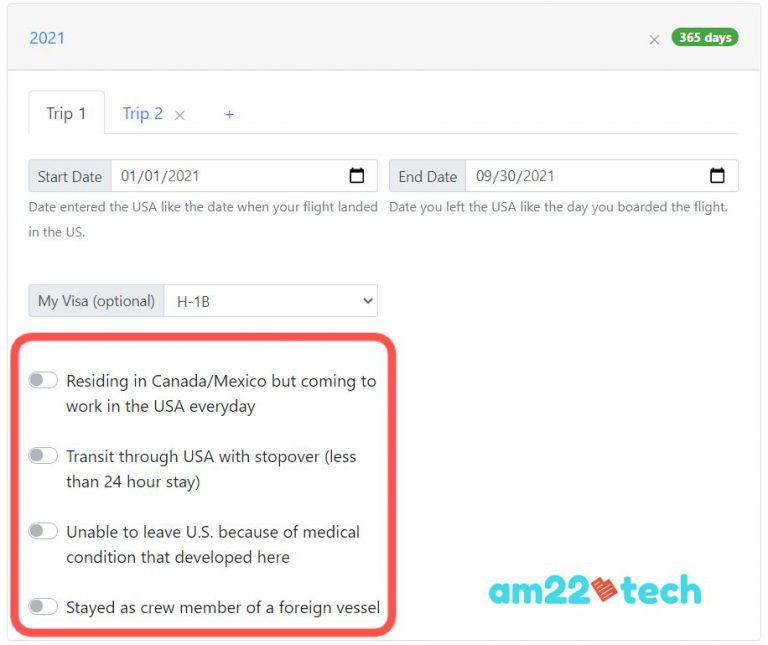

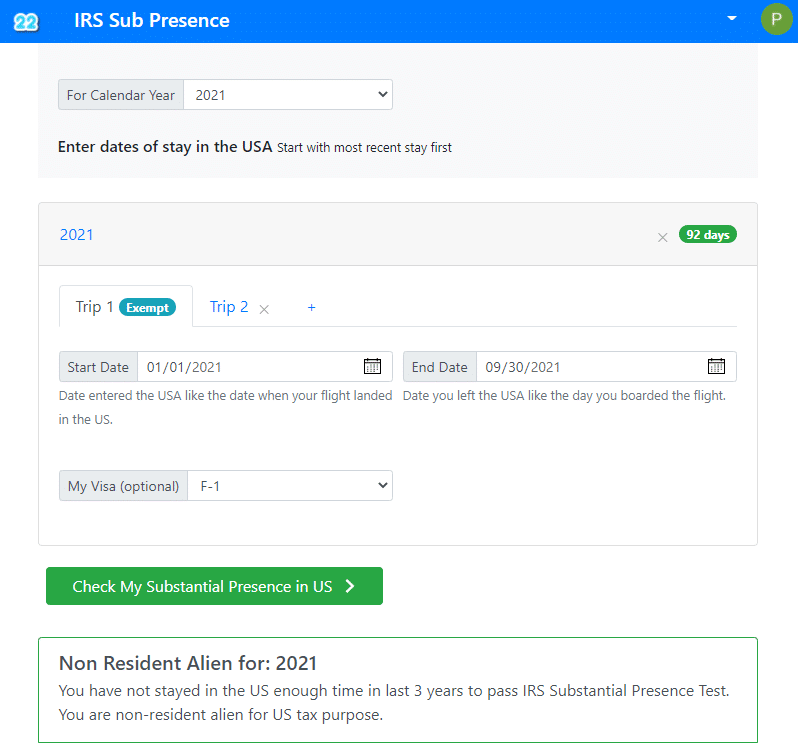

IRS Substantial Presence Test Calculator for All Visa Types AM22Tech - We will explain how to calculate days of presence in the united states (as outlined by the irs) below. If you’re struggling to calculate whether your time in the u.s. Passes the substantial presence test, you can use an automated calculator. The total number of days physically present in the united states must be at least 180 days to be. You should also read this: Schamroth's Window Test

