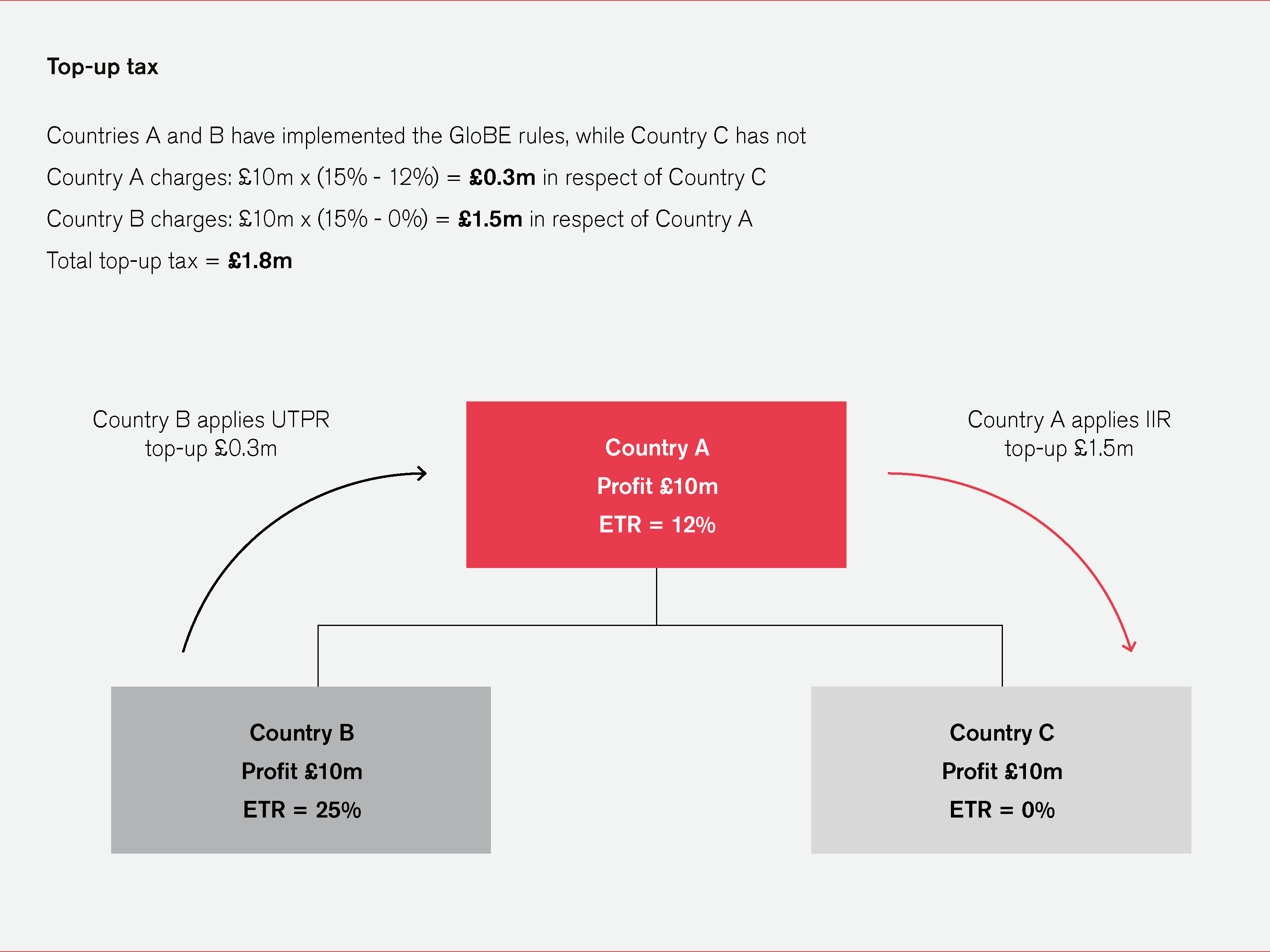

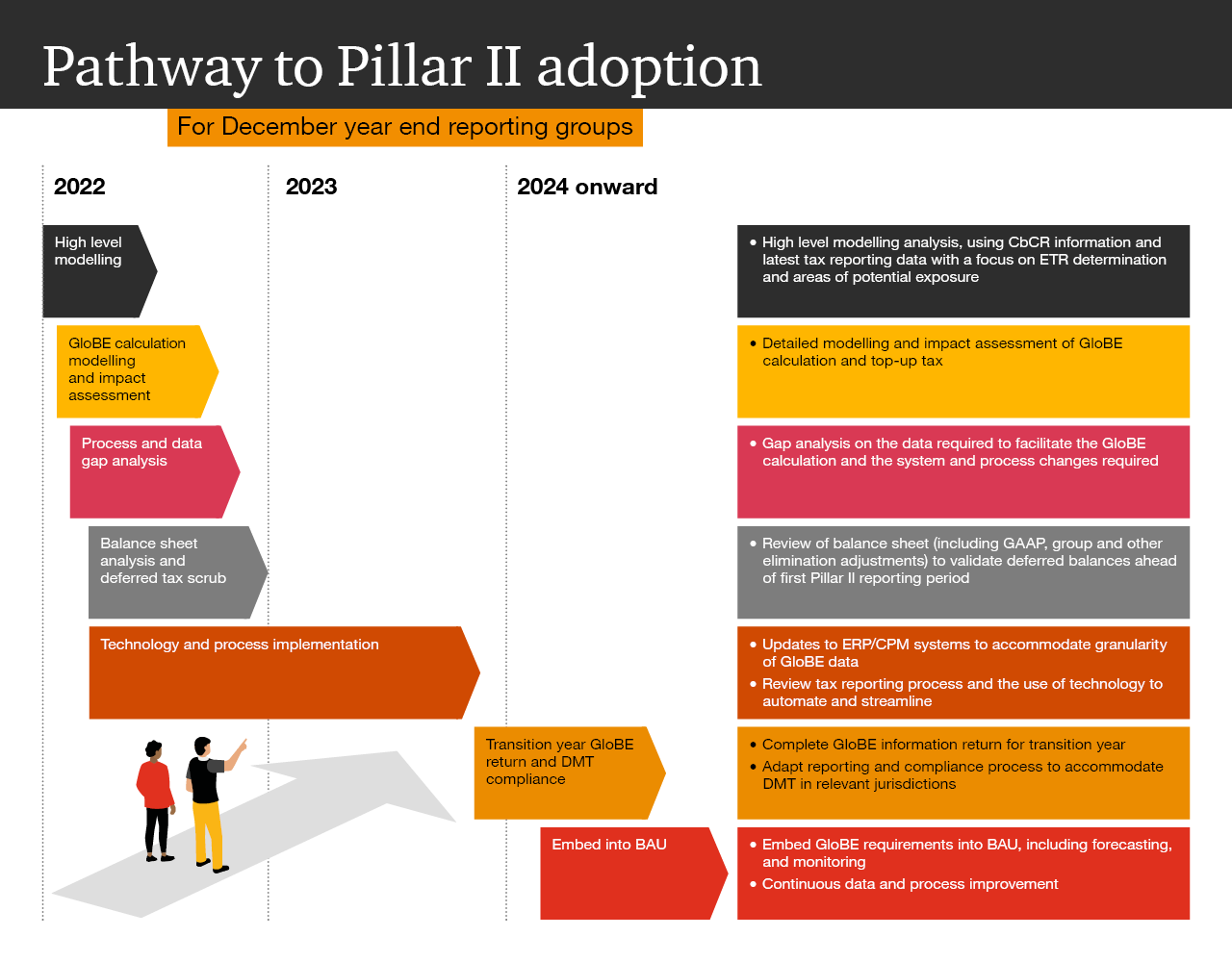

Pillar 2 framework Executive Summary - The simplified etr test, which is met if the etr calculated by comparing the covered taxes reported in the group’s accounts for a jurisdiction to the pbt reported for that. A “simplified etr test” (mne has a simplified etr. The simplified etr for a jurisdiction is at least 15% for 2024 (16% for 2025, 17% for 2026). The simplified etr. You should also read this: Vitamin B Lab Test

