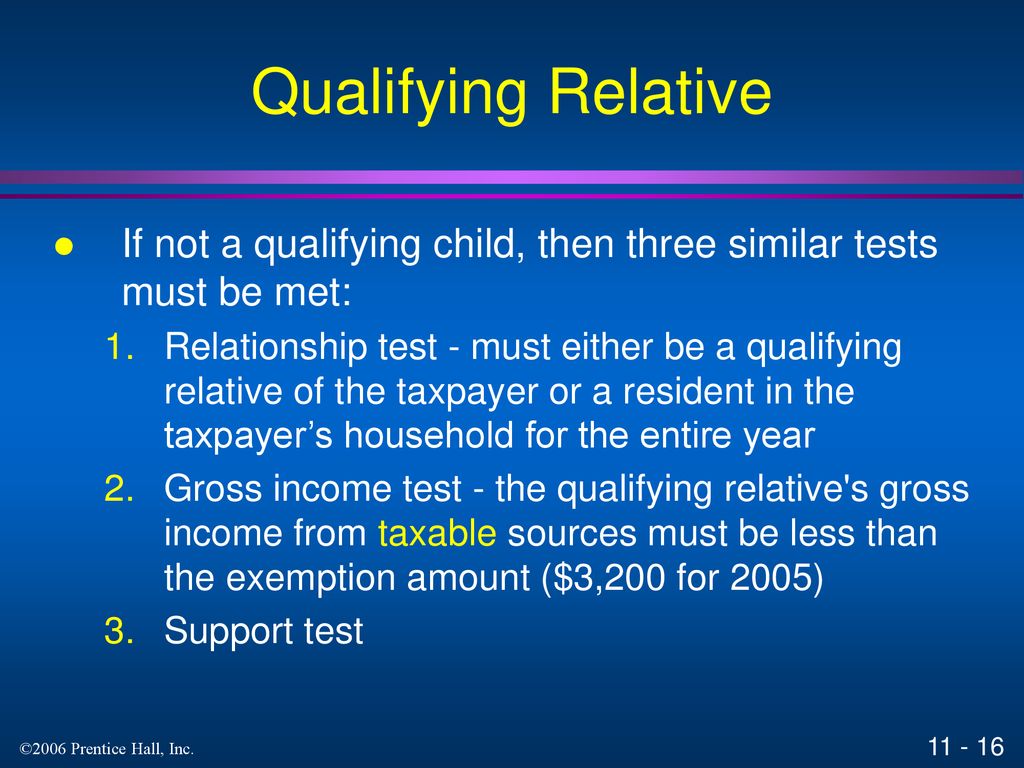

Taxation of Individuals ppt download - If someone is your qualifying relative, then you can claim them as a dependent on your tax return. Review module 4 tax tutorial for the definition of a qualifying child. How do you determine if a dependent is a qualifying child or qualifying relative? Visit the irs website by clicking here. Member of household test — qualifying relative. You should also read this: West Bend Emissions Testing

