The Substantial Presence Test How to Calculate It with Examples - After five years of being present in the u.s. After the five years period, you. The substantial presence test is a calculation that determines the resident or nonresident status of a foreign national for tax purposes. The formula is a total of 183 days to be. Essentially, the spt is an irs formula used to determine if a person has. You should also read this: America's Test Kitchen Stollen Recipe

How to use substantial presence test calculator YouTube - Under an f1 visa, or if you meet the substantial presence test sooner, you may be considered a resident alien for tax purposes. Essentially, the spt is an irs formula used to determine if a person has been in the united states long enough to be taxed as a resident alien. The test must be applied on a yearly basis.. You should also read this: Insure One Fecal Test

Substantial Presence Test How to Calculate YouTube - If you enter the us on this type of visa, you’re classified as an exempt individual for 5 calendar years (2016 through 2020).days in the. As of january 1, 2018 you would need to start to count days of presence in the us to see when you meet the substantial presence test. On 120 days in each of the years. You should also read this: Msafp Blood Test

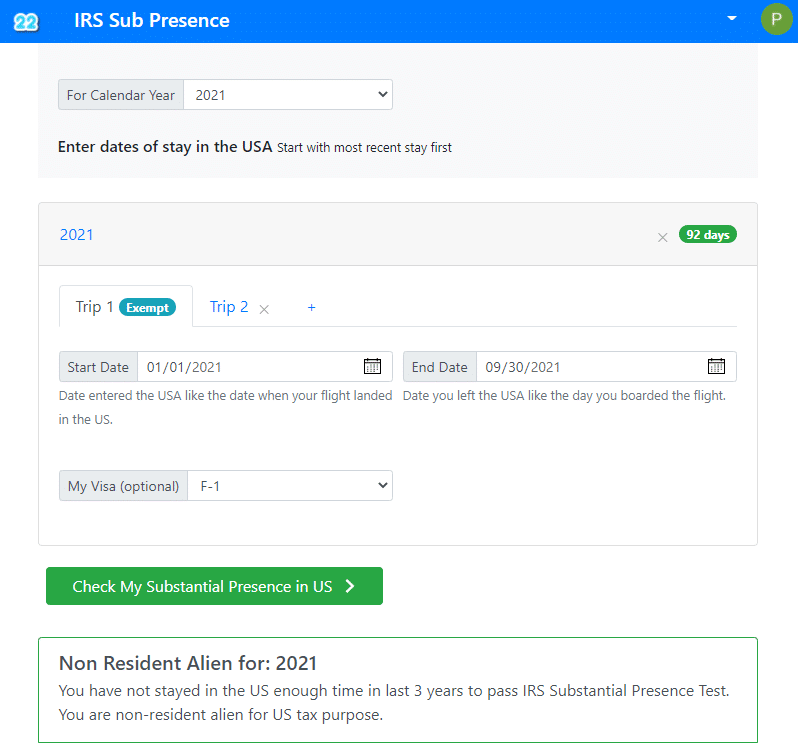

IRS Substantial Presence Test Calculator (All Visa Types) AM22Tech - The formula is a total of 183 days to be. After the five years period, you. After five years of being present in the u.s. Whether you have taken affirmative steps to change your status from nonimmigrant to lawful permanent resident as discussed under closer connection to a foreign country. During this period do not count toward the. You should also read this: Labrum Tear Special Test

Substantial Presence Test for U.S. Tax Purposes What Are the Basics - To meet the substantial presence test, an individual must be physically present in the u.s. The substantial presence test (spt) is a. Once they become a resident alien under the substantial presence test they. Form 8843 exempts f1 students from the substantial presence test,. Under an f1 visa, or if you meet the substantial presence test sooner, you may be. You should also read this: Valgus Varus Stress Test Elbow

