PPT Liberty Tax Service Online Basic Tax Course Lesson 2 - Understand the criteria and requirements for claiming a qualifying relative on your taxes, including relationship, residency, income, and support tests. Your grandchild isn’t your qualifying child because the residency test isn’t met. Use the relucator tax tool to see if you have a qualifying child or relative to claim as a dependent on your tax return: The child must be. You should also read this: Which Tube Is Used For Glucose Testing

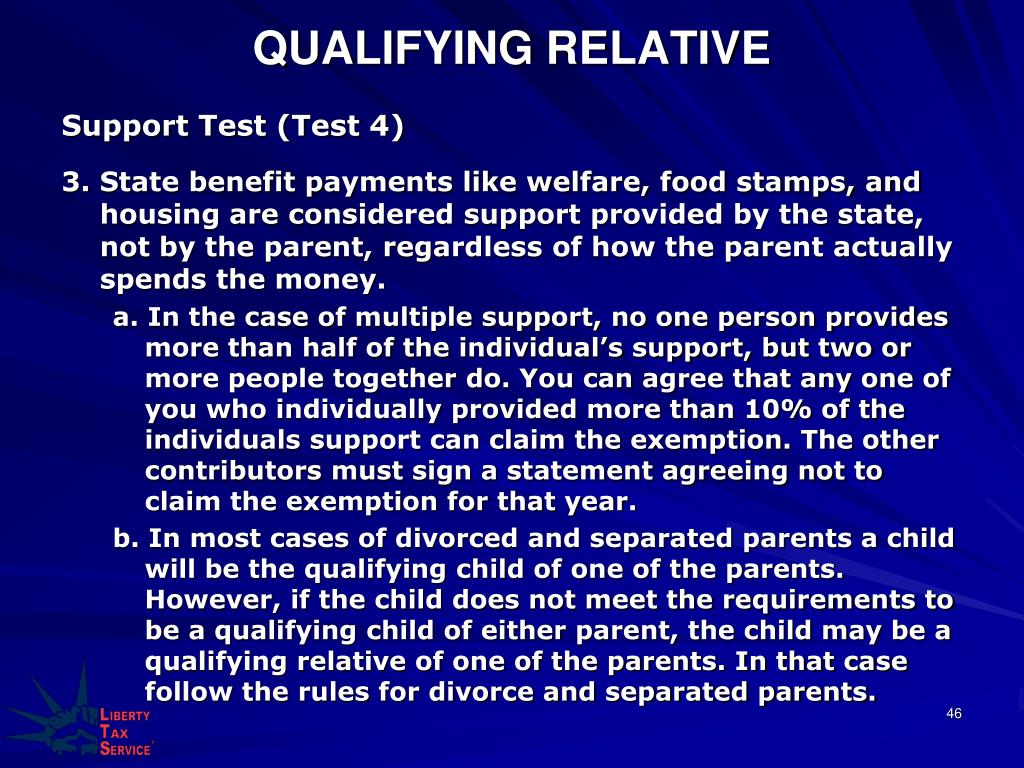

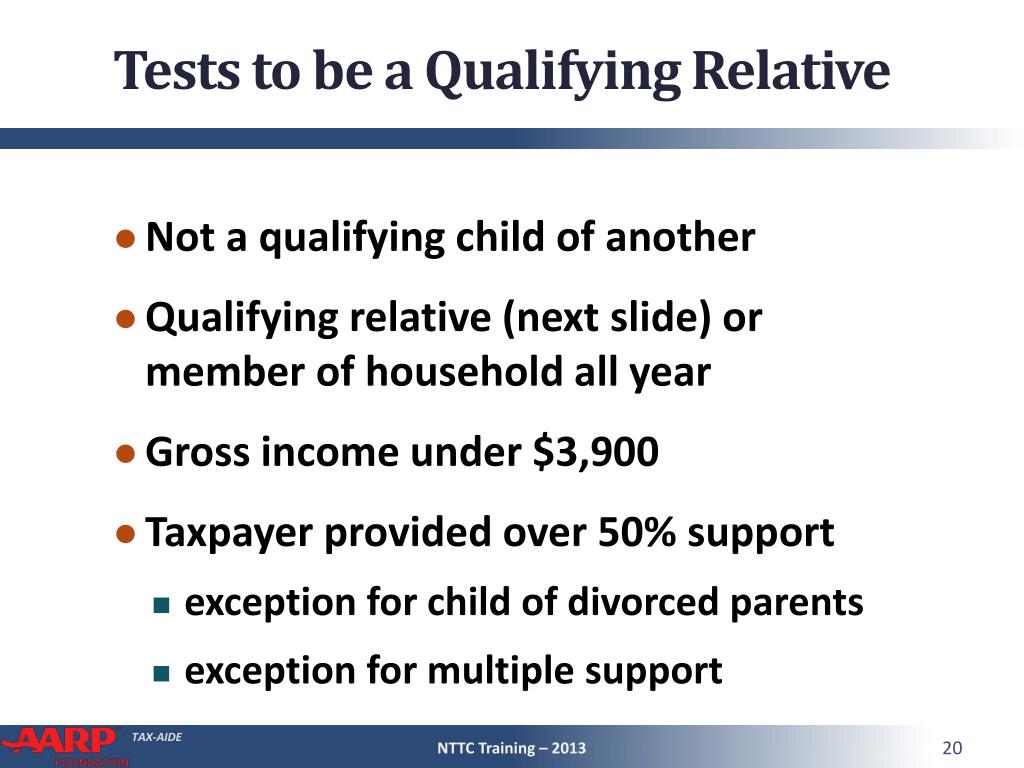

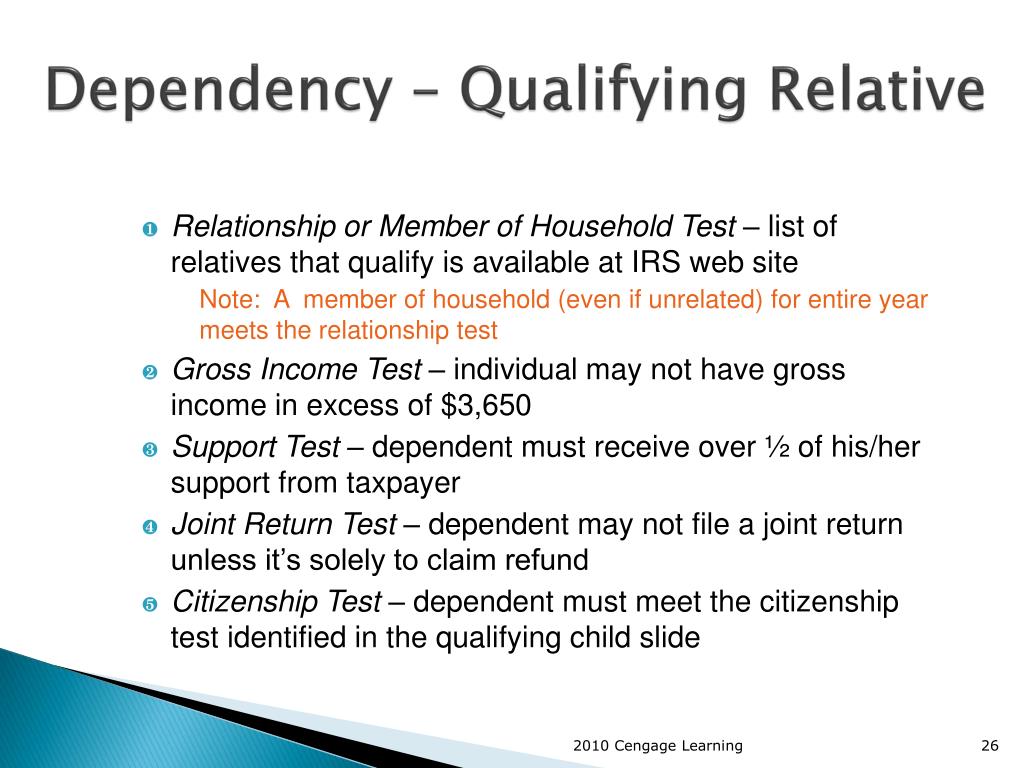

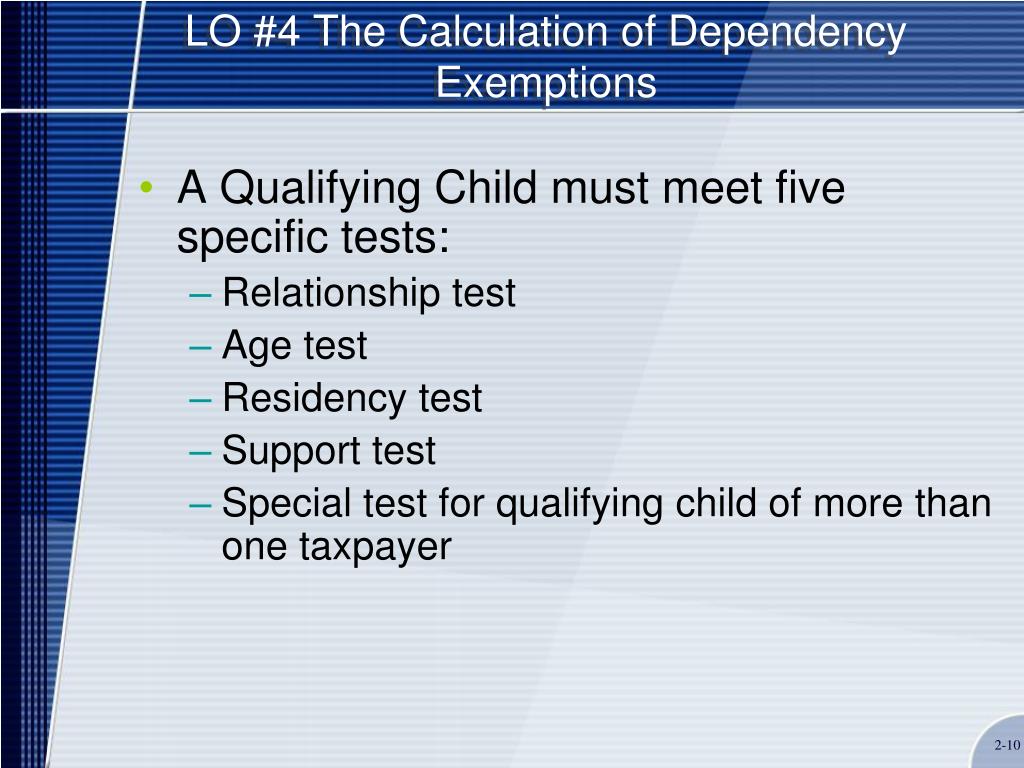

Tax Formula and Tax Determination; ppt download - Is this individual a u.s. Begin with this table to determine both qualifying child and qualifying relative dependents. This guide covers the latest irs qualifying relative rules for 2021 and explains how you can. Taxpayers will meet this test if the taxpayer provided more than half of a person's total support for the entire year. Support test — qualifying relative. You should also read this: How To Test Cr2025 Battery

Tax Formula and Tax Determination; ppt download - The child must be your son, daughter, stepchild, foster child, brother, sister, half. This guide covers the latest irs qualifying relative rules for 2021 and explains how you can. Your grandchild isn’t your qualifying child because the residency test isn’t met. Taxpayers will meet the member of household test for persons who live with them under the following conditions: Understand. You should also read this: Bnp Blood Test Tube Color

