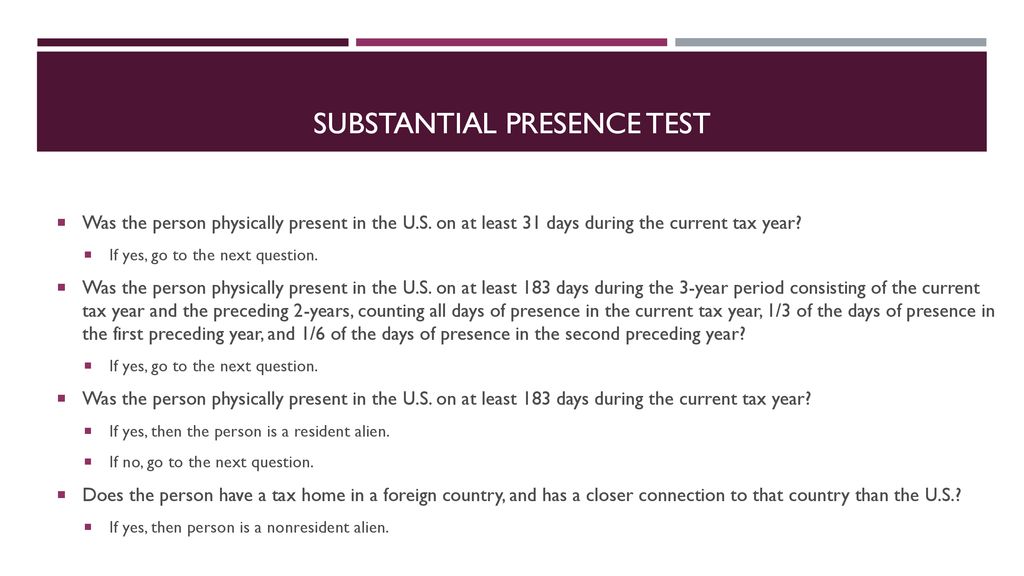

Substantial Presence Test for U.S. Tax Purposes What Are the Basics - The substantial presence test is a calculation that determines the resident or nonresident status of a foreign national for tax purposes in the united states. Person for federal tax purposes if he or she is physically present in the united states for 183 or more days during a calendar year,. To determine if you meet the substantial presence test for. You should also read this: Modified Stroke Test

What is the Substantial Presence Test & How to Calculate it - If you qualify to exclude days of presence as a student, you must file a. Please refer to the closer connection exception to the substantial presence test for foreign students. Person for federal tax purposes if he or she is physically present in the united states for 183 or more days during a calendar year,. No matter whether you arrived. You should also read this: F.a.s.t Test Meaning

Easy Substantial presence test calculator - Learn how to determine your us tax residency status with our guide to the substantial presence test. During this period do not count toward the. The substantial presence test (spt) is a. Please refer to the closer connection exception to the substantial presence test for foreign students. No matter whether you arrived to study, work or travel, the substantial presence. You should also read this: Color Guard Colon Test

