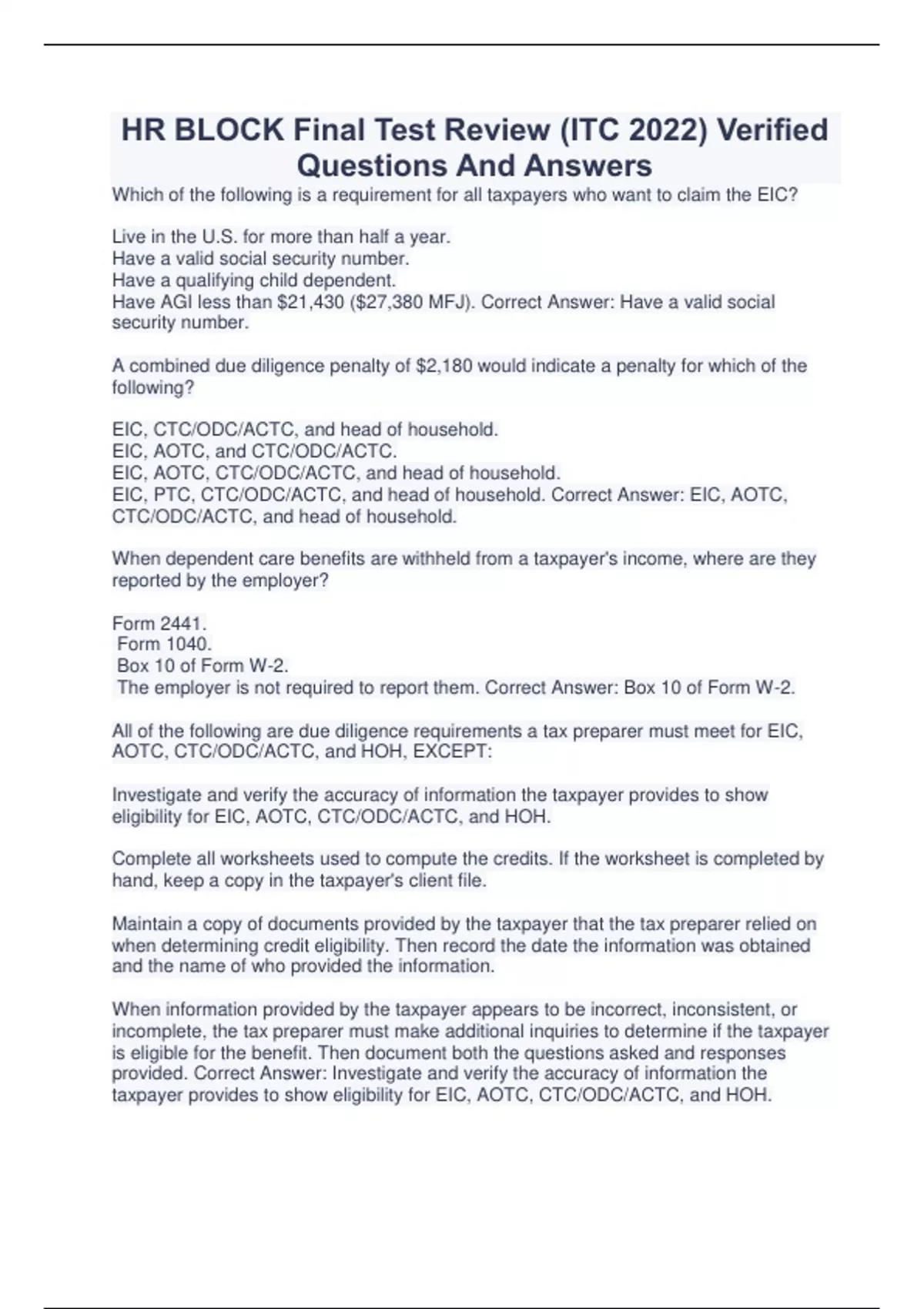

HR BLOCK Final Test Review (ITC 2022) Verified Questions And Answers - Which of the following is an example of a casualty and/or theft loss? Looking for answers to the h&r block tax knowledge assessment test? Protection from being required to disclose confidential. Value of any economic benefit received by the. Requirements that tax professionals must follow when preparing income tax returns. You should also read this: Tnf Lab Test