Pillar 2 Elections Explained Election to Spread Capital Gains - The guidance also provides clarification regarding the etr computation and the routine profit test. A “de minimis test” (mne has total revenue less than eur10 million, and profit (loss) before tax less than eur1 million based on cbcr). Including more details on the definition of qfss, the computation of the simplified etr and routine profits test, including in circumstances when. You should also read this: Brain Test Unblocked

PPT Pillar 2 and Pillar 3 of Solvency II PowerPoint Presentation - The simplified etr is calculated by dividing the simplified covered taxes (income tax expense reported in the mne’s financial statements, minus any taxes that are not covered taxes or. (2) simplified effective tax rate (“etr”); The simplified etr for a country is calculated by dividing the sh taxes by the pbt. A charging provision would apply if the etr. The. You should also read this: Faint Line On Blue Dye Pregnancy Test

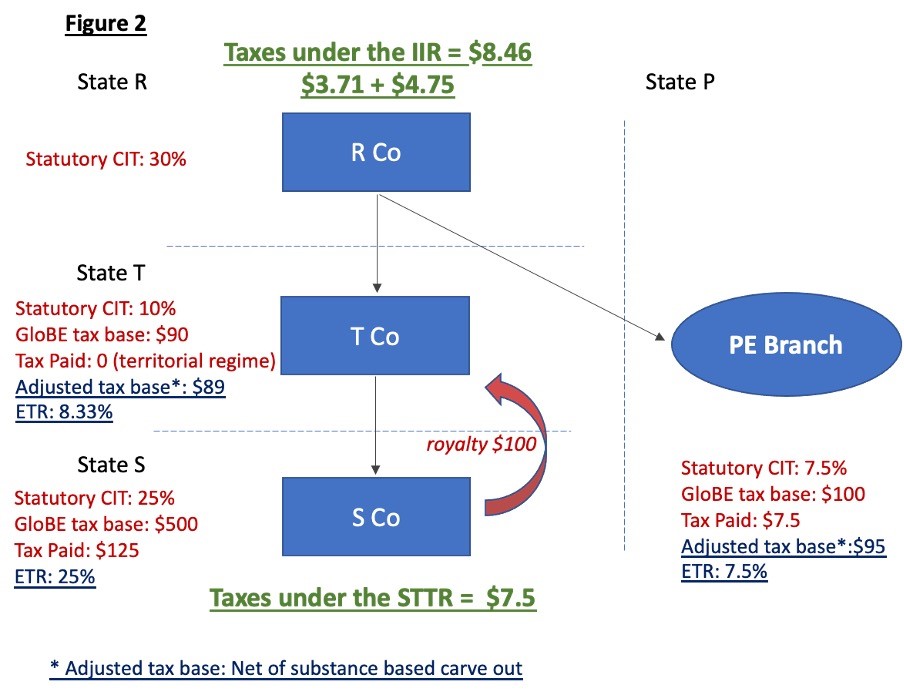

Better understand the mechanics of the PillarTwo / GloBE Rules - Jurisdictions where they are eligible for one of three safe harbour tests: A charging provision would apply if the etr. The simplified etr is calculated by dividing the simplified covered taxes (income tax expense reported in the mne’s financial statements, minus any taxes that are not covered taxes or. The simplified etr for a country is calculated by dividing the. You should also read this: Egg Freshness Water Test

Pillar 2 Tax and Longview insightsoftware - The simplified etr test, which is met if the etr calculated by comparing the covered taxes reported in the group’s accounts for a jurisdiction to the pbt reported for that. These simplified calculations safe harbours would permit the mne to rely on simplified income, revenue, and tax calculations in determining whether it meets the de minimis, routine profits or. The. You should also read this: Ap Biology Unit 7 Test