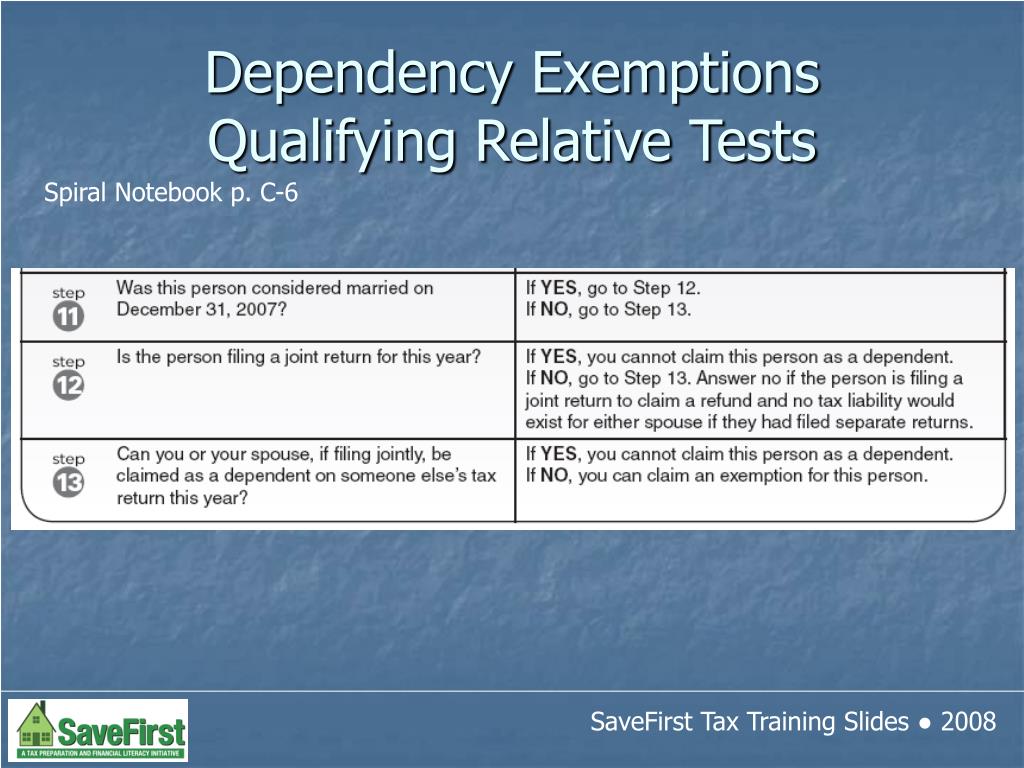

Tax Formula and Tax Determination; ppt download - A qualifying relative must meet general rules for dependents and pass these tests: If someone is your qualifying relative, then you can claim them as a dependent on your tax return. Understand the criteria and requirements for claiming a qualifying relative on your taxes, including relationship, residency, income, and support tests. Was the person married as of december 31, 2020?. You should also read this: Dollar Tree Drug Test Kit

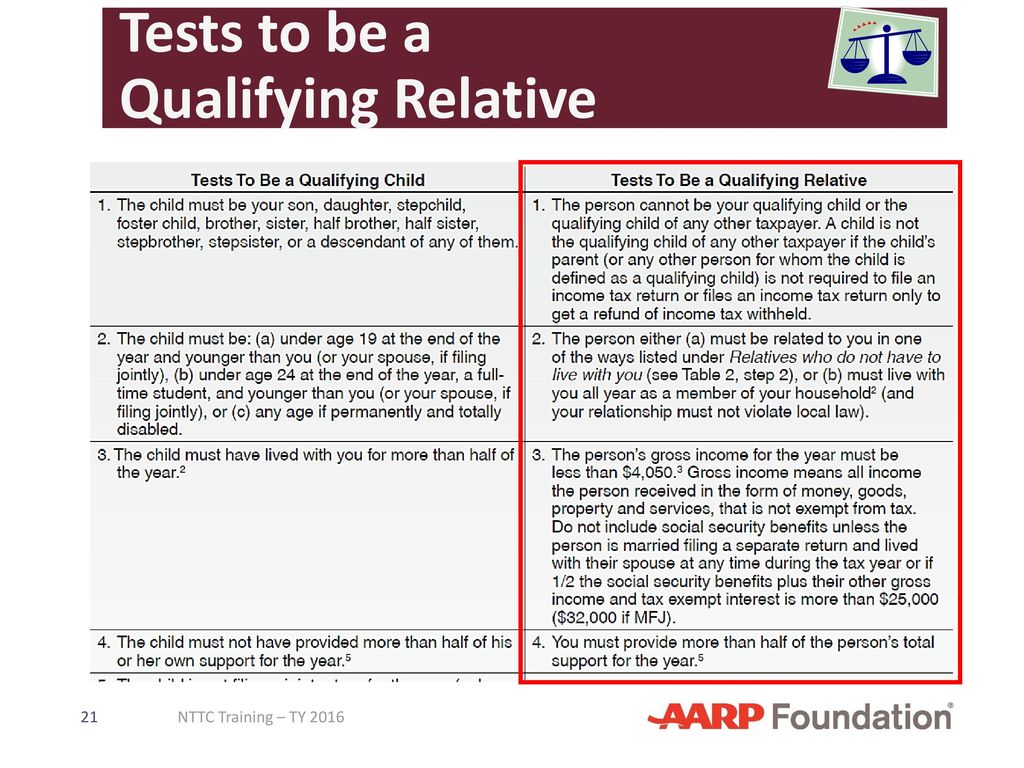

Pub 4012 Tab C Pub 4491 Part 2 Lessons 6 and 7 ppt download - To claim a dependency exemption for a qualifying child or a qualifying relative, these three tests must be met: Depending on their age and other factors, you might qualify for a $500 credit for other. Taxpayers will meet the member of household test for persons who live with them under the following conditions: The person can't be your qualifying child. You should also read this: When You Are Pregnant Do They Test For Herpes