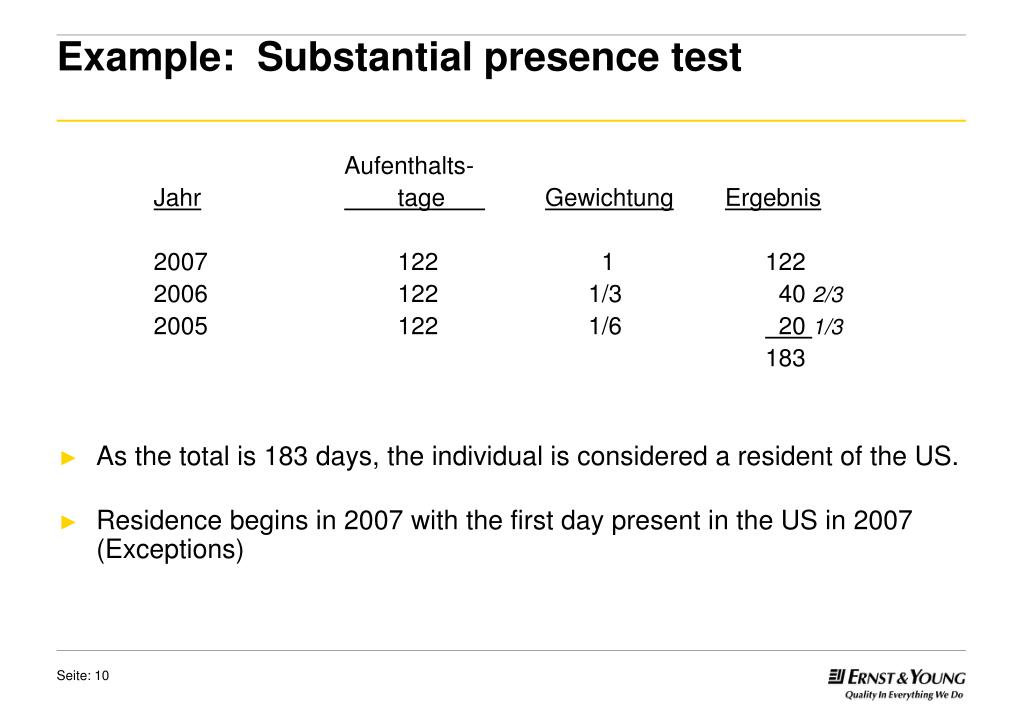

PPT The Taxation System of the U.S. Selected Topics on U.S. Taxation - That’s important when it comes to. After the five years period, you. You were physically present in the u.s. Learn how to determine your us tax residency status with our guide to the substantial presence test. The substantial presence test (spt) is a. You should also read this: Does Safeway Do Drug Tests

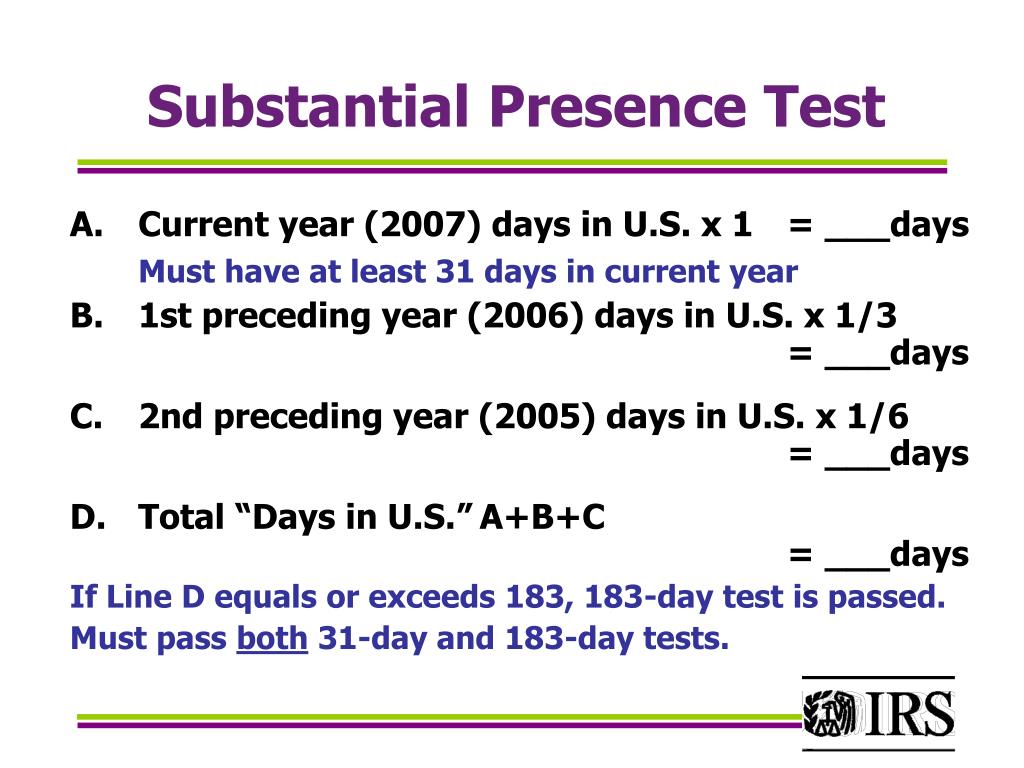

PPT Internal Revenue Service Wage and Investment Stakeholder - To determine if you meet the substantial presence test for 2023, count the full 120 days of presence in 2023, 40 days in 2022 (1/3 of 120), and 20 days in 2021 (1/6 of 120). The green card test determines that you are a resident for tax purposes automatically the day when you become a lawful permanent resident. Does not. You should also read this: When To Use A Independent T Test

Unique filing status and exemption situations ppt download - The substantial presence test is a calculation that determines the resident or nonresident status of a foreign national for tax purposes. On 120 days in each of the years 2021, 2022 and 2023. To determine if you meet the substantial presence test for 2023, count the full 120 days of presence in 2023, 40 days in 2022 (1/3 of 120),. You should also read this: Bile Malabsorption Test

