Physical Presence Test vs. Bona Fide Residence US Tax Filing - Citizens and resident aliens to exclude a certain amount of their foreign earnings from u.s. You must pass the bona fide. You meet the physical presence test if you are physically present in a foreign country or countries 330 full days during any period of 12 consecutive months including some part of the year at. To qualify for the foreign. You should also read this: False Negative Cvs Pregnancy Test

![Bona Fide Residence Test [Guide + Examples] Bona Fide Residence Test [Guide + Examples]](https://blog.savvynomad.io/content/images/size/w1200/2024/05/JPEG-image-3F0FA039121D-1.jpeg)

Bona Fide Residence Test [Guide + Examples] - One of the major differences between the bona fide residence test vs. Once you are eligible for this benefit, you can fill out form 2555, which can be. To qualify for the foreign earned income exclusion, you need to pass either the bona fide residence test or the physical presence test. Expats learn how these tests affect their taxes, with.. You should also read this: Quick Fix For Dot Drug Test

Bona Fide Residence and Physical Presence Test US Expat Taxation - To qualify, expats will need to pass the bona fide residence test or the physical presence test. What is the bona fide residence test? To qualify for the foreign earned income exclusion (feie), you must pass either the bona fide residence test or the physical presence test. The physical presence test is that the ppt depends on how long individual. You should also read this: Alt Blood Test 57

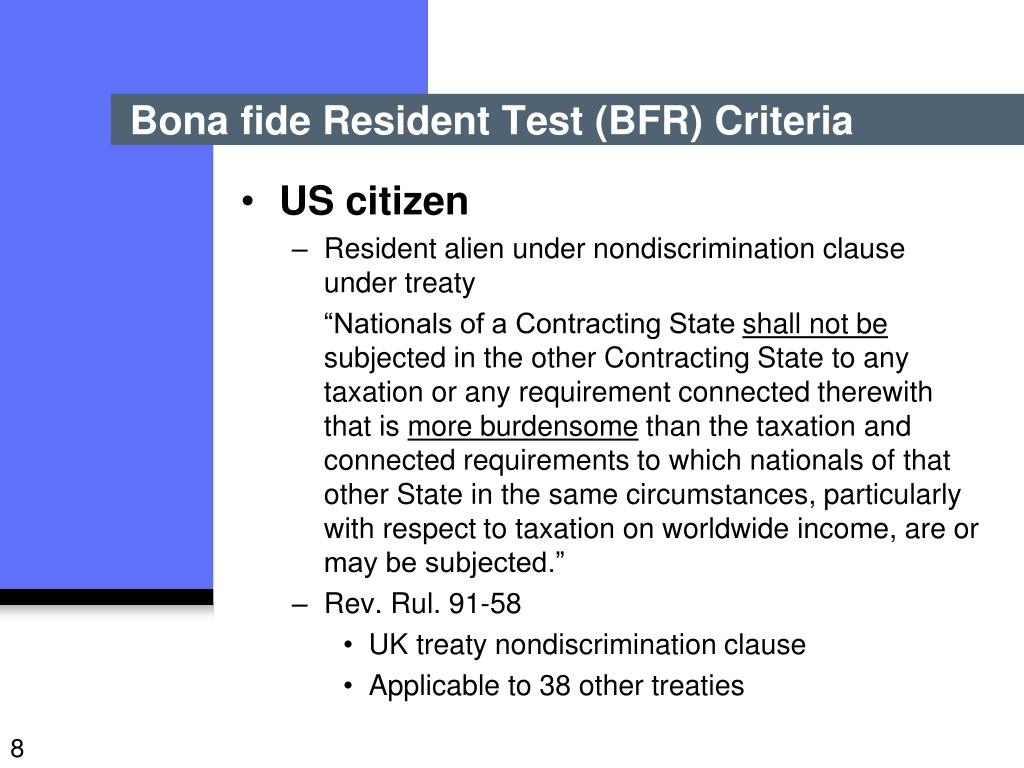

PPT Agenda for Class 2 and 3 PowerPoint Presentation, free download - To qualify for the foreign earned income exclusion (feie), you must pass either the bona fide residence test or the physical presence test. To qualify, expats must pass either the physical presence test or the bona fide residence test. Discover key insights into qualifying for foreign earned income exclusions, understand the nuances between bona fide and. Once you are eligible. You should also read this: Florida Driver's Permit Test Online

Foreign Earned Exclusion Bona Fide Residence vs. Physical - Unlike the physical presence test, which simply counts days abroad, the bona fide residence test looks at the quality and permanence of your ties to a foreign country. The waiver of time requirements allows a taxpayer. In order to claim the foreign earned income exclusion, or feie, a us expat must have a tax home that is located outside of. You should also read this: Achpn Practice Test

Bona Fide Residence vs. Physical Presence Test - Expats learn how these tests affect their taxes, with. There are two exceptions to meeting the minimum time requirements under the bona fide residence and the physical presence tests: Whether you are a bona fide resident of a foreign country is determined by the facts of your situation and may include such factors as your intention or purpose for being. You should also read this: Jon Tester Abortion

