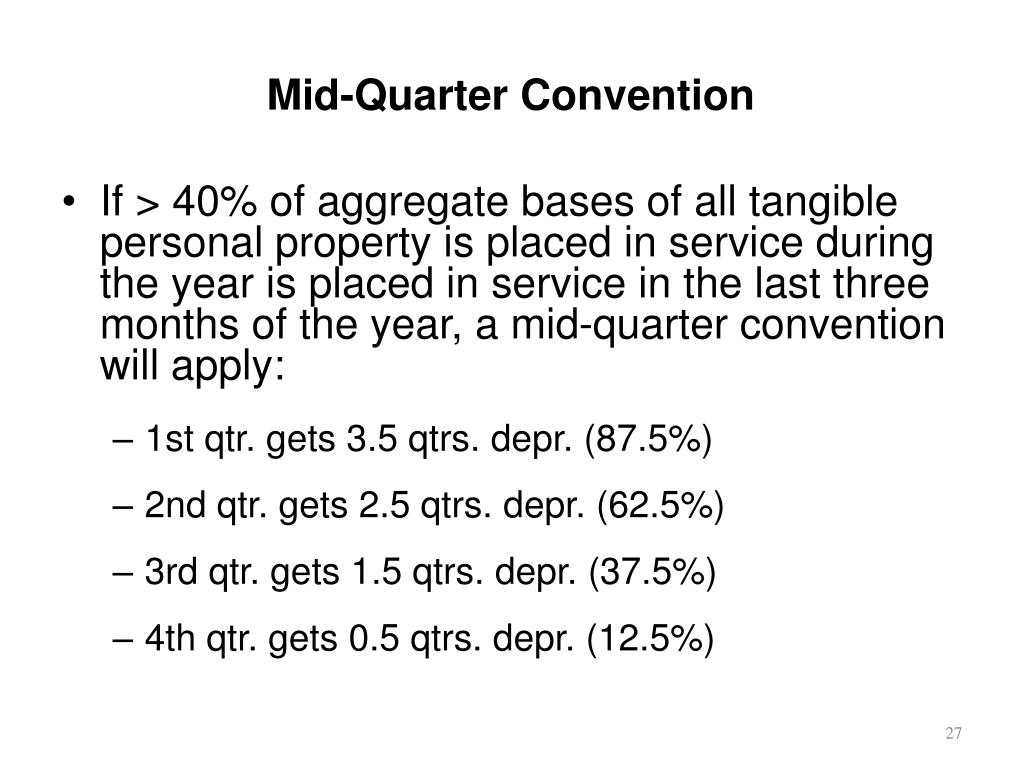

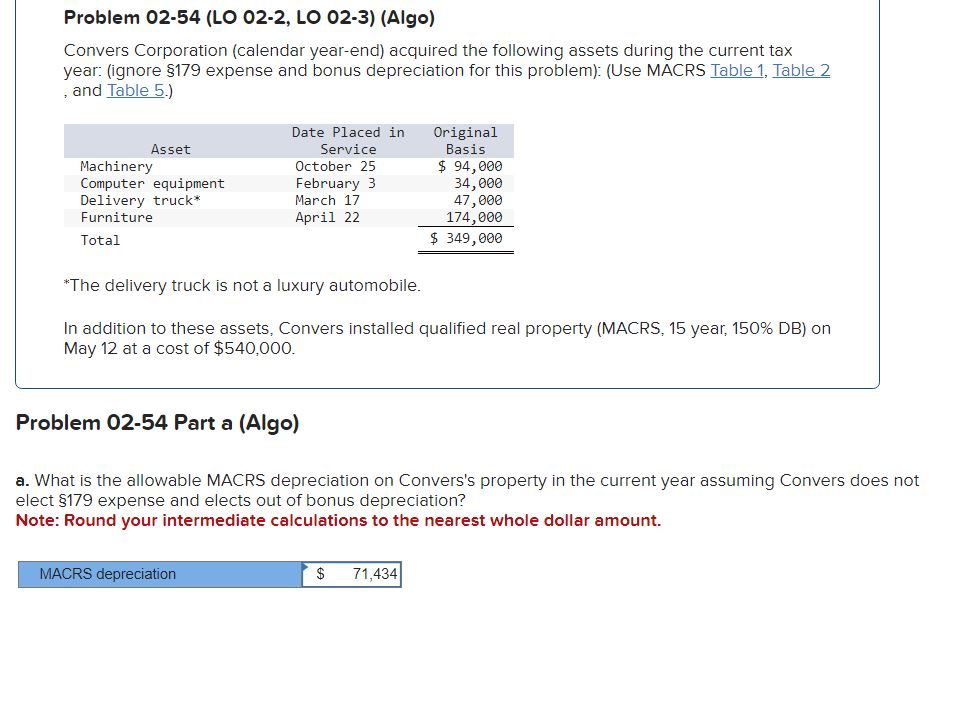

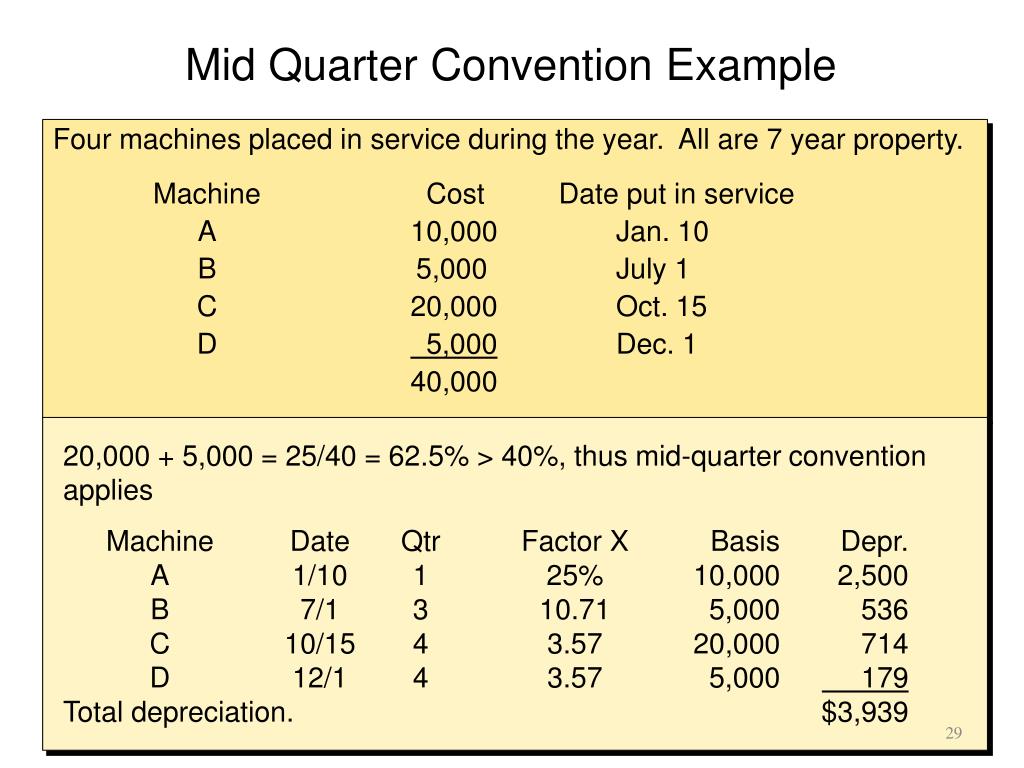

PPT Chapter 8 PowerPoint Presentation, free download ID5911603 - You can run the midquarter applicability report to determine whether a company must use the midquarter convention for qualified assets placed in service during the selected year. In general, one uses the mid quarter convention if the cost basis of assets purchased or placed in service during the fourth quarter of the year is greater than 40% of the total. You should also read this: Embrace Talk Test Strips

