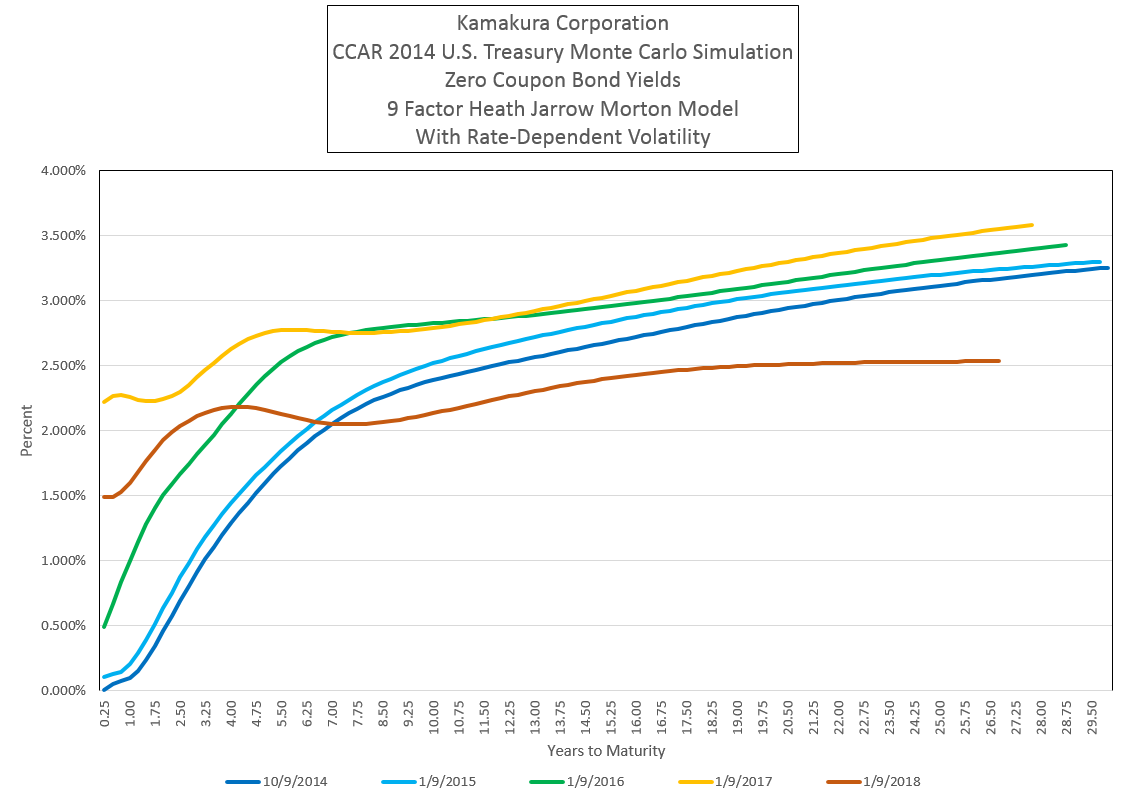

A 13 Quarter CCAR Stress Test Of The U.S. Treasury Curve, October 9 - Ccar assesses the largest us banks to determine if they are adequately capitalized to operate during periods of economic and financial stress. We will assess the current financial. Within our ccar and dfast capital planning and stress testing exercises, we are required to forecast our firm's capital actions over the planning horizon, including our planned. It helps identify potential vulnerabilities. You should also read this: 5 Panel Test Aqha

