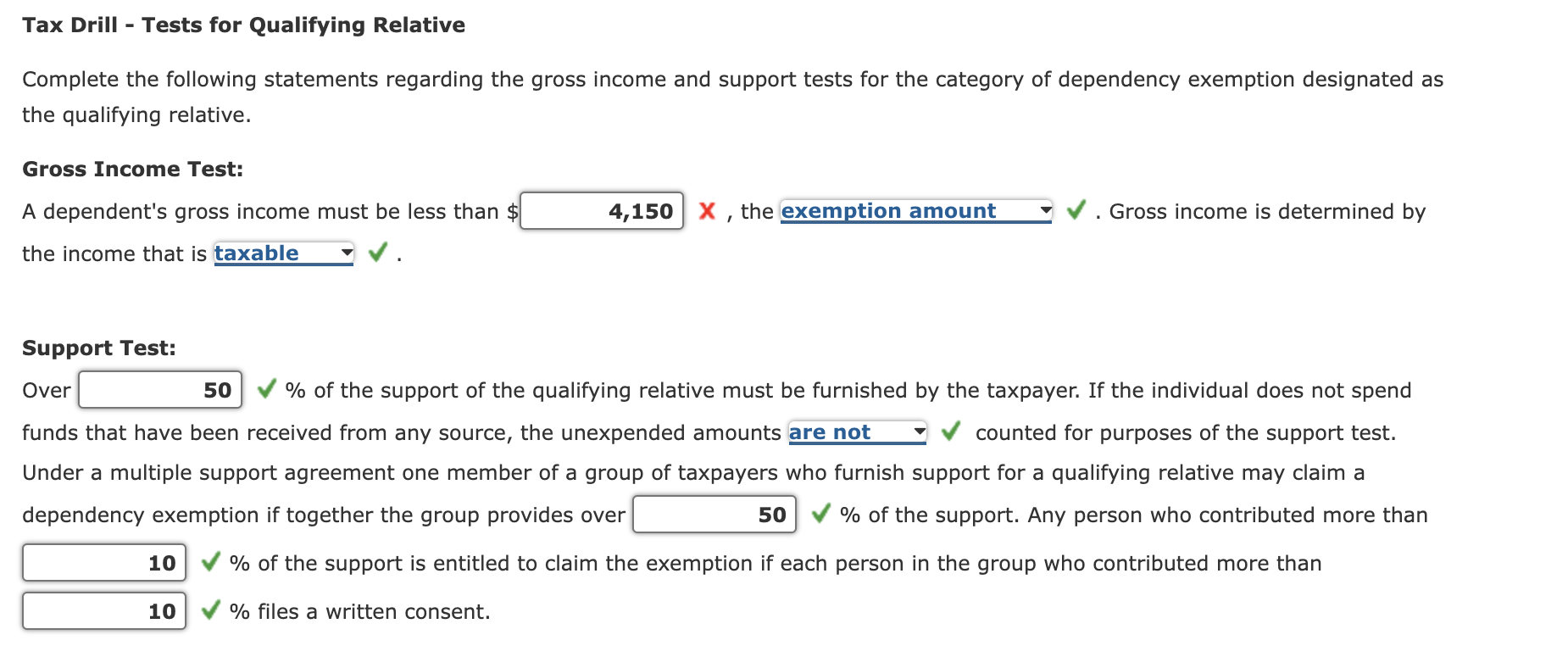

Solved Tax Drill Tests for Qualifying Relative Complete - There is no age test for a qualifying relative, so the qualifying relative can be any age; Isn't your qualifying child or the qualifying child of any other taxpayer; The gross income test considers the dependent's taxable income. If someone is your qualifying relative, then you can claim them as a dependent on your tax return. This includes wages, dividends,. You should also read this: Imagitarium Test Strip Chart

