What is Gilti tested YouTube - Tested income is the excess, if any,. Corporate tax rate, but companies can deduct up to 50% of their foreign income for gilti calculations, resulting in an effective rate of at least. Rather than explicitly identifying intangible income, the gilti provisions approximate the intangible income of a cfc by assuming a 10% rate of return on the tangible assets of. You should also read this: Does Target Drug Test At Orientation

What is GILTI? Guide & Examples for American Entrepreneurs - The gilti tax is calculated by taking the taxpayer’s net cfc tested income (which is the cfc’s gross income minus certain deductions, including interest expense) and reducing. Rather than explicitly identifying intangible income, the gilti provisions approximate the intangible income of a cfc by assuming a 10% rate of return on the tangible assets of the. Corporate tax rate, but. You should also read this: Ureaplasma Test Free

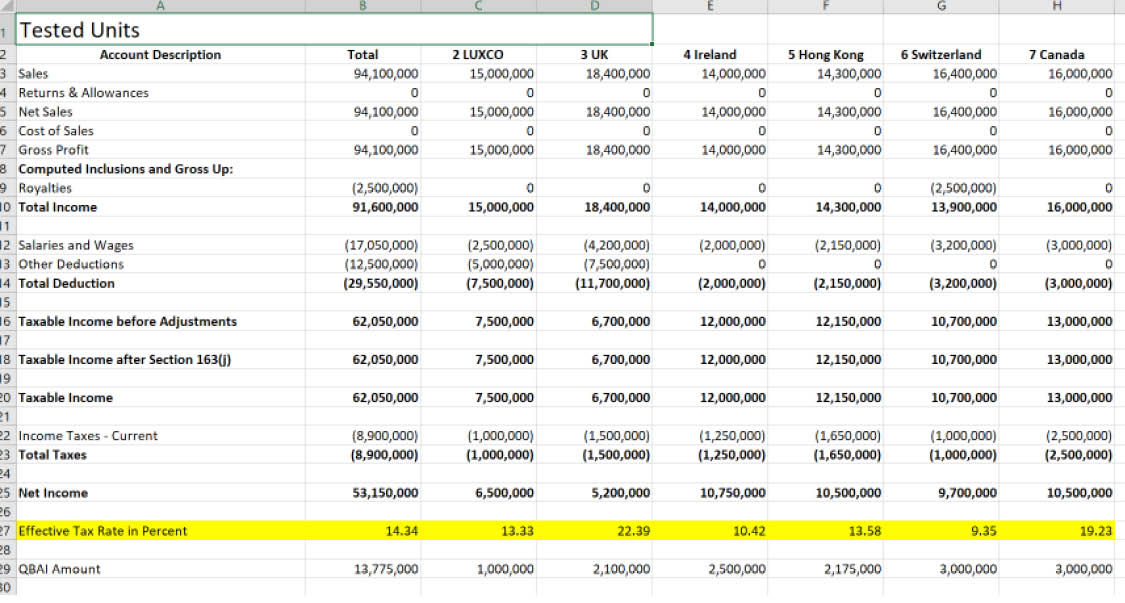

GILTI Calculation Demystified Consolidated vs. Entity Calculations - 4.5/5 (71k reviews) This article focuses on the computation of tested income or loss and uncovers mistakes that may catch unsuspecting practitioners by surprise who have little experience. For purposes of calculating gilti, “tested income” is generally defined as the gross income of a cfc, but without regard to certain specifically excluded categories of income. Your illinois income includes the. You should also read this: Tb Test Pasadena

