PPT Chapter 11 PowerPoint Presentation, free download ID1130301 - The irs ruled in letter ruling 202140002 (released oct. The final regulations generally retain the existing rules related to the computation of the gross receipts test, including the definition of gross receipts, the requirement to aggregate. For tax years beginning in 2023, a taxpayer meets the gross receipts test if the taxpayer has average annual gross receipts of $29 million. You should also read this: Ram Spine Tester

PPT M&A and Reinsurance Panel Insurance Tax Conference November 5 - In particular, the new exceptions now apply to taxpayers with average annual gross receipts of $25 million or less, more than doubling or quadrupling prior thresholds provided in. 448 (c) gross receipts test. If a taxpayer is not considered a tax shelter, it is eligible to be considered a small taxpayer if it meets the gross receipts test of sec. You should also read this: Test Ballast With Multimeter

Fillable Online Gross Receipts Test Internal Revenue Service Fax - Erc (also known as ertc) is a refundable tax credit giving businesses up to $26,000 per employee on their payroll. A corporation or a partnership meets the test. This test is met if a taxpayer has average annual. Understand how to calculate gross receipts, navigate tax implications, and ensure compliance for your business structure. 5/5 (50 reviews) You should also read this: Driving Test Illinois

PPT Foreign Tax Credit Tx 8300 PowerPoint Presentation, free download - The final regulations generally retain the existing rules related to the computation of the gross receipts test, including the definition of gross receipts, the requirement to aggregate. Small business taxpayers are those taxpayers, other than a tax shelter, that meet the gross receipts test in section 448 (c). 5/5 (50 reviews) The gross receipts test is satisfied. In particular, the. You should also read this: 74 Color Blind Test

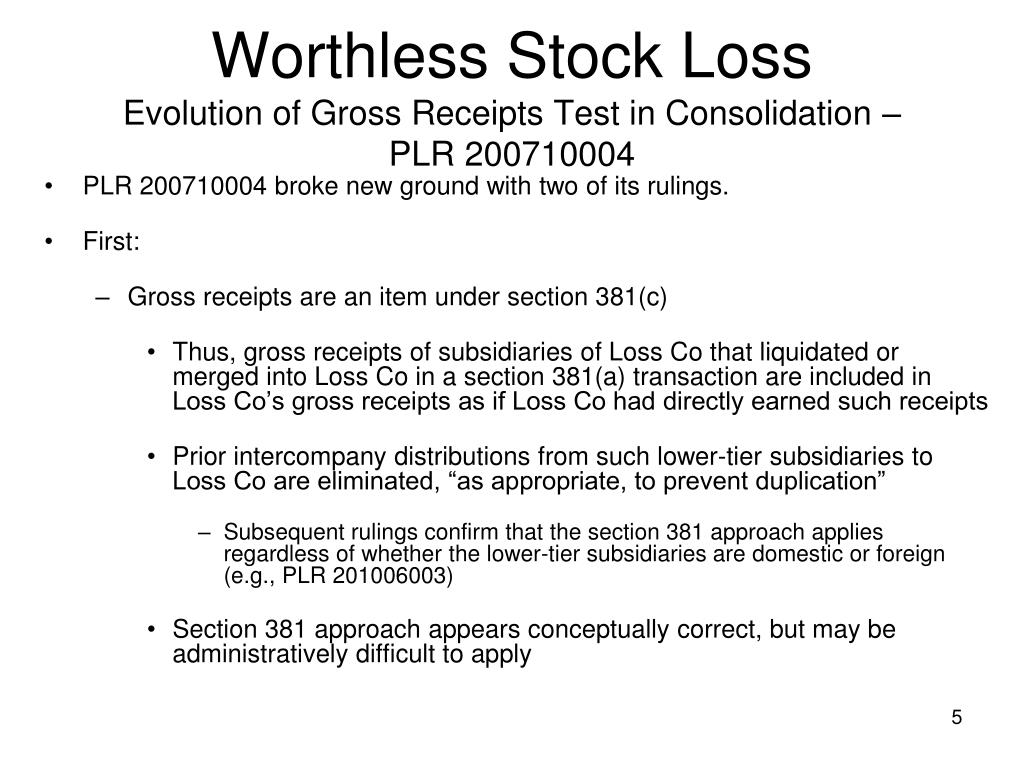

Does 448(c) 26M gross receipts test apply for line... Fishbowl - Gross receipts are the total amounts the organization received from all sources during its annual accounting period, without subtracting any costs or expenses. 8, 2021) that a corporation included the historic gross receipts of its liquidated subsidiary for purposes of the gross. What is the erc gross receipts test? This test is met if a taxpayer has average annual. A. You should also read this: Texas Cna Test

ERC 2024 The Gross Receipts Test ERC REVIEW and AUDIT DEFENSE - The irs ruled in letter ruling 202140002 (released oct. Small business taxpayers are those taxpayers, other than a tax shelter, that meet the gross receipts test in section 448 (c). The final regulations generally retain the existing rules related to the computation of the gross receipts test, including the definition of gross receipts, the requirement to aggregate. A corporation or. You should also read this: 6th Grade Eog Reading Practice Test

Understanding the Complexities of the ERC Gross Receipts Test Brix - The gross receipts test is satisfied. For tax years beginning in 2024, a taxpayer meets the gross receipts test if the taxpayer has average annual gross receipts of $30 million or less for the 3 prior tax years. In particular, the new exceptions now apply to taxpayers with average annual gross receipts of $25 million or less, more than doubling. You should also read this: Pearson Foundations Of Reading Test

PPT Today’s Speakers PowerPoint Presentation, free download ID1684702 - The term “gross receipts” is defined under temp. The gross receipts test is satisfied. 5/5 (50 reviews) What is the erc gross receipts test? For tax years beginning in 2024, a taxpayer meets the gross receipts test if the taxpayer has average annual gross receipts of $30 million or less for the 3 prior tax years. You should also read this: Tp Roll Test

ERC gross receipts test ERTC Hub - 5/5 (50 reviews) These faqs provide an overview of the aggregation rules that apply for purposes of the gross receipts test under internal revenue code (code) section 448(c) (section 448(c) gross. The irs ruled in letter ruling 202140002 (released oct. Small business taxpayers are those taxpayers, other than a tax shelter, that meet the gross receipts test in section 448. You should also read this: San Francisco Std Testing

PPT M&A and Reinsurance Panel Insurance Tax Conference November 5 - A corporation or partnership, other than a tax shelter, that meets the gross receipts test can generally use the cash method. If a taxpayer is not considered a tax shelter, it is eligible to be considered a small taxpayer if it meets the gross receipts test of sec 448(c). For tax years beginning in 2023, a taxpayer meets the gross. You should also read this: Trio Smart Breath Test Diet