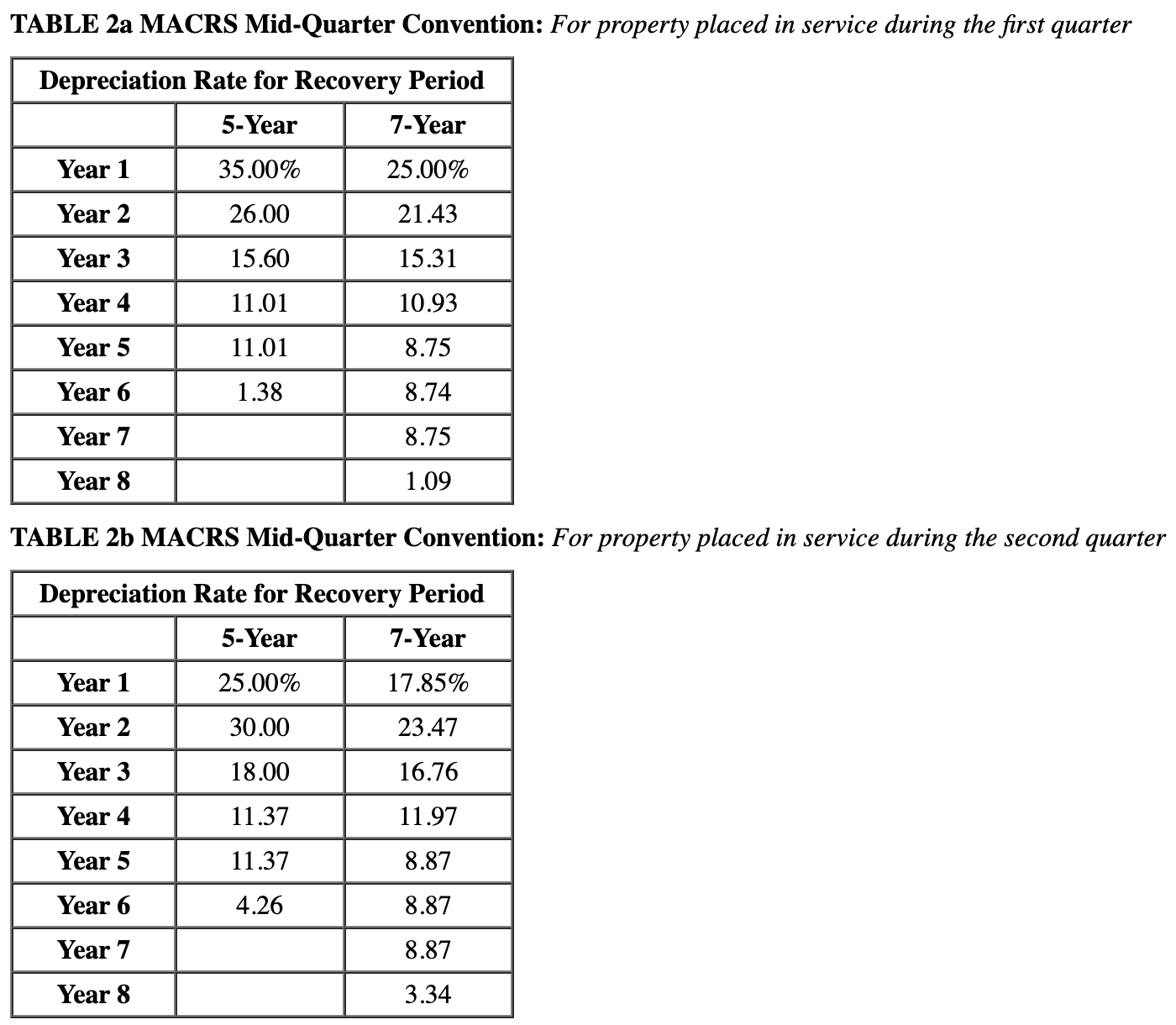

PPT Chapter 9 PowerPoint Presentation, free download ID25941 - Take the yearly allowable depreciation from step 1 and multiple it by the appropriate percentage from the charts below (placed in service mid quarter or disposed of mid quarter). In general, one uses the mid quarter convention if the cost basis of assets purchased or placed in service during the fourth quarter of the year is greater than 40% of. You should also read this: Tcole Practice Test Free

PPT Chapter 8 PowerPoint Presentation, free download ID5911603 - Take the yearly allowable depreciation from step 1 and multiple it by the appropriate percentage from the charts below (placed in service mid quarter or disposed of mid quarter). The cost of property acquired with a life of 27.5, 31.5, 39, 40 and 50 years. Explore the distinctions between half year and mid quarter conventions, learn how to switch, and. You should also read this: Pizzeria Testa Frisco

PPT Chapter 9 PowerPoint Presentation, free download ID25941 - This convention applies when more than 40% of the total cost of property (other. The cost of property acquired with a life of 27.5, 31.5, 39, 40 and 50 years. Explore the distinctions between half year and mid quarter conventions, learn how to switch, and understand the impact on depreciation calculations. You can run the midquarter applicability report to determine. You should also read this: Pharmacology Test Bank