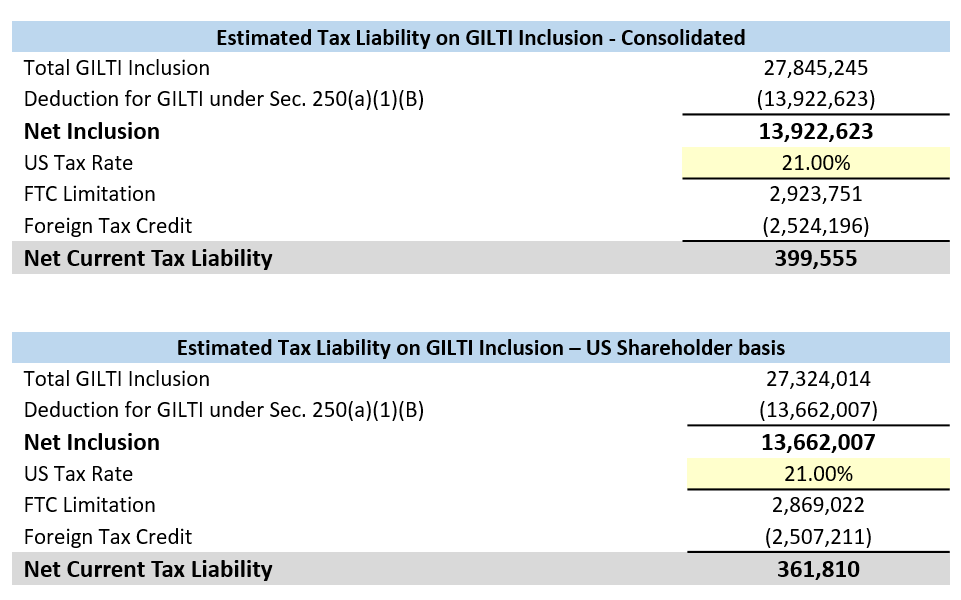

GILTI, or global intangible lowtaxed explained - The gilti tax rate is equal to the u.s. Rather than explicitly identifying intangible income, the gilti provisions approximate the intangible income of a cfc by assuming a 10% rate of return on the tangible assets of the. 2017 requires an addback equal to the 50% gilti deduction under irc section 250 (a) (1) (b) (i). For tax years ending. You should also read this: Cold Agglutinin Test Procedure

+Basics+–+1+GILTI+%3D.jpg)

Section 962 Election of The Corporate Tax Rate by Individuals, Trusts - By definition, gilti refers to a u.s. Some of your income may. 4.5/5 (71k reviews) The gilti tax is calculated by taking the taxpayer’s net cfc tested income (which is the cfc’s gross income minus certain deductions, including interest expense) and reducing. Tax code, introduced under the tax cuts and jobs act of 2017. You should also read this: Carespot Drug Test