Substantial Presence Test Calculator 2024 - Find out if you meet the criteria of the substantial presence test (spt) for us tax purposes as a canadian snowbird. The total number of days physically present in the united states must be at least 180 days to be considered a resident under the substantial presence test for 2021. Use this tool to determine your us tax residency based. You should also read this: Melanoma In Blood Test

Substantial Presence Test Calculator And Guide - Learn about the substantial presence test, the closer connection. The substantial presence test is key in determining whether you are considered a resident or nonresident alien for tax purposes. The total number of days physically present in the united states must be at least 180 days to be considered a resident under the substantial presence test for 2021. Determine your. You should also read this: Indeed Test Score Ratings

IRS Substantial Presence Test Calculator (All Visa Types) AM22Tech - The substantial presence test is key in determining whether you are considered a resident or nonresident alien for tax purposes. The total number of days physically present in the united states must be at least 180 days to be considered a resident under the substantial presence test for 2021. Calculate your us tax residency status using the substantial presence test. You should also read this: Paired T Test Equation

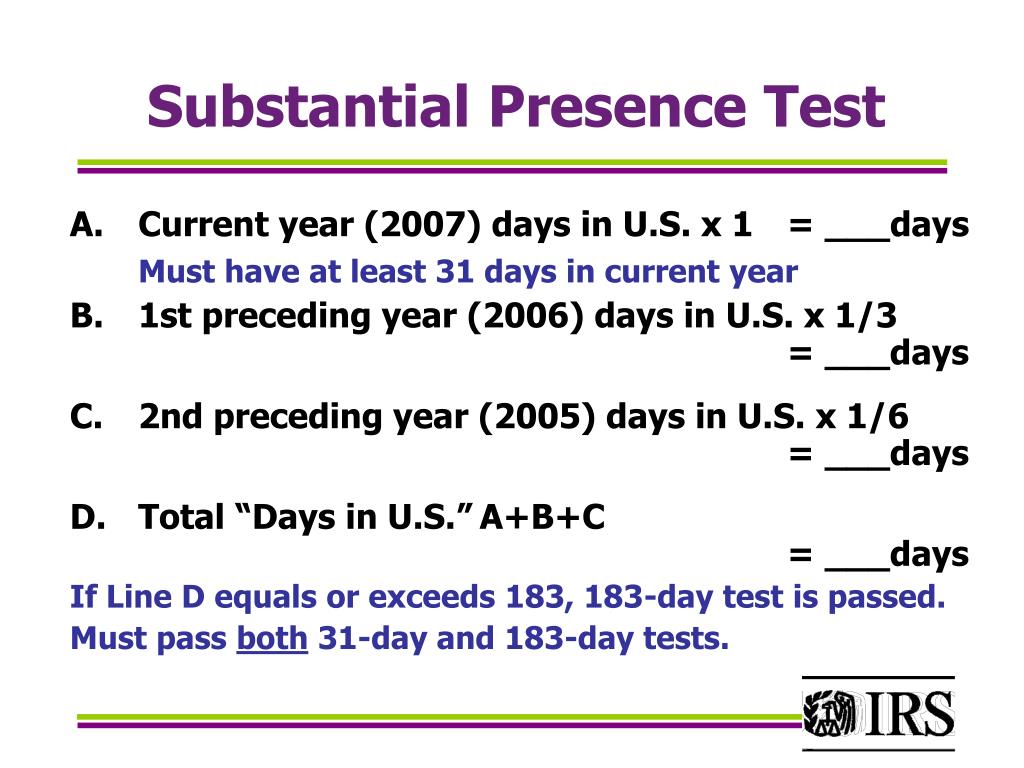

IRS Substantial Presence Test Calculator (All Visa Types) AM22Tech - A calculation of the number of days of physical presence in the u.s. 120 days (current year) + 20 days (1/3 of 60 days in 2023) + 5 days (1/6 of 30 days in 2022) = 145 days. The substantial presence test is key in determining whether you are considered a resident or nonresident alien for tax purposes. Determine your. You should also read this: Golf Ball Size Lump After Blood Test

