PPT Chapter 3 PowerPoint Presentation, free download ID5982320 - The joint return test is designed to ensure that married taxpayers who file a joint return are liable for the tax they owe. Joint filing can result in a lower tax bill and a higher refund. It also means that they are entitled to the deductions and. Understand the joint return test, its impact on dependent claims, and key factors. You should also read this: Marathi Typing Test

What is the Joint Return Test? YouTube - Joint filing can result in a lower tax bill and a higher refund. A comprehensive guide to understanding the joint return test, its criteria, how it works, and the notable exceptions. The dependent does not have to. The irs rules provide the joint return test in which married couples can file jointly to take advantage of certain tax benefits. Joint. You should also read this: Permit Test Springfield Mo

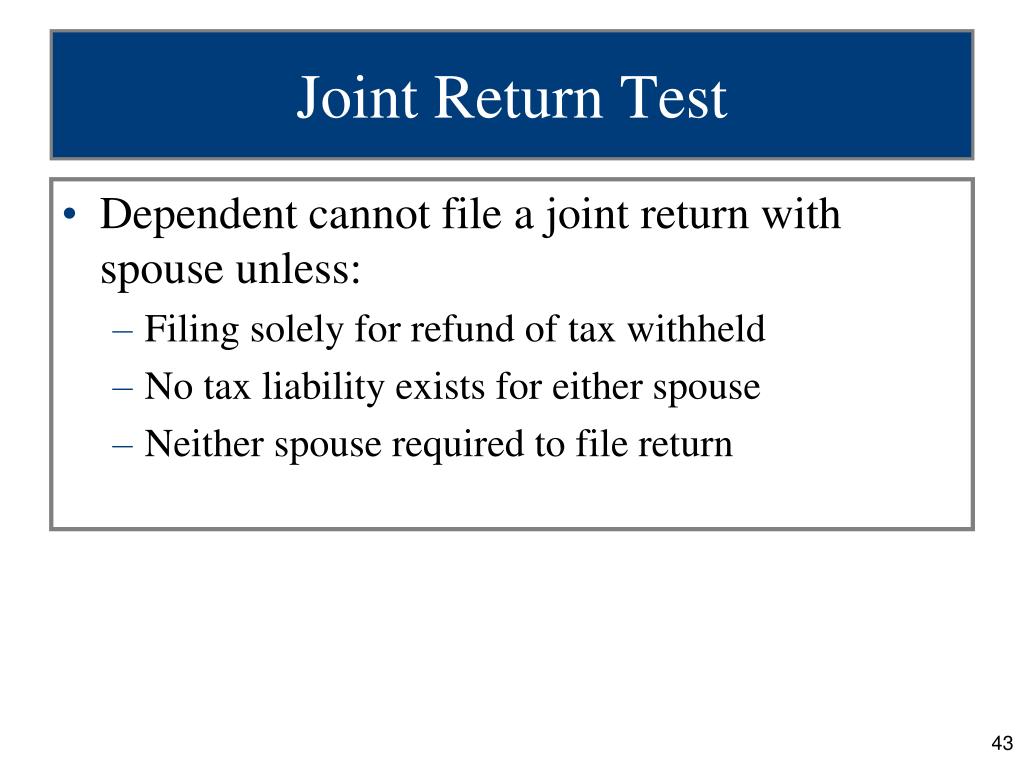

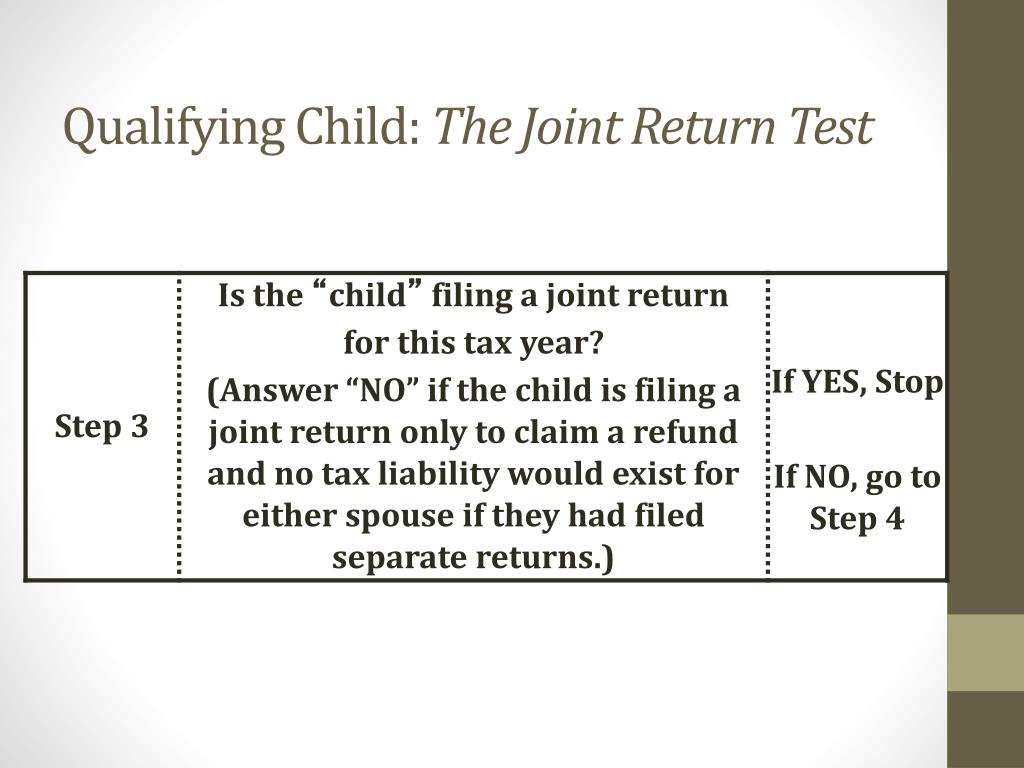