Substantial Presence Test Finance and Treasury - During this period do not count toward the. After five years, you need to count your. F1 and j1 student visa holders may exempt 5 calendar years of presence for purposes of the substantial presence test. After the five years period, you. The substantial presence test is a calculation that determines the resident or nonresident status of a foreign national. You should also read this: Mn Road Test Score Sheet

What is the Substantial Presence Test & How to Calculate it - F1 and j1 student visa holders may exempt 5 calendar years of presence for purposes of the substantial presence test. After five years of being present in the u.s. Form 8843 exempts f1 students from the substantial presence test,. Under an f1 visa, or if you meet the substantial presence test sooner, you may be considered a resident alien for. You should also read this: Abdeckplane Motorrad Test

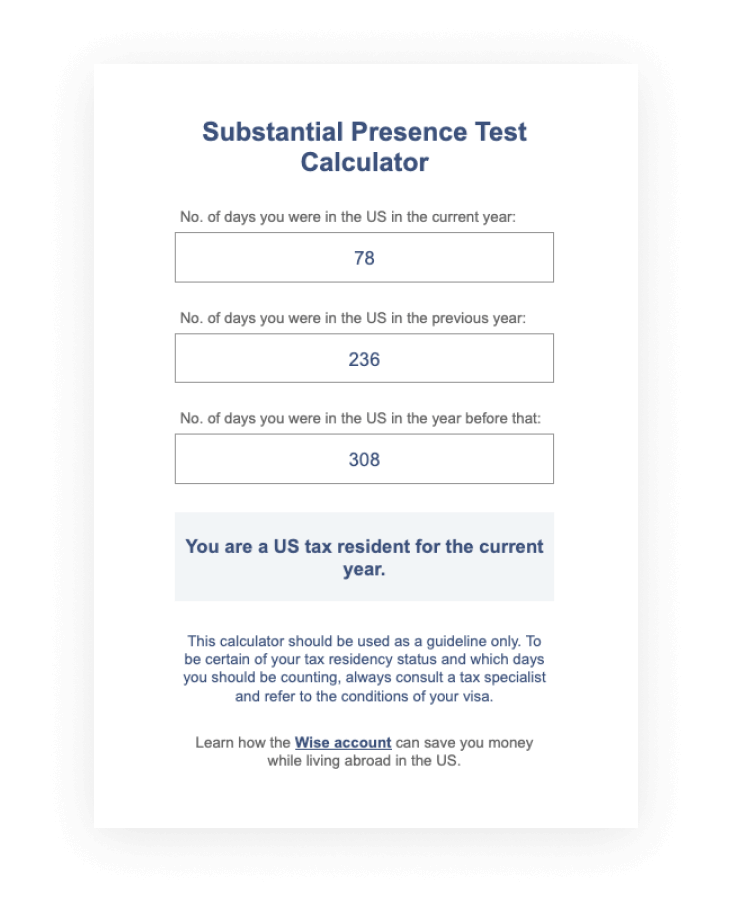

Substantial Presence Test Calculator Wise - Essentially, the spt is an irs formula used to determine if a person has been in the united states long enough to be taxed as a resident alien. The substantial presence test (spt) is a. Under an f1 visa, or if you meet the substantial presence test sooner, you may be considered a resident alien for tax purposes. To determine. You should also read this: Manual Testing Entry Level Jonbs

The Substantial Presence Test Tax Compliance Freeman Law - Essentially, the spt is an irs formula used to determine if a person has been in the united states long enough to be taxed as a resident alien. Form 8843 exempts f1 students from the substantial presence test,. To determine if you meet the substantial presence test for 2023, count the full 120 days of presence in 2023, 40 days. You should also read this: Danbury Ct Emissions Testing

Easy Substantial presence test calculator - The green card test determines that you are a resident for tax purposes automatically the day when you become a lawful permanent resident. You will be considered a united states. You were physically present in the u.s. International students are exempt from the substantial presence test for the first five years in the us. As of january 1, 2018 you. You should also read this: Sharpey's Test