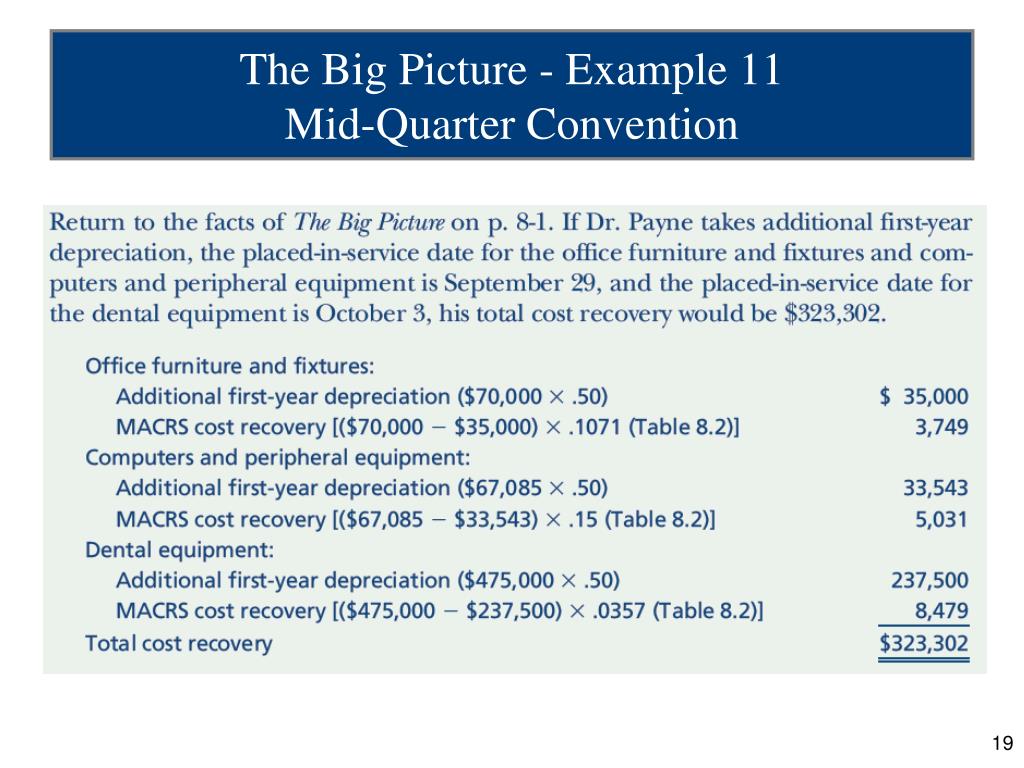

Cost Recovery MACRS Mid Quarter Convention. CPA/EA Exam YouTube - You can run the midquarter applicability report to determine whether a company must use the midquarter convention for qualified assets placed in service during the selected year. Take the yearly allowable depreciation from step 1 and multiple it by the appropriate percentage from the charts below (placed in service mid quarter or disposed of mid quarter). In general, one uses. You should also read this: Blood Test Cmc

PPT Chapter 7 Accounting Periods & Methods & Depreciation PowerPoint - In general, one uses the mid quarter convention if the cost basis of assets purchased or placed in service during the fourth quarter of the year is greater than 40% of the total basis of all. Take the yearly allowable depreciation from step 1 and multiple it by the appropriate percentage from the charts below (placed in service mid quarter. You should also read this: Atdhe Practice Test

Solved Table A2. 3, 5, 7, 10, 15, And 20Year Prope... - The cost of property acquired with a life of 27.5, 31.5, 39, 40 and 50 years. Explore the distinctions between half year and mid quarter conventions, learn how to switch, and understand the impact on depreciation calculations. This convention applies when more than 40% of the total cost of property (other. In general, one uses the mid quarter convention if. You should also read this: How Many Questions Are On The Washington Drivers Test

Solved TABLE 2a MACRS MidQuarter Convention For property - This convention applies when more than 40% of the total cost of property (other. You can run the midquarter applicability report to determine whether a company must use the midquarter convention for qualified assets placed in service during the selected year. Explore the distinctions between half year and mid quarter conventions, learn how to switch, and understand the impact on. You should also read this: Fms Shoulder Mobility Test

Solved TABLE 2d MACRSMid Quarter Convention For property - Explore the distinctions between half year and mid quarter conventions, learn how to switch, and understand the impact on depreciation calculations. This convention applies when more than 40% of the total cost of property (other. In general, one uses the mid quarter convention if the cost basis of assets purchased or placed in service during the fourth quarter of the. You should also read this: Evap Line Clear Blue Test

PPT Chapter 9 PowerPoint Presentation, free download ID25941 - Take the yearly allowable depreciation from step 1 and multiple it by the appropriate percentage from the charts below (placed in service mid quarter or disposed of mid quarter). You can run the midquarter applicability report to determine whether a company must use the midquarter convention for qualified assets placed in service during the selected year. Explore the distinctions between. You should also read this: Ar Test And Answers