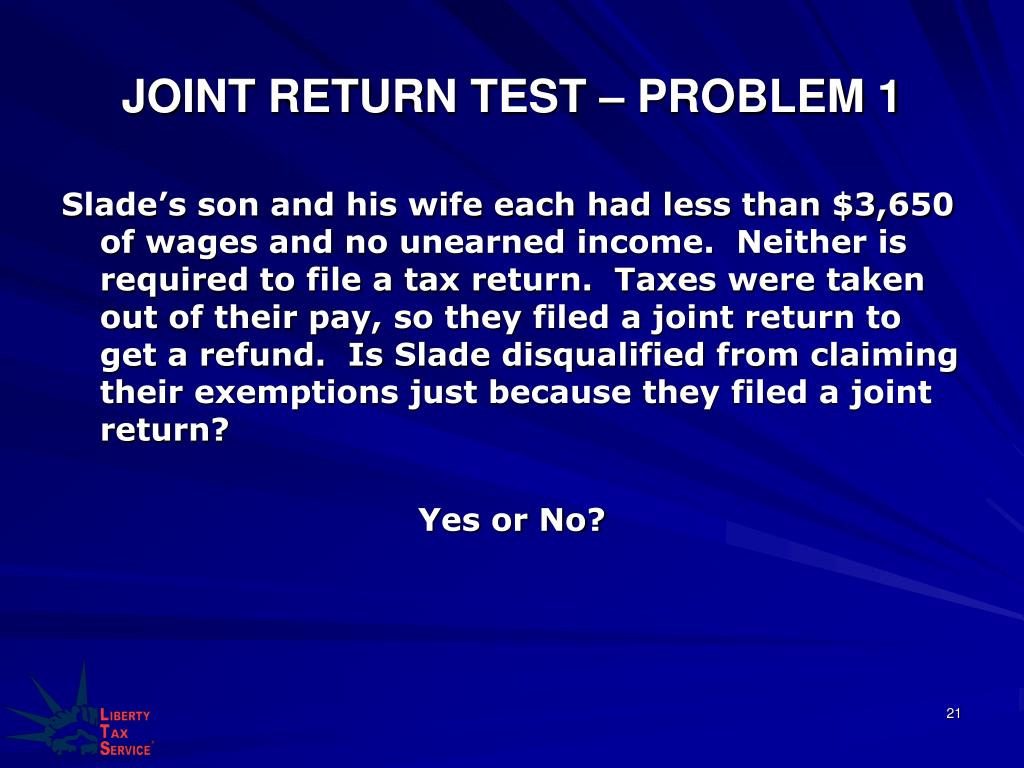

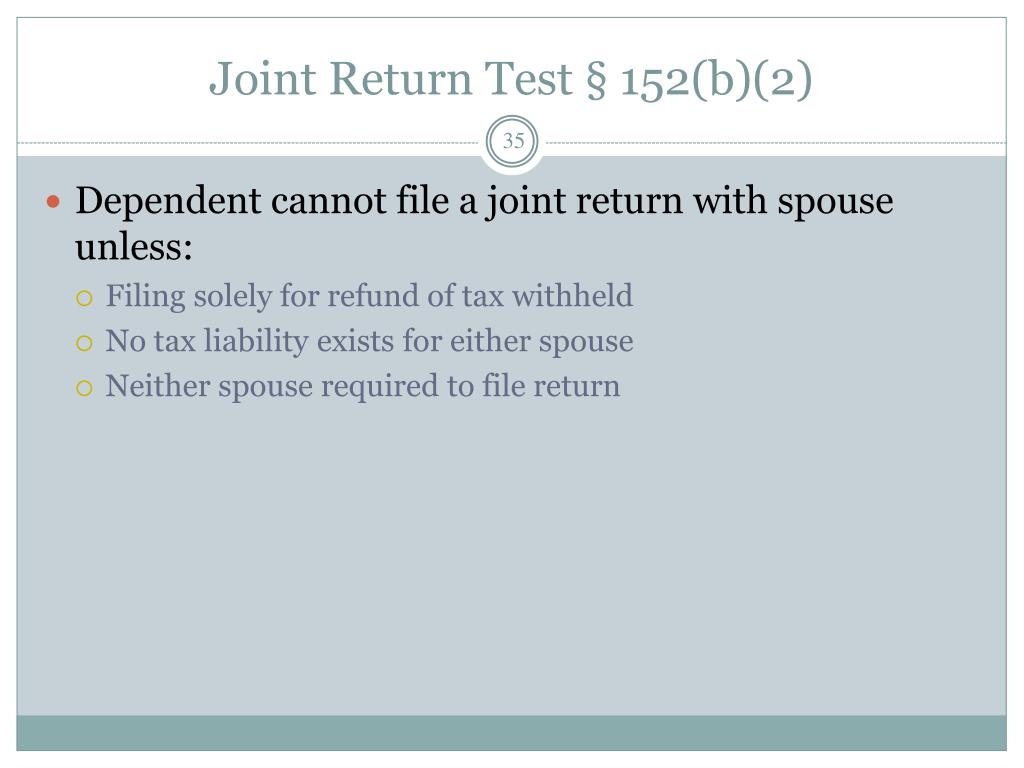

Personal and Dependency Exemptions ppt download - A comprehensive guide to understanding the joint return test, its criteria, how it works, and the notable exceptions. Married and file a joint return only to claim a refund of withheld tax; This test prohibits dependents from filing joint. Learn how the irs uses the joint return test to decide if a taxpayer can be claimed as a dependent or. You should also read this: Texas Doubles And Triples Practice Test

PPT 20132014 Volunteer Basic Tax Training A Session PowerPoint - The joint return test is one of the irs tests that potential dependentsmust pass in order to be claimed as such by another taxpayer. Married and file a joint return only to claim a refund of withheld tax; The joint return test states that a taxpayer may not claim a married person as a dependent if they file a joint tax return. You should also read this: Glue Test Connection

PPT Liberty Tax Service Online Basic Tax Course Lesson 2 - The joint return test is one of the irs tests that potential dependentsmust pass in order to be claimed as such by another taxpayer. It also means that they are entitled to the deductions and. Knee joint movement ability test. The joint return test is designed to ensure that married taxpayers who file a joint return are liable for the tax they. You should also read this: H Pylori Test And Omeprazole

:max_bytes(150000):strip_icc()/TermDefinitions_Jointreturntest_colorv1-e136d89c0af742328393f986af7e3e4e.png)

Joint Return Test What It is, How It Works - In summary, the joint return test is an important factor to consider when deciding whether to file taxes jointly or separately. When it comes to filing your taxes, there are various tests and requirements that taxpayers must meet to be eligible for certain deductions or credits. Joint return test is one of the five tests administered by the irs for. You should also read this: Chicago Cpat Testing