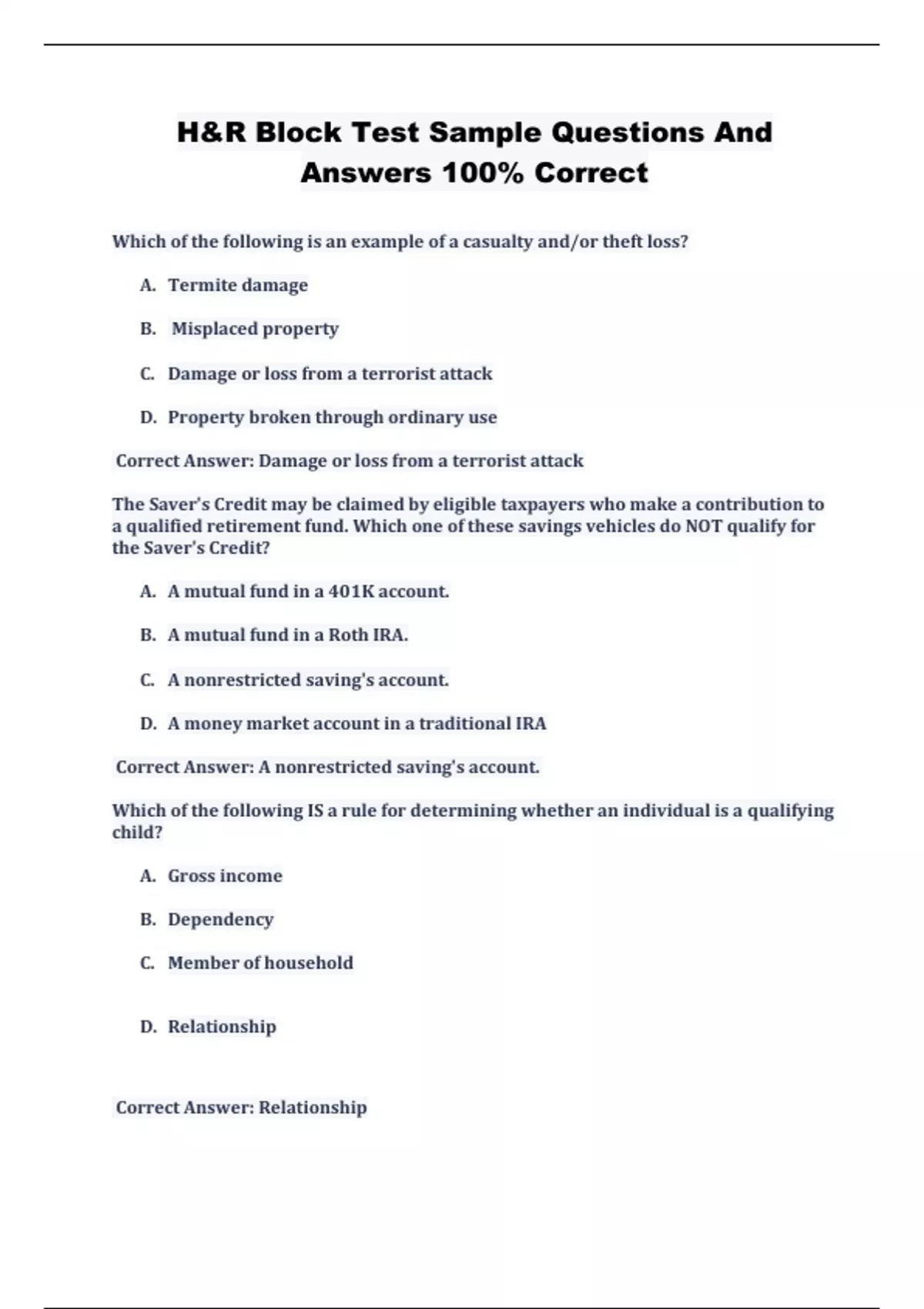

How To Clear And Start Over In H&R Block Online 2024 H&R Block Guide - H&r block ch 27 final exam review learn with flashcards, games, and more — for free. Which of the following is an example of a casualty and/or theft loss? H & r block tax services, h & r block bank, and mcgladrey are all divisions of their parent corporation, h & r block. Damage or loss from a terrorist attack.. You should also read this: Hpt Practice Test Online