Individual Tax Overview ppt download - If someone is your qualifying relative, then you can claim them as a dependent on your tax return. The relationship test is a key component in determining whether an individual qualifies as a dependent under the internal revenue code (irc). Use the relucator tax tool to see if you have a qualifying child or relative to claim as a dependent. You should also read this: Testing Coloring Pages

Personal Exemptions and Dependents on the 2022 Federal Tax Return - Start the relucator or qualifying person, relative tool. Your grandchild may be your. This guide covers the latest irs qualifying relative rules for 2021 and explains how you can. Understand the criteria and requirements for claiming a qualifying relative on your taxes, including relationship, residency, income, and support tests. The child must be your son, daughter,. You should also read this: Ruby Breath Test

Personal and Dependency Exemptions ppt download - National, or a resident of canada or mexico? Begin with this table to determine both qualifying child and qualifying relative dependents. The main differences between a qualifying child and a qualifying relative: Is this individual a u.s. Your grandchild isn’t your qualifying child because the residency test isn’t met. You should also read this: Fairmont Drivers Test

Personal Exemptions and Dependents on the 2022 Federal Tax Return - Tests to be a qualifying relative. Member of household test — qualifying relative. The rules for a qualifying child dependent are: Isn't your qualifying child or the qualifying child of. Your grandchild may be your. You should also read this: Police Psychological Exam Practice Test Free

PPT Exemptions PowerPoint Presentation, free download ID5331403 - They may also qualify for the child tax credit , credit for other dependents,. Tests to be a qualifying relative. There is no age test for a qualifying relative, so the qualifying relative can be any age; This comprehensive guide delves into what a qualifying relative is, the irs tests to determine eligibility, the differences between a qualifying child and. You should also read this: Permit Test Practice Colorado Quizlet

PPT CHAPTER 1 The Individual Tax Return PowerPoint - Use the relucator tax tool to see if you have a qualifying child or relative to claim as a dependent on your tax return: Your grandchild may be your. Taxpayers will meet the member of household test for persons who live with them under the following conditions: However, your claimed dependents must pass the qualifying relative test to count. They. You should also read this: Express Employment Drug Test Reddit

PPT Chapter 2 PowerPoint Presentation, free download ID2470830 - They may also qualify for the child tax credit , credit for other dependents,. Member of household test — qualifying relative. Per irs publication 501 dependents, standard deduction, and filing information, page 10: The child must be your son, daughter, stepchild, foster child, brother, sister, half. Is this individual a u.s. You should also read this: Regex Sed Tester