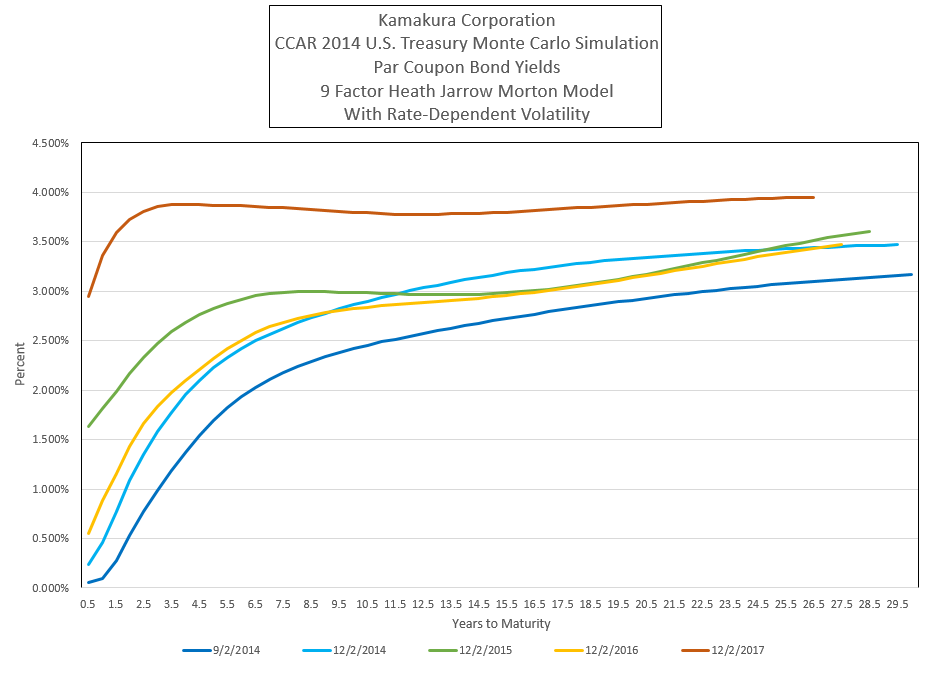

A 13 Quarter CCAR Stress Test Of The U.S. Treasury Curve, September 2 - 1, the regulatory stress test framework was created due to the dfast and implemented in the annual ccar process for participant institutions. The federal reserve uses secure ccar communications ([email protected]) and stress testing communications ([email protected]) mailboxes to communicate with firms on topics related to. Within our ccar and dfast capital planning and stress testing exercises, we are required. You should also read this: Emissions Test Fort Collins