H&R Block Test Sample Questions And Answers 100 Correct H&R Stuvia US - Looking for answers to the h&r block tax knowledge assessment test? Just answer a few quick questions to start estimating. H&r block ch 27 final exam review learn with flashcards, games, and more — for free. Hr block final test review (itc 2024) practice questions and answers which of the following is a requirement for all taxpayers who want to. You should also read this: Best Online Sat Test Prep

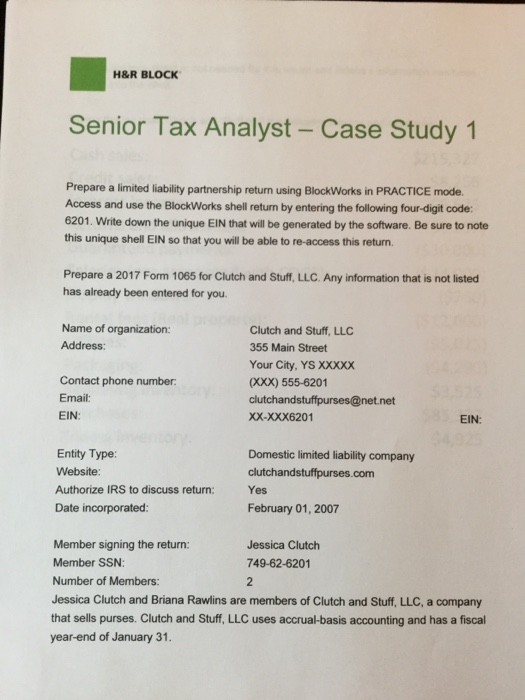

Solved H&R BLOCK Senior Tax Analyst Case Study 1 Prepare a - Requirements that tax professionals must follow when preparing income tax returns. In this article, we will provide you with everything you need to know about the h&r block assessment test answers. Which of the following is not a percentage of social security benefits subject to federal tax? H & r block tax services, h & r block bank, and mcgladrey. You should also read this: Test Ping To Ip

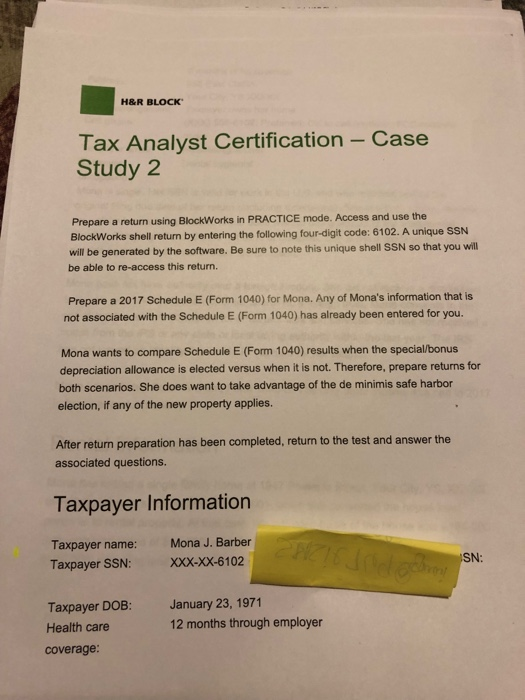

H R Block Tax Analyst Certification Case Study 2 Prepare Return Using - Take the tax knowledge assessment to see if. Value of any economic benefit received by the. Get the expert help you need to ace the test and advance your tax preparation career. H & r block tax services, h & r block bank, and mcgladrey are all divisions of their parent corporation, h & r block. Protection from being required. You should also read this: Std Testing Rochester Mn

H&R Block Final Exam Answer Guide 2025 - The saver's credit may be claimed by eligible taxpayers who make. Which of the following is not a percentage of social security benefits subject to federal tax? Learn how to do taxes with h&r block's online tax preparation course, taught by tax pro instructors and featuring interactive exercises. H&r block ch 27 final exam review learn with flashcards, games, and. You should also read this: Does Ashwagandha Come Up On A Drug Test

H & R Block Assessment Test Answers and Tips for Success - Failure or refusal to comply with the tax code. Value of any economic benefit received by the. Get your tax questions answered and discover helpful tax calculators. Which of the following is not a percentage of social security benefits subject to federal tax? Market value of rights exercised in consumption + change in property rights over the term. You should also read this: Gc Ms Drug Test

H and R Block Test Answers Complete Guide - Which of the following is an example of a casualty and/or theft loss? Market value of rights exercised in consumption + change in property rights over the term. The saver's credit may be claimed by eligible taxpayers who make. In this article, we will provide you with everything you need to know about the h&r block assessment test answers. H. You should also read this: Cdm Exam Practice Test