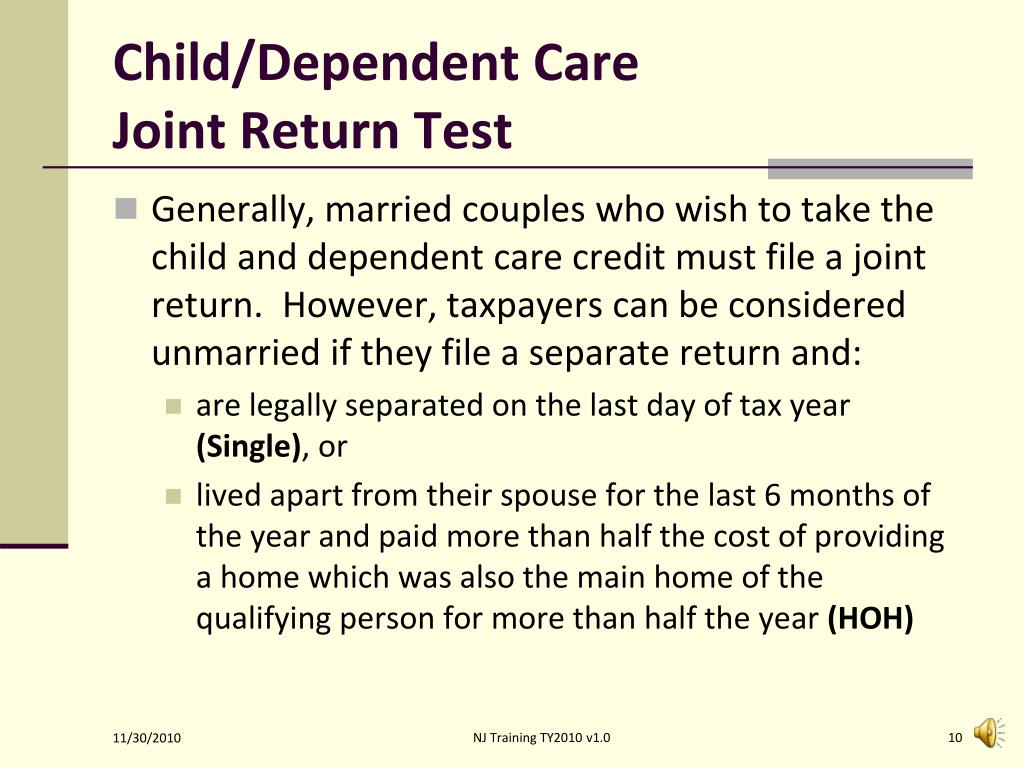

PPT NonRefundable Credits Child and Dependent Care Credit PowerPoint - When it comes to filing your taxes, there are various tests and requirements that taxpayers must meet to be eligible for certain deductions or credits. The joint return test is designed to ensure that married taxpayers who file a joint return are liable for the tax they owe. Joint return test is one of the five tests administered by the. You should also read this: A Positive Serological Test For Tuberculosis Indicates That

Joint Return Test AwesomeFinTech Blog - Joint return test is one of the five tests administered by the irs for the potential dependents. Learn how this test impacts your ability to claim. The joint return test is designed to ensure that married taxpayers who file a joint return are liable for the tax they owe. The hop test was performed as. The irs rules provide the. You should also read this: Cortisol Test Tube Color

CPE for CPAs and EAs 2013 Child and Dependent Care Expenses The Joint - When claiming dependents on your tax return, you may need to meet certain tests to qualify. This allows patients to improve their joint function and readiness to return to sports as early as possible after surgery, potentially reducing financial stress. To get qualified as a dependent the potential dependents must pass this test. The joint return test basically asserts that. You should also read this: Abbott Hiv Rapid Test

PPT Chapter 12 PowerPoint Presentation, free download ID1014928 - Learn how the irs uses the joint return test to decide if a taxpayer can be claimed as a dependent or file a joint tax return. The irs devised the joint return test to assess if you can claim another person as a dependent on your taxes. When claiming dependents on your tax return, you may need to meet certain. You should also read this: Neurofilament Light Chain Blood Test Normal Range