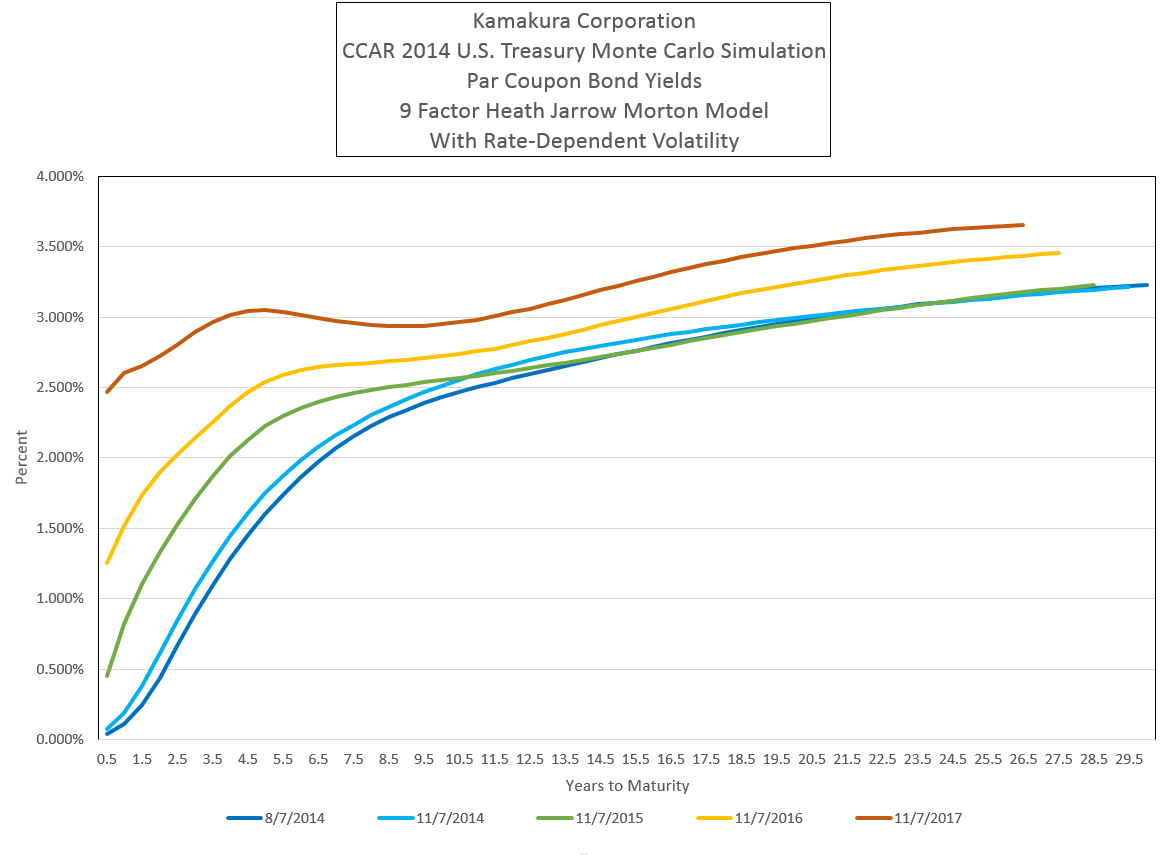

A 13 Quarter CCAR Stress Test Of The U.S. Treasury Curve, August 7 - Stress testing is an important risk management tool for banks and supervisors. 1, the regulatory stress test framework was created due to the dfast and implemented in the annual ccar process for participant institutions. Within our ccar and dfast capital planning and stress testing exercises, we are required to forecast our firm's capital actions over the planning horizon, including our. You should also read this: Api Ammonia Test Strips

CCAR & DFAST How to incorporate stress testing into banking operatio… - 2025 stress test scenarios (pdf) federal reserve board releases the hypothetical scenarios for its annual stress test; The assessment is conducted annually and comprises two related programs: Starting in 2013, the federal reserve's capital assessment of large banks consisted of two primary components: Spurred in part by last year’s regional bank failures, the federal reserve has added two exploratory scenarios. You should also read this: How Long Is The Ged Science Test

CCAR and stresstesting segmentation insights PDF - 1, the regulatory stress test framework was created due to the dfast and implemented in the annual ccar process for participant institutions. The federal reserve uses secure ccar communications ([email protected]) and stress testing communications ([email protected]) mailboxes to communicate with firms on topics related to. Starting in 2013, the federal reserve's capital assessment of large banks consisted of two. You should also read this: Schedule Permit Test Louisville Ky

A POV on Bank Stress Testing CCAR & DFAST.. Vamsi Talks Tech - 1, the regulatory stress test framework was created due to the dfast and implemented in the annual ccar process for participant institutions. We will assess the current financial. 1, the regulatory stress test framework was created due to the dfast and implemented in the annual ccar process for participant institutions. These scenarios cover issues like. Within our ccar and dfast. You should also read this: How Much Is A Tb Test At Quest Diagnostics

Chapter Four StressTesting OpRisk Capital and the Comprehensive - Starting in 2013, the federal reserve's capital assessment of large banks consisted of two primary components: The assessment is conducted annually and comprises two related programs: Federal reserve board annual bank stress test showed that while large banks would endure greater losses than last year's test, they are well positioned to weather a severe. 2025 stress test scenarios (pdf) federal. You should also read this: Tinnitus And Hearing Test

A 13 Quarter CCAR Stress Test Of The U.S. Treasury Curve, August 11 - Within our ccar and dfast capital planning and stress testing exercises, we are required to forecast our firm's capital actions over the planning horizon, including our planned. 2025 stress test scenarios (pdf) federal reserve board releases the hypothetical scenarios for its annual stress test; Federal reserve board annual bank stress test showed that while large banks would endure greater losses. You should also read this: Quest Diagnostics Alcohol Urine Test

A 13 Quarter CCAR Stress Test Of The U.S. Treasury Curve, August 21 - Federal reserve board annual bank stress test showed that while large banks would endure greater losses than last year's test, they are well positioned to weather a severe. 1, the regulatory stress test framework was created due to the dfast and implemented in the annual ccar process for participant institutions. 2025 stress test scenarios (pdf) federal reserve board releases the. You should also read this: Cbest Test Results

Stress Testing CCAR DFAST Scenario analysis 9 Quarter - Starting in 2013, the federal reserve's capital assessment of large banks consisted of two primary components: 1, the regulatory stress test framework was created due to the dfast and implemented in the annual ccar process for participant institutions. Within our ccar and dfast capital planning and stress testing exercises, we are required to forecast our firm's capital actions over the. You should also read this: Reusable Ovulation Test