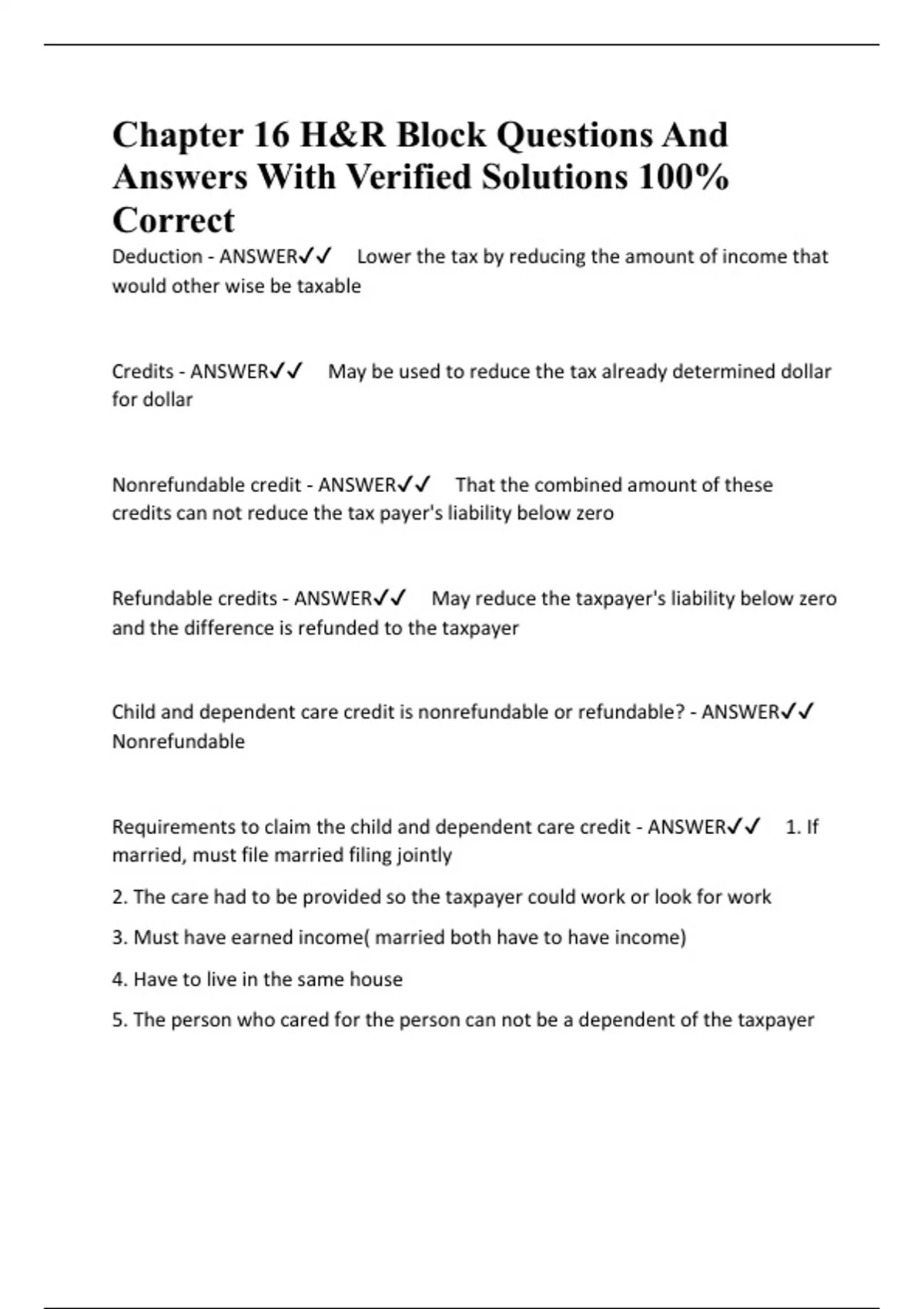

Chapter 16 H&R Block Questions And Answers With Verified Solutions 100 - Alternative is economic benefit definition. The saver's credit may be claimed by eligible taxpayers who make. Just answer a few quick questions to start estimating. H & r block tax services, h & r block bank, and mcgladrey are all divisions of their parent corporation, h & r block. Requirements that tax professionals must follow when preparing income tax returns. You should also read this: Rcn Bandwidth Test

