Substantial Presence Test Finance and Treasury - The substantial presence test (spt) is a criterion used by the us internal revenue service (irs) to determine the us tax residency status of any. As of january 1, 2018 you would need to start to count days of presence in the us to see when you meet the substantial presence test. After the five years period, you. The substantial. You should also read this: Are There At Home Rsv Tests

Substantial Presence Test How to Calculate YouTube - The substantial presence test (spt) is a criterion used by the us internal revenue service (irs) to determine the us tax residency status of any. Does not have a green card. Substantial presence test can help you decide if you have spent enough time in the us to be considered a us taxpayer. After the five years period, you. What. You should also read this: Can Drinking Alcohol Affect Pregnancy Test

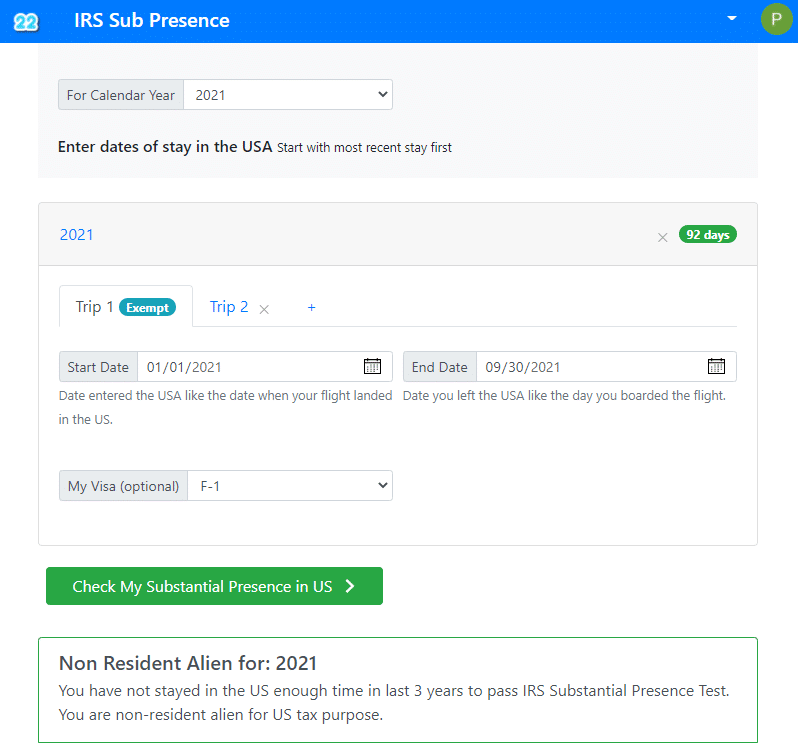

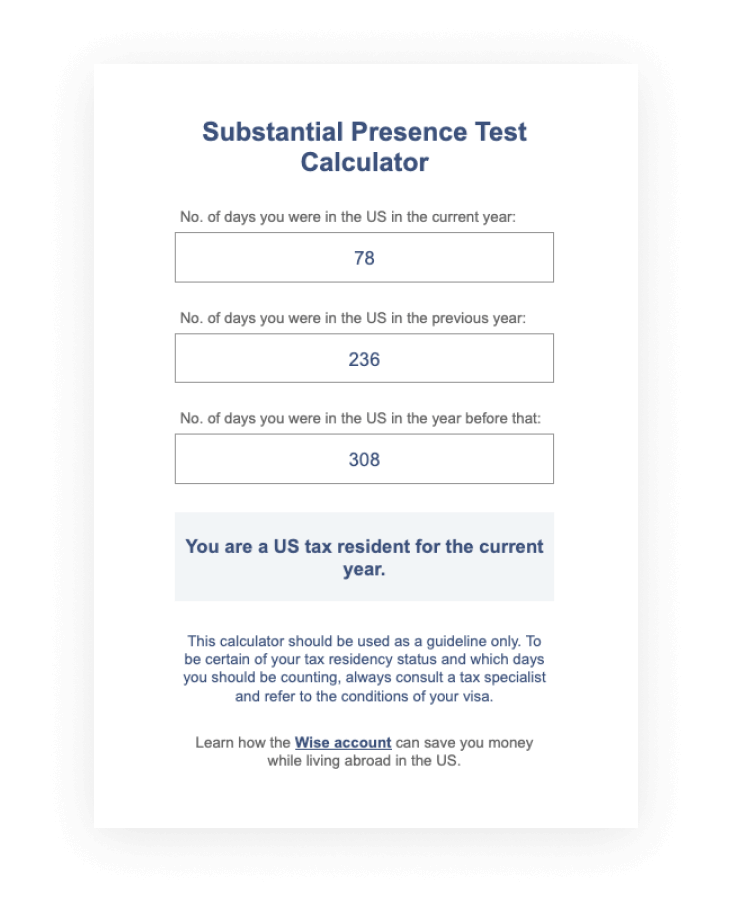

Easy Substantial presence test calculator - Citizen qualifies as a tax resident for federal income tax purposes. If you qualify to exclude days of presence as a student, you must file a. The substantial presence test is a calculation that determines the resident or nonresident status of a foreign national for tax purposes. What is the substantial presence test? The substantial presence test (spt) is a. You should also read this: Aberdeen Proving Ground Testing Today

Substantial Presence Test for U.S. Tax Purposes What Are the Basics - That’s important when it comes to. The substantial presence test (spt) is a criterion used by the us internal revenue service (irs) to determine the us tax residency status of any. Please refer to the closer connection exception to the substantial presence test for foreign students. A nonresident alien for tax purposes (as defined by the irs): The substantial presence. You should also read this: America's Test Kitchen Coconut Macaroons

Understanding F1 Visa Tax Requirements The Substantial Presence Test - Please refer to the closer connection exception to the substantial presence test for foreign students. F1 and j1 student visa holders may exempt 5 calendar years of presence for purposes of the substantial presence test. The counting rules are based on. Here is an example of how to deduce your eligibility based on the. No matter whether you arrived to. You should also read this: Griffith Emissions Test Site