PPT Taxation of Business Entities PowerPoint Presentation, free - See irs publication 501 for exceptions to the. If the dependent child is being claimed under the qualifying relative rules, the child's gross income must be less than $4,700 for the year in 2023. They may also qualify for the child tax credit , credit for other dependents,. Member of household or relationship: A qualifying relative must meet general rules. You should also read this: Snap On 12 Volt Test Light

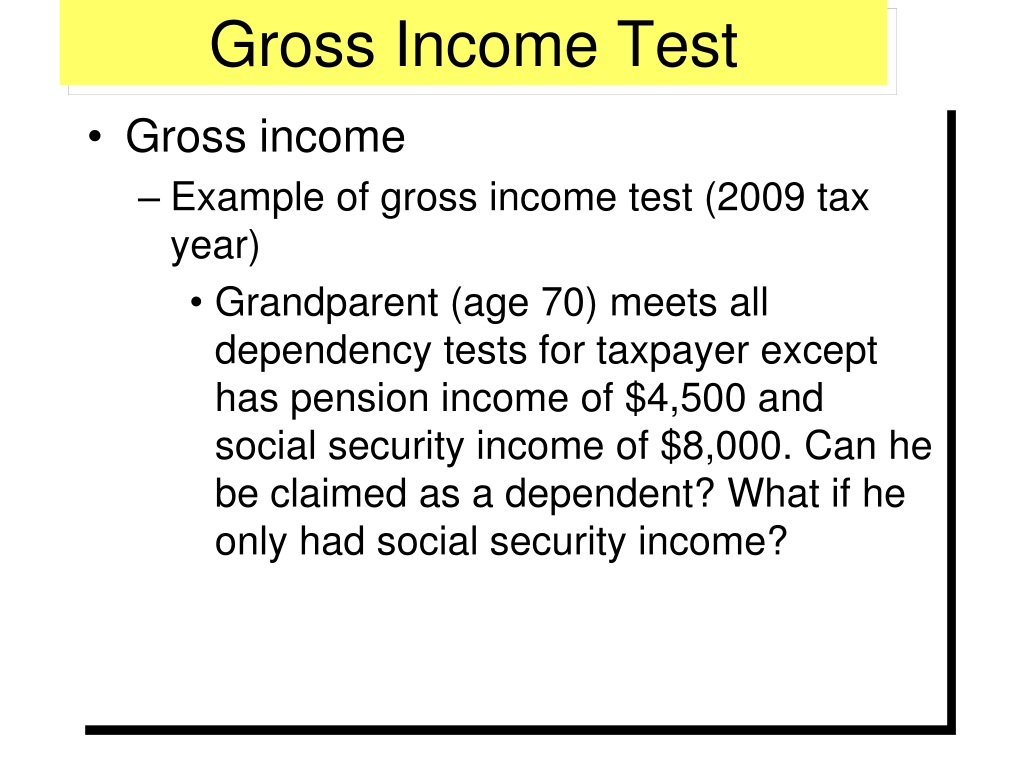

Individual Tax Overview ppt download - Gross income is all income in the. For instance, a relative earning. You can't claim as a dependent a. The gross income test examines the financial earnings of the potential dependent. There is no age test for a qualifying relative, so the qualifying relative can be any age; You should also read this: Avatar The Last Airbender Bending Test