Pillar Two Transitional CbCR Safe Harbour Modelling Tool - The simplified etr is calculated by dividing the simplified covered taxes (income tax expense reported in the mne’s financial statements, minus any taxes that are not covered taxes or. The guidance also provides clarification regarding the etr computation and the routine profit test. The simplified etr needs to be at least the transition rate specified for. The simplified etr for. You should also read this: Galleri Test Requisition Form

The Pillar Two Mechanism in Light of the Blueprint A Case Study - The simplified etr for a jurisdiction is at least 15% for 2024 (16% for 2025, 17% for 2026). The etr is calculated using profit or loss before income tax. These simplified calculations safe harbours would permit the mne to rely on simplified income, revenue, and tax calculations in determining whether it meets the de minimis, routine profits or. A “simplified. You should also read this: Amherst Driving Test Site

Pillar Two proposals what you need to know Lexology - Jurisdictions where they are eligible for one of three safe harbour tests: A charging provision would apply if the etr. Assess the safe harbor impact. The mne group has a simplified etr that is equal to or greater than the transition rate in a jurisdiction for the fiscal year. A kpmg report on this guidance is. You should also read this: Late-night Salivary Cortisol Test Instructions

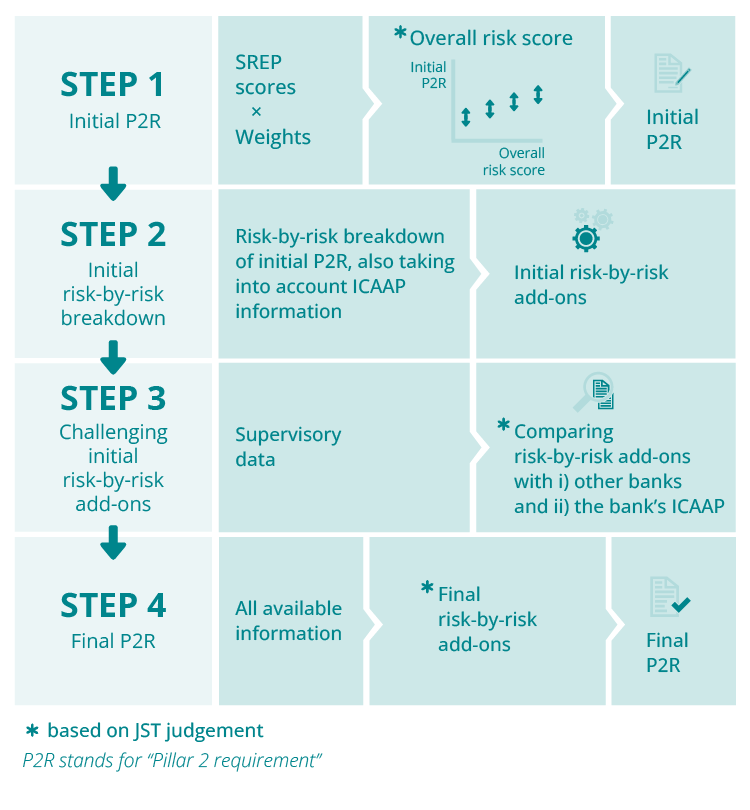

How the Pillar 2 requirement is set - A kpmg report on this guidance is. (2) simplified effective tax rate (“etr”); Subject to agreed administrative guidance, these simplified calculations provide mnes with a pathway to streamline compliance. The third administrative guidance clarifies the design and operation of the transitional cbcr safe harbour rules in respect of joint ventures, use of qualified financial statements, simplified etr. The simplified etr. You should also read this: Lachman Test Acl

Pillar 2 A pathway forward PwC UK - The simplified etr for a jurisdiction is at least 15% for 2024 (16% for 2025, 17% for 2026). These simplified calculations safe harbours would permit the mne to rely on simplified income, revenue, and tax calculations in determining whether it meets the de minimis, routine profits or. Including more details on the definition of qfss, the computation of the simplified. You should also read this: Msu Placement Test