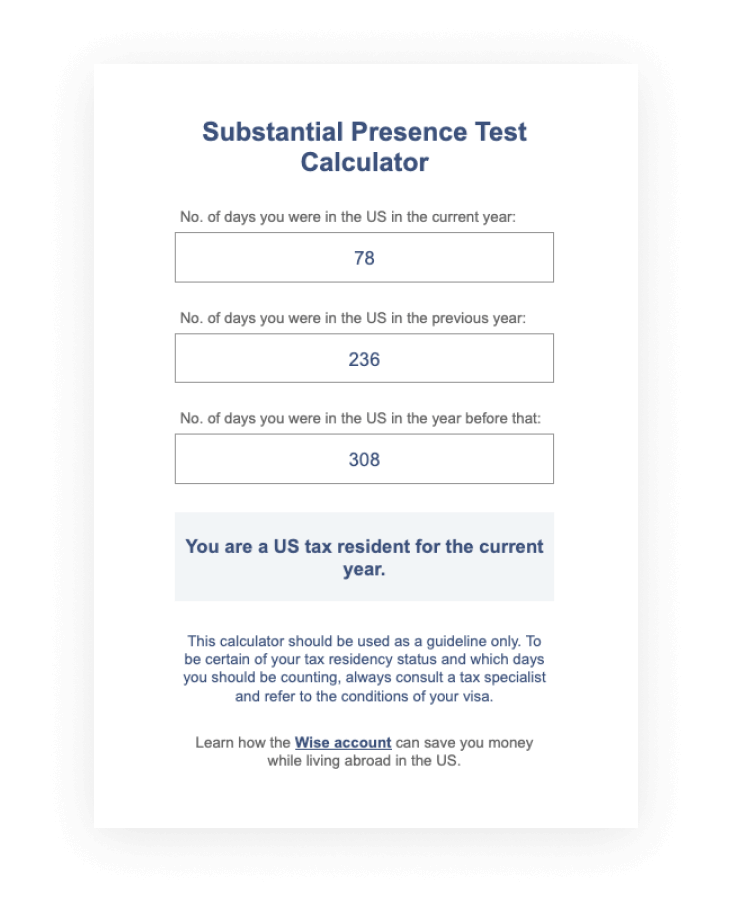

Easy Substantial presence test calculator - Learn about the substantial presence test, the closer connection. Using the substantial presence test, we calculate her days as follows: Calculate your us tax residency status with our free substantial presence test calculator. Learn about the test criteria, the closer connection exception and how to file form. One such calculator can be. You should also read this: Temu Product Tester Job

Substantial Presence Test Calculator Wise - 120 days (current year) + 20 days (1/3 of 60 days in 2023) + 5 days (1/6 of 30 days in 2022) = 145 days. Use the calculator to enter your days spent in the us and get the result. But first, it’s important to note that the substantial presence test specifically. Learn about the test criteria, the closer connection. You should also read this: Clearblue Plus Pregnancy Test

sherycove Blog - Find out if you meet the criteria of the substantial presence test (spt) for us tax purposes as a canadian snowbird. Track your days and determine irs residency criteria instantly. Learn about the substantial presence test, the closer connection. If you’re struggling to calculate whether your time in the u.s. But first, it’s important to note that the substantial presence. You should also read this: Iacssp Change 9 Test Answers

PPT Internal Revenue Service Wage and Investment Stakeholder - Find out if you meet the criteria of the substantial presence test (spt) for us tax purposes as a canadian snowbird. 120 days (current year) + 20 days (1/3 of 60 days in 2023) + 5 days (1/6 of 30 days in 2022) = 145 days. If you’re struggling to calculate whether your time in the u.s. Calculate your us. You should also read this: Bnp Blood Test Tube Color

How to use substantial presence test calculator YouTube - The total number of days physically present in the united states must be at least 180 days to be considered a resident under the substantial presence test for 2021. One such calculator can be. Track your days and determine irs residency criteria instantly. Calculate your us tax residency status with our free substantial presence test calculator. Calculate your us tax. You should also read this: Resolve Test Prep