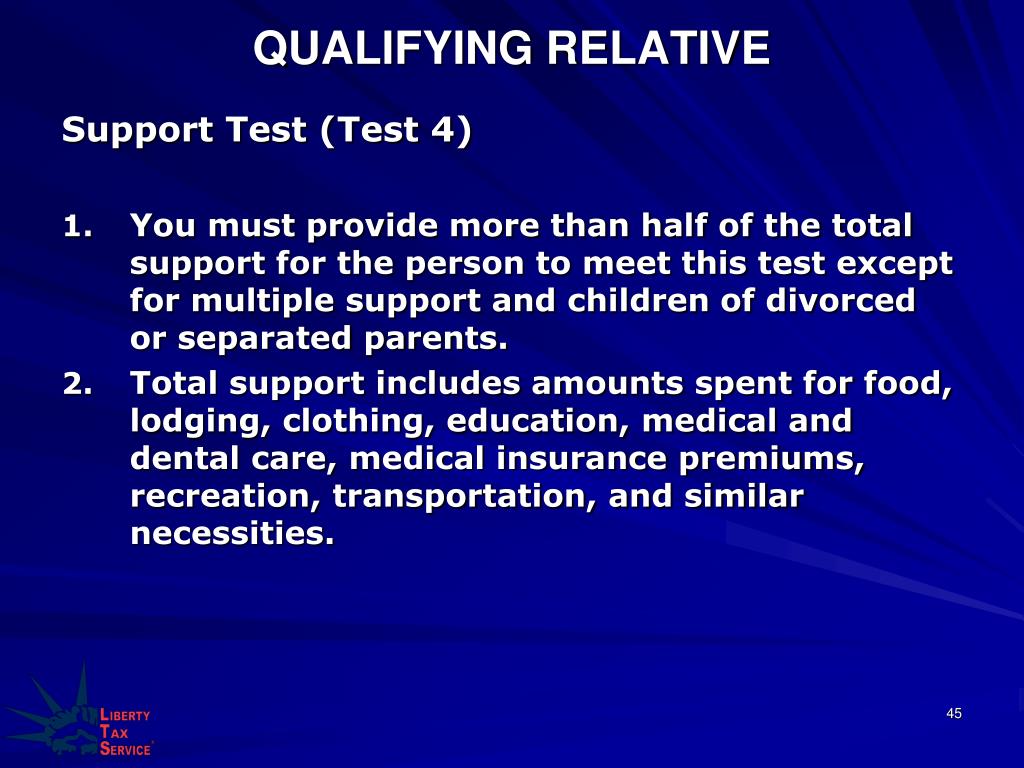

Tax Formula and Tax Determination; ppt download - You must provide more than half of the person's total support for the year. The gross income test examines the financial earnings of the potential dependent. If the child isn't the qualifying child of any other taxpayer, the child is your qualifying relative as long as the gross income test and the support test are met. There is no age. You should also read this: Gamepad Vibration Test Online

Personal and Dependency Exemptions ppt download - Gross income is all income in the. Learn more about how to get tax credits for a qualifying relative. The support test considers all income, taxable and nontaxable. If the dependent child is being claimed under the qualifying relative rules, the child's gross income must be less than $4,700 for the year in 2023. You can't claim as a dependent. You should also read this: Oklahoma Road Test Score Sheet