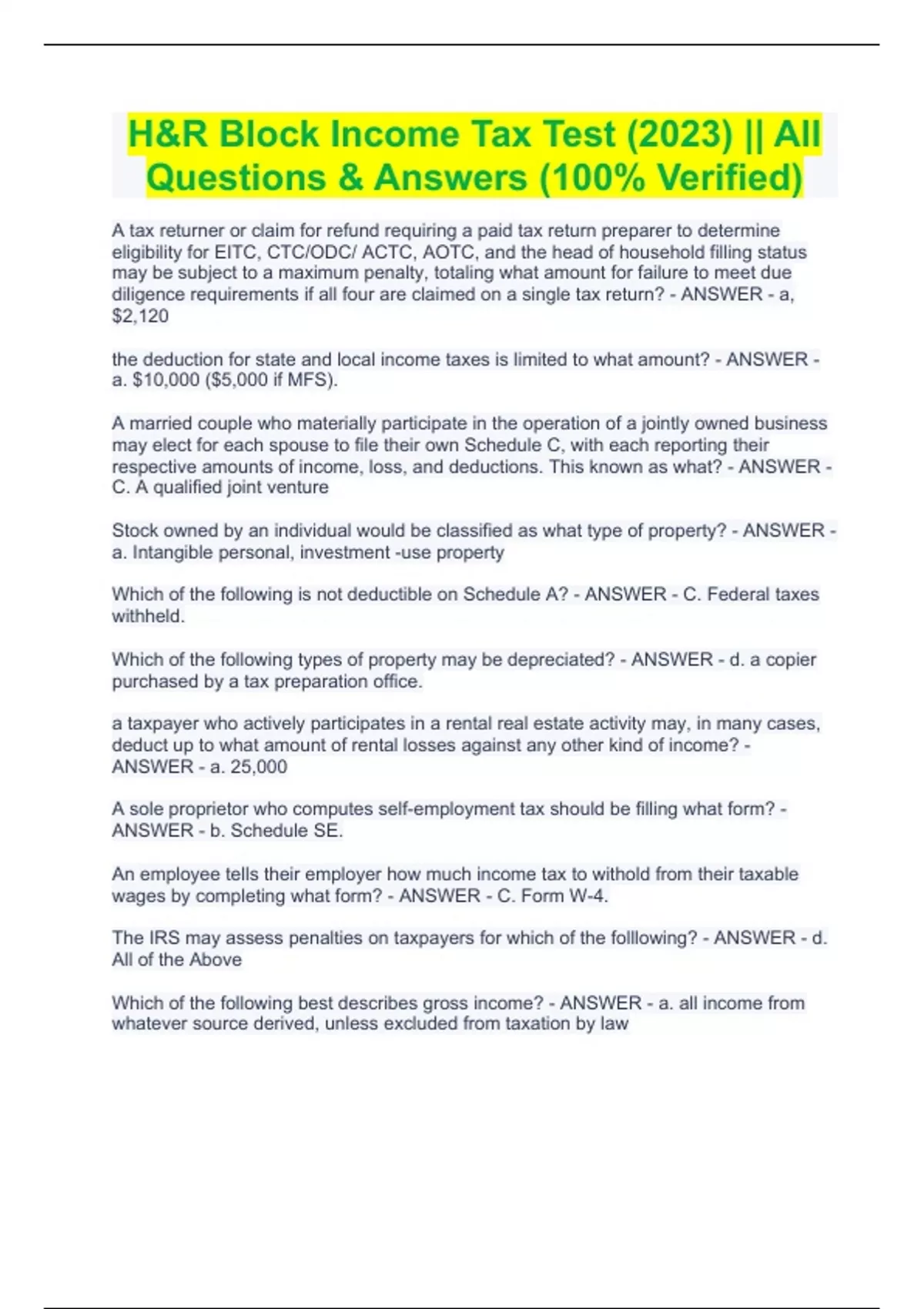

H&R Block Tax Test (2023) All Questions & Answers (100 - Hr block final test review (itc 2024) practice questions and answers which of the following is a requirement for all taxpayers who want to claim the eic? Get your tax questions answered and discover helpful tax calculators. Alternative is economic benefit definition. Market value of rights exercised in consumption + change in property rights over the term. Take the tax. You should also read this: West Memphis 3 Dna Testing