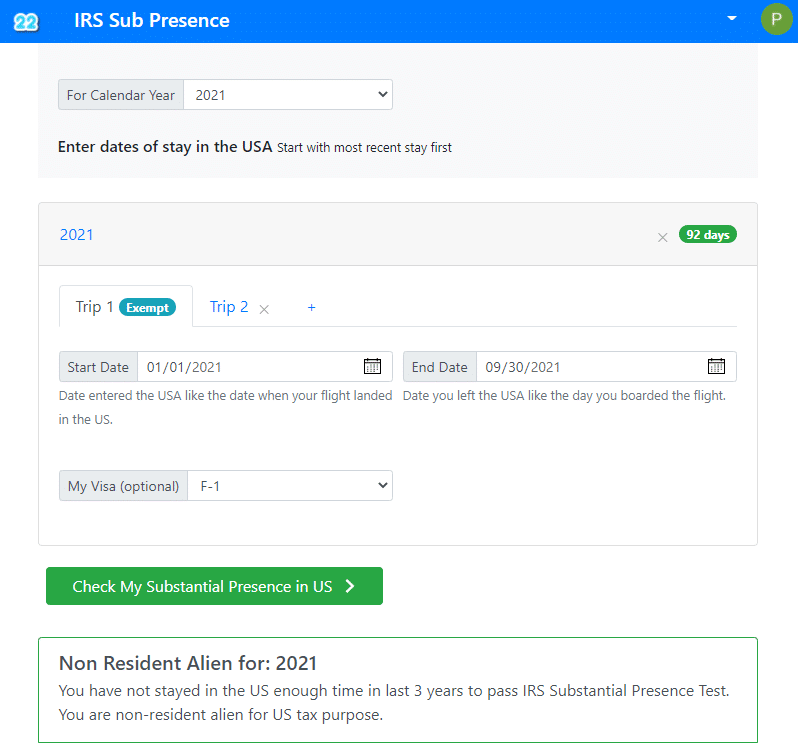

IRS Substantial Presence Test Calculator (All Visa Types) AM22Tech - You were physically present in the u.s. Person for federal tax purposes if he or she is physically present in the united states for 183 or more days during a calendar year,. To determine if you meet the substantial presence test for 2023, count the full 120 days of presence in 2023, 40 days in 2022 (1/3 of 120), and. You should also read this: Risk-based Testing

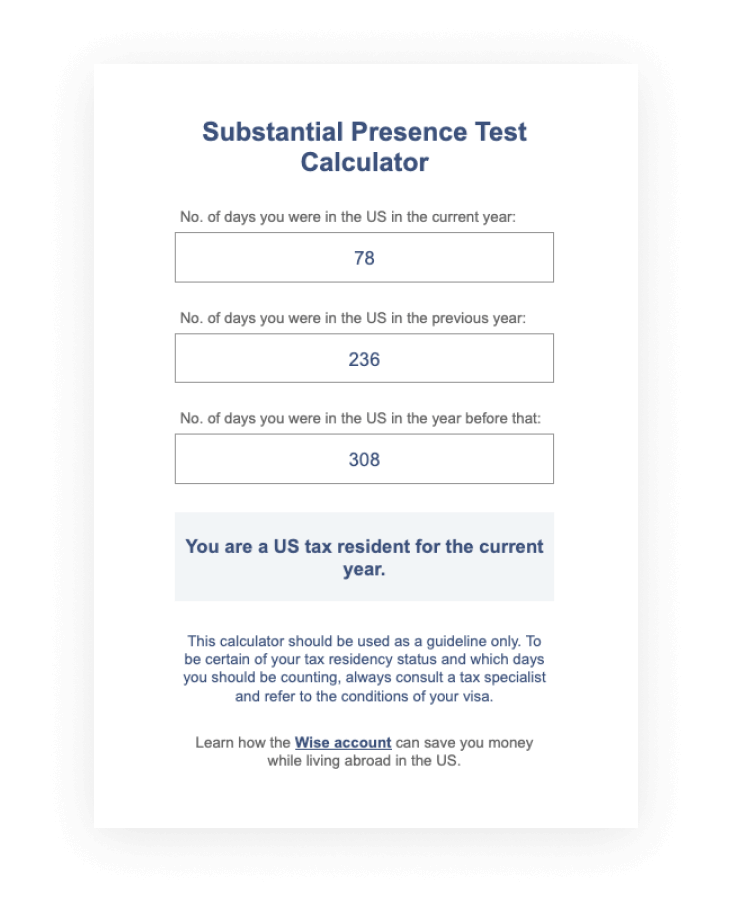

Substantial Presence Test Calculator Wise - It provides that an alien individual is classified as a u.s. The counting rules are based on. You were physically present in the u.s. Learn how to determine your us tax residency status with our guide to the substantial presence test. The substantial presence test is a calculation that determines the resident or nonresident status of a foreign national for. You should also read this: Caloric Ear Test

Substantial Presence Test How to Calculate YouTube - Does not have a green card. You were physically present in the u.s. Form 8843 exempts f1 students from the substantial presence test,. The counting rules are based on. F1 visa holders are typically classified as “exempt individuals” for their first five calendar years, meaning days spent in the u.s. You should also read this: Does Academy Sports Drug Test

If I switched from F1 to H1B in 2021 and pass the Fishbowl - Does not have a green card. The test must be applied on a yearly basis. To determine if you meet the substantial presence test for 2023, count the full 120 days of presence in 2023, 40 days in 2022 (1/3 of 120), and 20 days in 2021 (1/6 of 120). The green card test determines that you are a resident. You should also read this: Hazmat Practice Test Tn