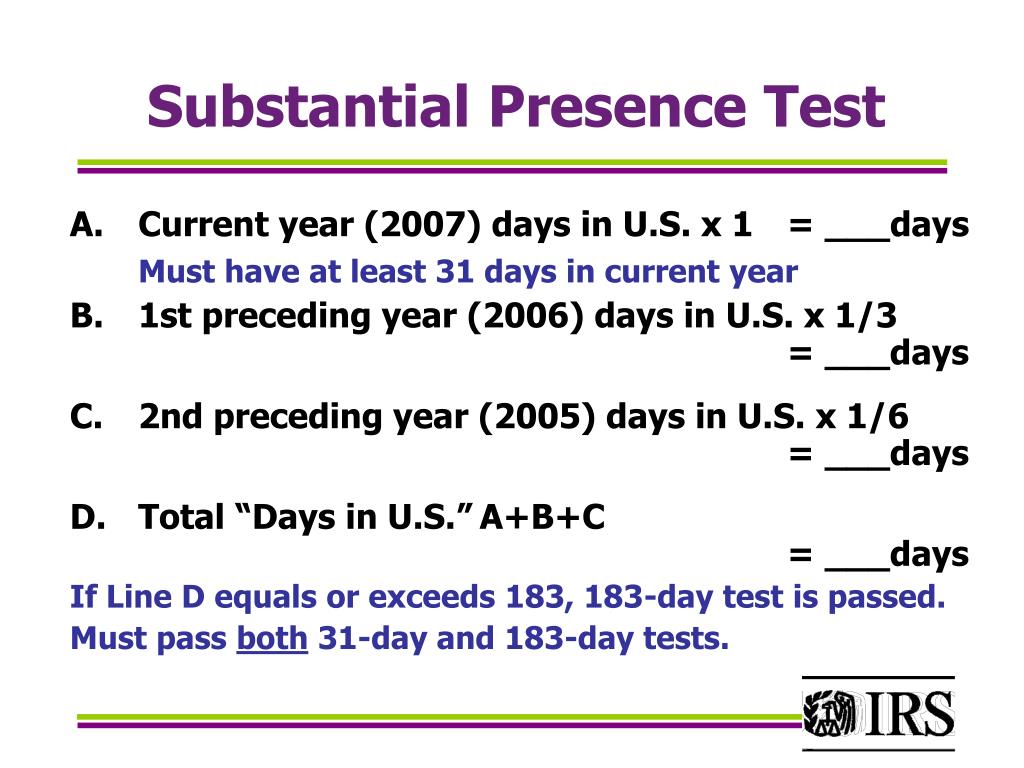

PPT Internal Revenue Service Wage and Investment Stakeholder - The irs substantial presence test is a criterion used to determine if an individual qualifies as a resident alien for tax purposes in the. Essentially, the spt is an irs formula used to determine if a person has been in the united states long enough to be taxed as a resident alien. Completing form 8843 requires providing personal information, details. You should also read this: Bioenergetic Testing Machine

Substantial Presence Test How to Calculate YouTube - The substantial presence test (spt) is a. The green card test determines that you are a resident for tax purposes automatically the day when you become a lawful permanent resident. Once you meet the substantial presence test, you are considered a resident alien for the entire tax year, including periods when you were a nonresident. This test applies to people. You should also read this: Do Sesame Seeds Show Up On A Drug Test

The Substantial Presence Test Tax Compliance Freeman Law - The substantial presence test method calculates the numbers of days a foreign national is physically present in the u.s. This test is a critical determinant used by the internal revenue service (irs) to assess tax liability. Once you meet the substantial presence test, you are considered a resident alien for the entire tax year, including periods when you were a. You should also read this: Test For Tibial Torsion

What is the Substantial Presence Test & How to Calculate it - The irs uses the substantial presence test (spt) to figure out if you qualify as a u.s. One crucial concept that frequently comes into play is the substantial presence test (spt). First, there is the general exception to the substantial presence test available to all aliens under i.r.c. As a general rule, you. The formula is a total of 183. You should also read this: Turquoise Tongue Test

What is the Substantial Presence Test & How to Calculate it - Essentially, the spt is an irs formula used to determine if a person has been in the united states long enough to be taxed as a resident alien. This test is a critical determinant used by the internal revenue service (irs) to assess tax liability. This test applies to people who aren't u.s. You were physically present in the u.s.. You should also read this: Embark Dna Test Coupon

Substantial Presence Test for U.S. Tax Purposes What Are the Basics - As a general rule, you. This test is a critical determinant used by the internal revenue service (irs) to assess tax liability. Once you meet the substantial presence test, you are considered a resident alien for the entire tax year, including periods when you were a nonresident. Essentially, the spt is an irs formula used to determine if a person. You should also read this: How To Test Compression On Diesel Engine