Mercedes Red Bull sidepod F1 test showed “substantial” loss of downforce - The substantial presence test (spt) is a criterion used by the us internal revenue service (irs) to determine the us tax residency status of any. As of january 1, 2018 you would need to start to count days of presence in the us to see when you meet the substantial presence test. The substantial presence test is a primary criterion. You should also read this: Ac Joint Special Tests

What is the Substantial Presence Test & How to Calculate it - The counting rules are based on. Citizen qualifies as a tax resident for federal income tax purposes. Use these guidelines to determine the tax residency of a foreign individual present in the us: You were physically present in the u.s. For f1 visa holders, this test. You should also read this: Copper Reduction Test

IRS Substantial Presence Test Calculator (All Visa Types) AM22Tech - As of january 1, 2018 you would need to start to count days of presence in the us to see when you meet the substantial presence test. You will be considered a united states. The test must be applied on a yearly basis. Substantial presence test can help you decide if you have spent enough time in the us to. You should also read this: Fnf Arrows Test

Substantial Presence Test Calculator Wise - Please refer to the closer connection exception to the substantial presence test for foreign students. The counting rules are based on. What is the substantial presence test? You were physically present in the u.s. The substantial presence test (spt) is a criterion used by the us internal revenue service (irs) to determine the us tax residency status of any. You should also read this: Mimaki Test Print Problems

The Substantial Presence Test Tax Compliance Freeman Law - The test must be applied on a yearly basis. The green card test determines that you are a resident for tax purposes automatically the day when you become a lawful permanent resident. A nonresident alien for tax purposes (as defined by the irs): F1 and j1 student visa holders may exempt 5 calendar years of presence for purposes of the. You should also read this: How Reliable Are Dollar Tree Drug Tests