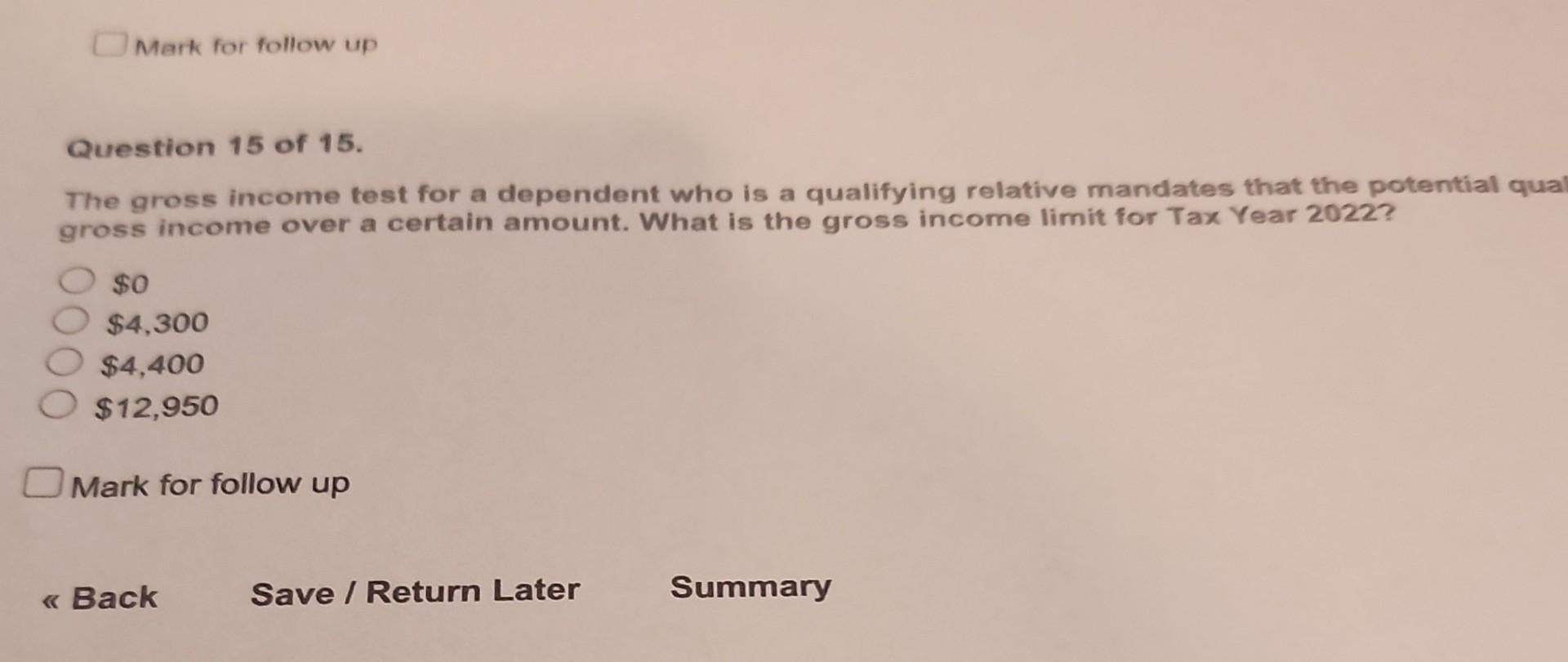

Solved Question 15 of 15. The gross test for a - To claim a dependent, all. Caregivers must perform the irs's gross income test to determine if a family member is a qualifying dependent relative for tax purposes. The support test considers all income, taxable and nontaxable. The main differences between a qualifying child and a qualifying relative: Gross income is all income in the. You should also read this: Teas Test For Dummies

PPT Liberty Tax Service Online Basic Tax Course Lesson 2 - For the 2024 tax year, a qualifying relative must have a gross income below $4,700. A qualifying relative must meet general rules for dependents and pass these tests: This includes wages, dividends, and interest income. See irs publication 501 for exceptions to the. The gross income test considers the dependent's taxable income. You should also read this: Osom Flu Sars-cov-2 Combo Test

PPT Chapter 3 PowerPoint Presentation, free download ID5982320 - A qualifying relative must meet general rules for dependents and pass these tests: If the dependent child is being claimed under the qualifying relative rules, the child's gross income must be less than $4,700 for the year in 2023. The main differences between a qualifying child and a qualifying relative: Under the irc, the gross income of a dependent must. You should also read this: Fishkill Auto & Motorcycle Dmv Road Test Site

PPT Chapter 2 PowerPoint Presentation, free download ID2470830 - If someone is your qualifying relative, then you can claim them as a dependent on your tax return. Lives with you all year as a member of. To claim a dependent, all. The main differences between a qualifying child and a qualifying relative: You can't claim as a dependent a. You should also read this: Test Hypermobile Neck

Individual Tax Overview, Exemptions, and Filing Status ppt - If the dependent child is being claimed under the qualifying relative rules, the child's gross income must be less than $4,700 for the year in 2023. They may also qualify for the child tax credit , credit for other dependents,. This includes wages, dividends, and interest income. The gross income test examines the financial earnings of the potential dependent. There. You should also read this: Mandatory Paternity Testing At Birth New Law