PPT SaveFirst A Tax Preparation and Financial Literacy Initiative - A qualifying relative must meet general rules for dependents and pass these tests: (to claim a qualifying relative dependent, you must first meet the dependent taxpayer, joint return and citizen or. Depending on their age and other factors, you might qualify for a $500 credit for other. You can use the irs interactive tool to assist you in determining who. You should also read this: Emissions Testing In Aurora Colorado

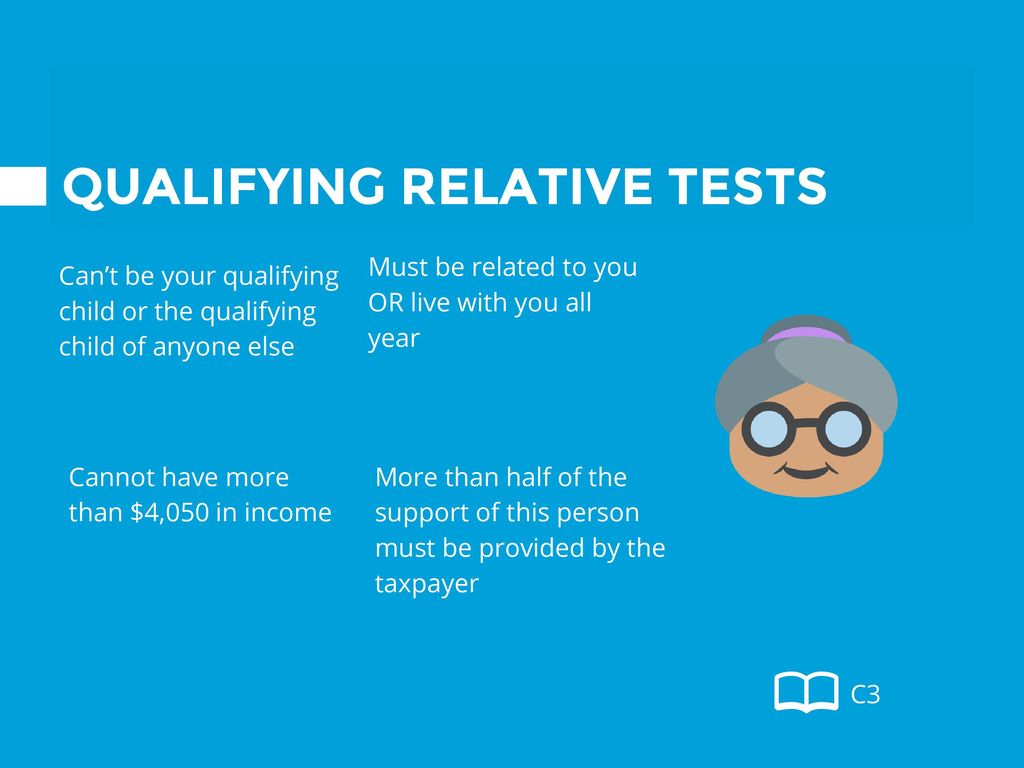

Qualifying Child Test versus Qualifying Relative Test. CPA/EA Exam - The person can't be your qualifying child or the qualifying child of any other taxpayer. Visit the irs website by clicking here. Taxpayers will meet the member of household test for persons who live with them under the following conditions: To claim a dependency exemption for a qualifying child or a qualifying relative, these three tests must be met: Is. You should also read this: Atls Post Test Answers

EKS 2 SCENARIOBASED TRAINING ppt download - These tests must be met for all dependents. Begin with this table to determine both qualifying child and qualifying relative dependents. The person can't be your qualifying child or the qualifying child of any other taxpayer. Was the person married as of december 31, 2020? Visit the irs website by clicking here. You should also read this: When Is The Pearsons Test Center Rogers Times Open

Personal and Dependency Exemptions ppt download - Was the person married as of december 31, 2020? They may also qualify for the child tax credit , credit for other dependents,. Can you claim a relative, parent or friend as a dependent? Taxpayers will meet the member of household test for persons who live with them under the following conditions: Visit the irs website by clicking here. You should also read this: Uga Test Optional

PPT Chapter 3 PowerPoint Presentation, free download ID5982320 - Is the person filing a joint return for this tax. (to claim a qualifying relative dependent, you must first meet the dependent taxpayer, joint return and citizen or. They may also qualify for the child tax credit , credit for other dependents,. To meet the qualifying child test, your child must be. State or local law must treat the child. You should also read this: Jal Shark Skin Coating Test