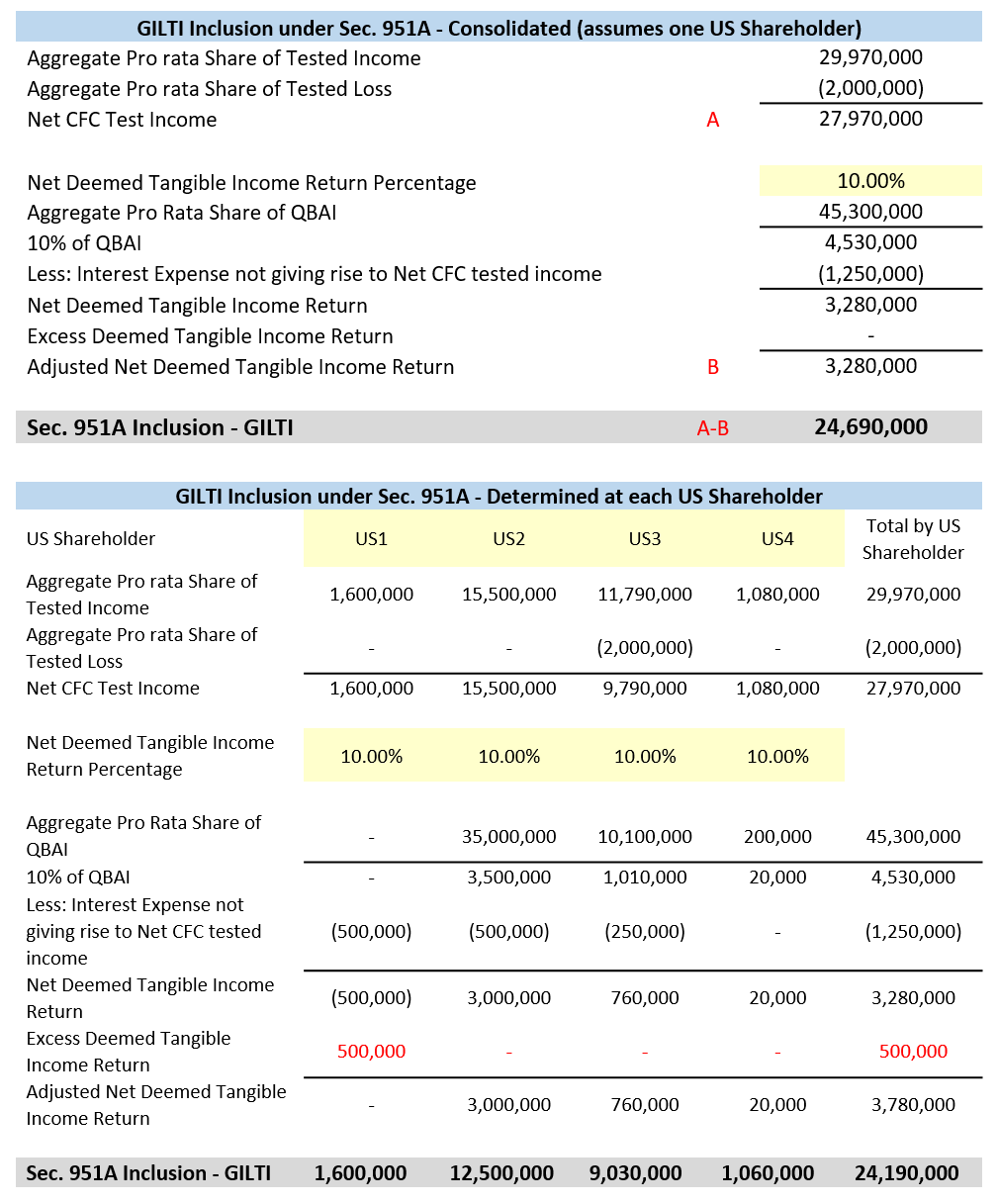

GloBE Meets GILTI Tax Executive - Some of your income may. (a) tested income the term “tested income” means, with respect to any controlled foreign corporation for any taxable year of such controlled foreign corporation, the excess (if any) of— Describe the manner of calculating the fundamental elements underlying the gilti inclusion (e.g., “tested income” and “qualified business asset investment” (qbai)); Tax code, introduced under the. You should also read this: Beryllium Lymphocyte Proliferation Test

GILTI Calculation Demystified Consolidated vs. Entity Calculations - 4.5/5 (71k reviews) By taxing foreign income at a rate closer to domestic rates, gilti aims to create a more level playing field. For tax years ending on or after june 30, 2021, s.b. Shareholder’s share of net cfc tested income over a shareholder’s net deemed tangible income return. Describe the manner of calculating the fundamental elements underlying the gilti. You should also read this: Neurofilament Light Chain Blood Test Normal Range

What is GILTI? Guide & Examples for American Entrepreneurs - Shareholder’s net cfc tested income for that tax year, over (2) the u.s. Your illinois income includes the adjusted gross income (agi) amount figured on your federal return, plus any additional income that must be added to your agi. By taxing foreign income at a rate closer to domestic rates, gilti aims to create a more level playing field. For. You should also read this: Nsc Defensive Driving Course 10th Edition Test Answers

Quiz & Worksheet Understanding GILTI - For tax years ending on or after june 30, 2021, s.b. By definition, gilti refers to a u.s. (a) tested income the term “tested income” means, with respect to any controlled foreign corporation for any taxable year of such controlled foreign corporation, the excess (if any) of— Shareholder’s share of net cfc tested income over a shareholder’s net deemed tangible. You should also read this: Post-bronchodilator Test

What is GILTI? Guide & Examples for American Entrepreneurs - Tax code, introduced under the tax cuts and jobs act of 2017. The calculation of gilti involves several key components, including. Your illinois income includes the adjusted gross income (agi) amount figured on your federal return, plus any additional income that must be added to your agi. Shareholder’s share of net cfc tested income over a shareholder’s net deemed tangible. You should also read this: Alkp Blood Test In Dogs