How to qualify for the Physical Presence Test to use FEIE 1040 Abroad - To qualify, expats will need to pass the bona fide residence test or the physical presence test. You meet the physical presence test if you are physically present in a foreign country or countries 330 full days during any period of 12 consecutive months including some part of the year at. To qualify for the foreign earned income exclusion, you. You should also read this: Cmp With Egfr Labcorp Test Code

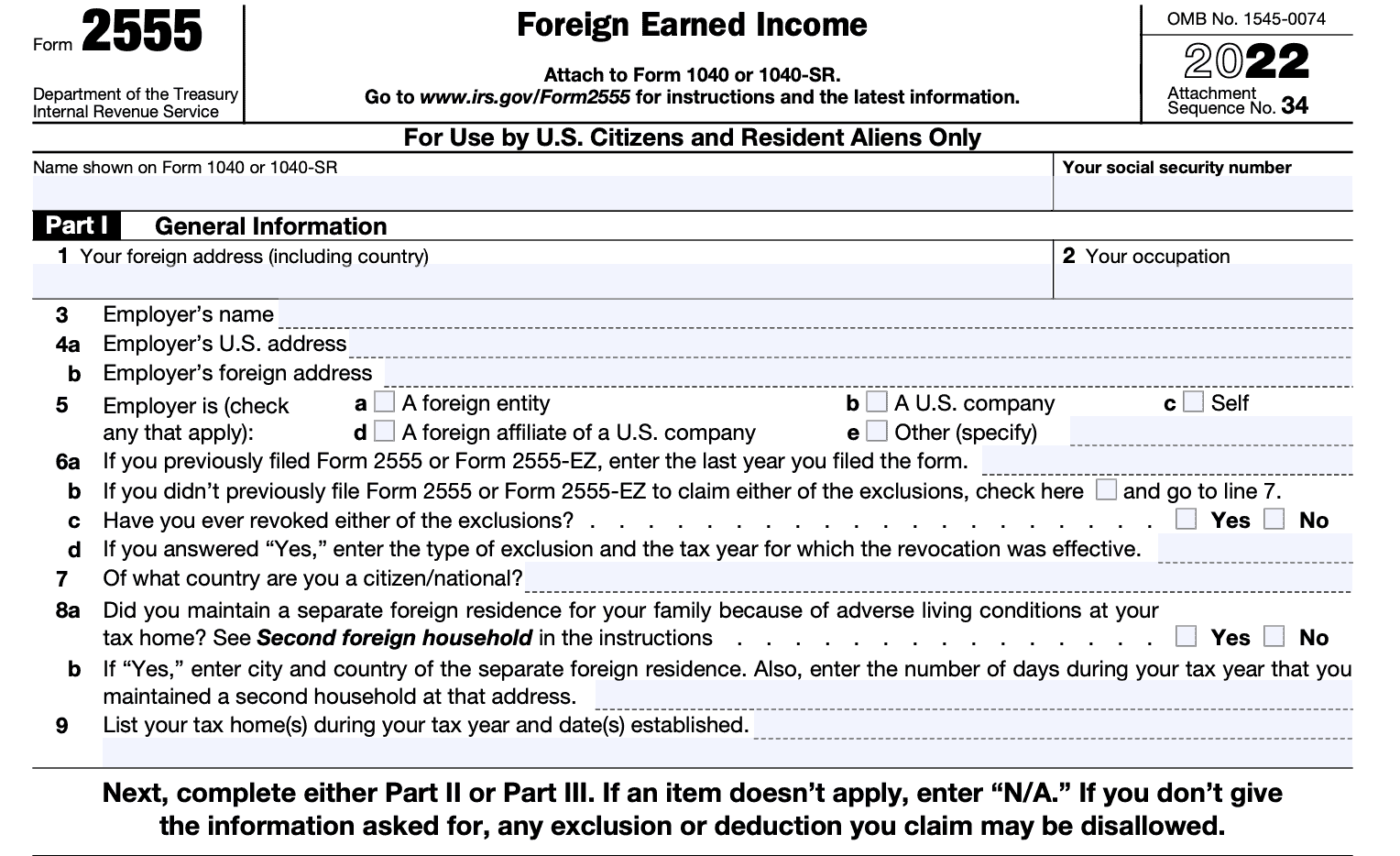

IRS Form 2555 A Foreign Earned Guide - There are two exceptions to meeting the minimum time requirements under the bona fide residence and the physical presence tests: To qualify for the foreign earned income exclusion, you need to pass either the bona fide residence test or the physical presence test. Discover key insights into qualifying for foreign earned income exclusions, understand the nuances between bona fide and.. You should also read this: Oneadvisor-800 Caa Pim Test

Bona Fide Residence Test What Is It And How It Works - What is the bona fide residence test? To qualify for the foreign earned income exclusion, you need to pass either the bona fide residence test or the physical presence test. One of the major differences between the bona fide residence test vs. The feie allows qualifying u.s. In order to claim the foreign earned income exclusion, or feie, a us. You should also read this: Blood Test For Progesterone

Jan 18, Thursday What is Bona Fide Residence or Physical Presence - Discover key insights into qualifying for foreign earned income exclusions, understand the nuances between bona fide and. This article focuses on the bona fide residence test, providing updated information for 2024 and detailing everything you need to know to claim it. Once you are eligible for this benefit, you can fill out form 2555, which can be. To claim this. You should also read this: Occult Heartworm Test