PPT Chapter 2 PowerPoint Presentation, free download ID2470830 - To claim a dependency exemption or a tax credit for dependents, the dependent must satisfy the requirements for a qualifying child or relative, the primary requirement being that the taxpayer. In case an individual does not qualify as a dependent on your tax return, answer a few simple questions below. Live with you all year as a member of your. You should also read this: Instron Tensile Tester Price

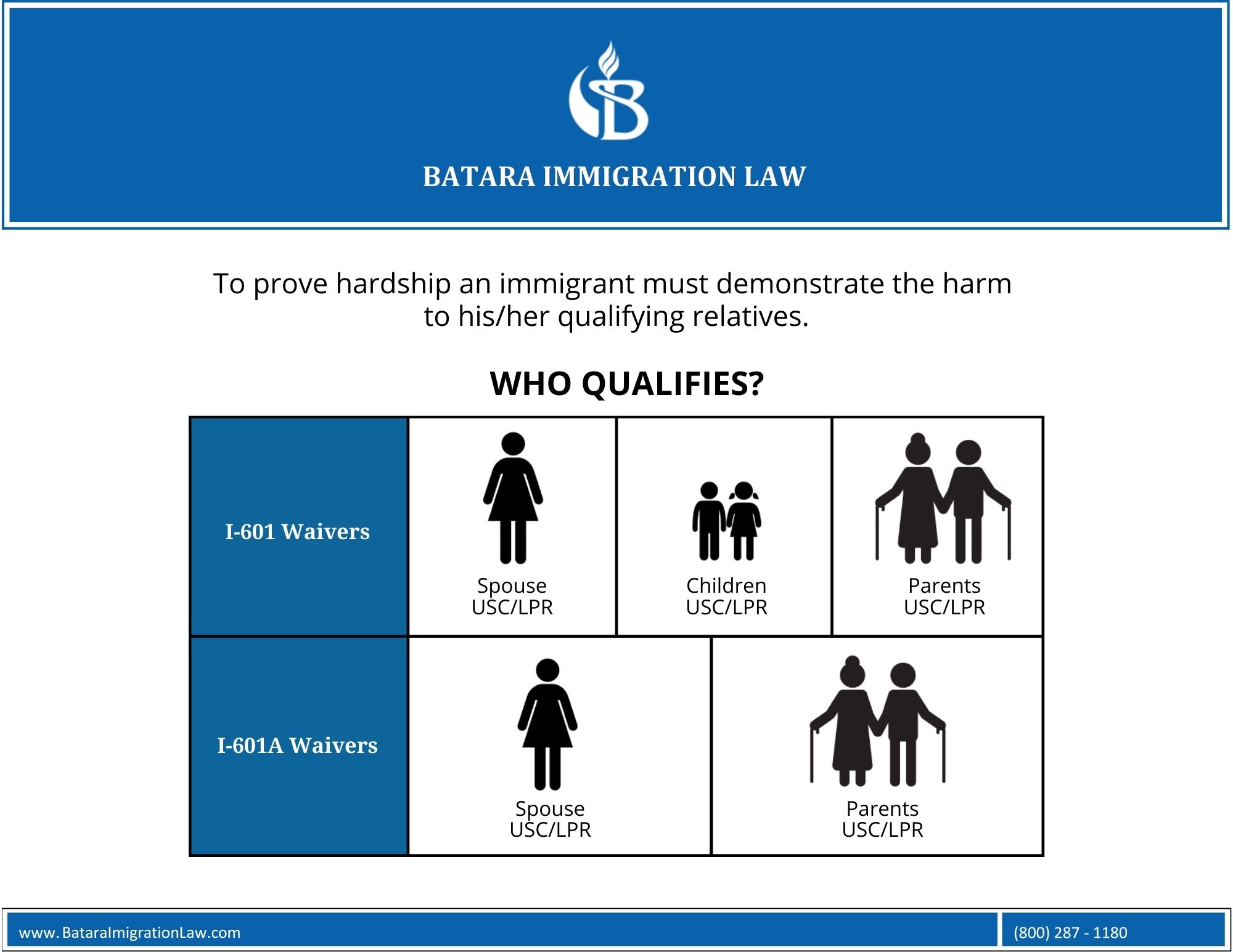

Qualifying Relatives The Key To I601 And I601A Waiver Success - If someone is your qualifying relative, then you can claim them as a dependent on your tax return. The person either (a) must be related to you in one of the ways listed. A qualifying relative must meet general rules for dependents and pass these tests: To claim a dependency exemption or a tax credit for dependents, the dependent must. You should also read this: Adhd Testing Wichita Ks