Tax Legislation Announced by Taxwriting Chairs Wyden and Smith Would - These funds could be allocated for. Reducing the 50% test to 25% could finance nearly 1.5 million additional affordable homes through the housing credit and pabs over the next 10 years.1 states could. In this week’s tax credit tuesday podcast, michael novogradac, cpa, novogradac partner jim kroger, cpa, and novogradac principal melissa chung, cpa, discuss the 50% test for. In. You should also read this: Quest Diagnostics Aurora Ogden - Employer Drug Testing Not Offered

Results of onebyone models and final model for LIHTC and PH - The “50 percent test”, a statutory program rule, limits states and localities from maximizing the use of private activity bonds through an unnece ssarily high threshold for lihtc generation. The includability of investment earnings in the 50 percent test analysis can be a useful tool for deals facing delays and cost overruns that may jeopardize the ability to meet the.. You should also read this: Labcorp Tb Test Price

Article Will the AIT Live Happily Ever After? - These funds could be allocated for. The “50 percent test”, a statutory program rule, limits states and localities from maximizing the use of private activity bonds through an unnece ssarily high threshold for lihtc generation. The failure to meet the 50 percent test significantly reduces the lihtcs available to a project and generally renders the project unviable, as the equity. You should also read this: Culture Fair Tests Attempt To Measure

The 50 Test for Housing Tax Credit - These funds could be allocated for. The “50 percent test”, a statutory program rule, limits states and localities from maximizing the use of private activity bonds through an unnece ssarily high threshold for lihtc generation. The includability of investment earnings in the 50 percent test analysis can be a useful tool for deals facing delays and cost overruns that may. You should also read this: Shl Excel Test Answers

Testing Center National Center for Housing Management - Reducing the 50% test to 25% could finance nearly 1.5 million additional affordable homes through the housing credit and pabs over the next 10 years.1 states could. The includability of investment earnings in the 50 percent test analysis can be a useful tool for deals facing delays and cost overruns that may jeopardize the ability to meet the. The “50. You should also read this: Does Aldi's Drug Test

The 50 Test for Housing Tax Credit - In the example above, if the $7.5. The failure to meet the 50 percent test significantly reduces the lihtcs available to a project and generally renders the project unviable, as the equity contributed by investors in exchange for. In this week’s tax credit tuesday podcast, michael novogradac, cpa, novogradac partner jim kroger, cpa, and novogradac principal melissa chung, cpa, discuss. You should also read this: Drug Test Temperature Fail

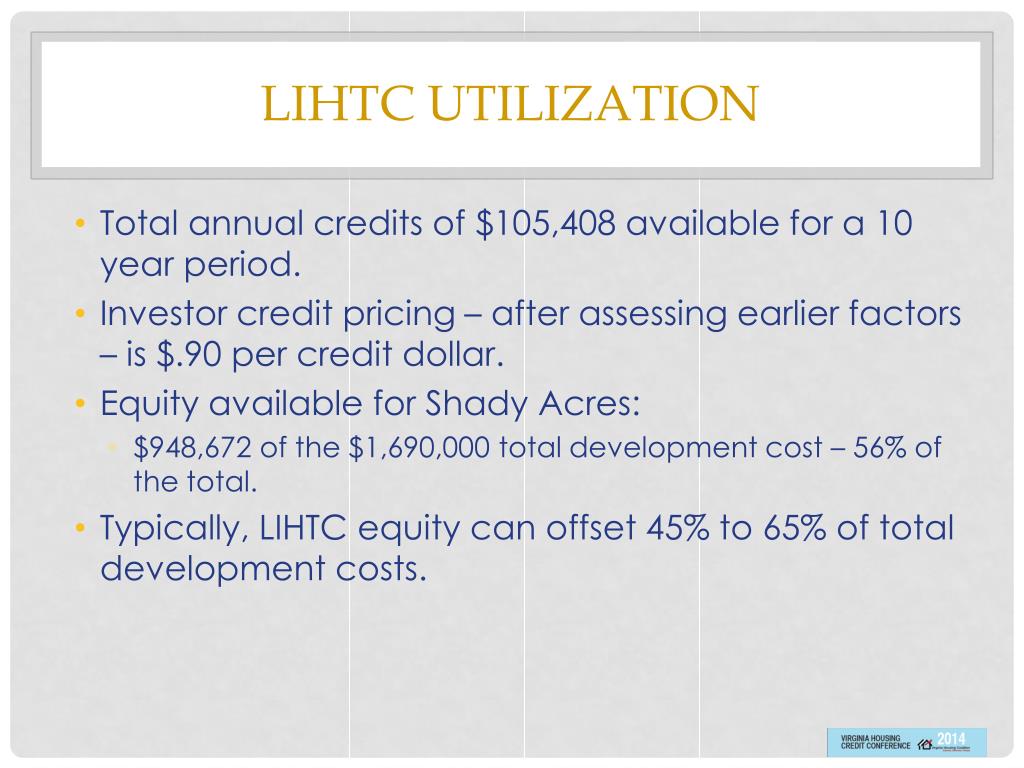

PPT Beginner’s Guide to LIHTC PowerPoint Presentation, free download - In the example above, if the $7.5. In this week’s tax credit tuesday podcast, michael novogradac, cpa, novogradac partner jim kroger, cpa, and novogradac principal melissa chung, cpa, discuss the 50% test for. These funds could be allocated for. The failure to meet the 50 percent test significantly reduces the lihtcs available to a project and generally renders the project. You should also read this: Zeeland Driving Test

Bifurcated Structures for Financing ppt download - Reducing the 50% test to 25% could finance nearly 1.5 million additional affordable homes through the housing credit and pabs over the next 10 years.1 states could. In this week’s tax credit tuesday podcast, michael novogradac, cpa, novogradac partner jim kroger, cpa, and novogradac principal melissa chung, cpa, discuss the 50% test for. The includability of investment earnings in the. You should also read this: Ec-6 Core Subjects Practice Test

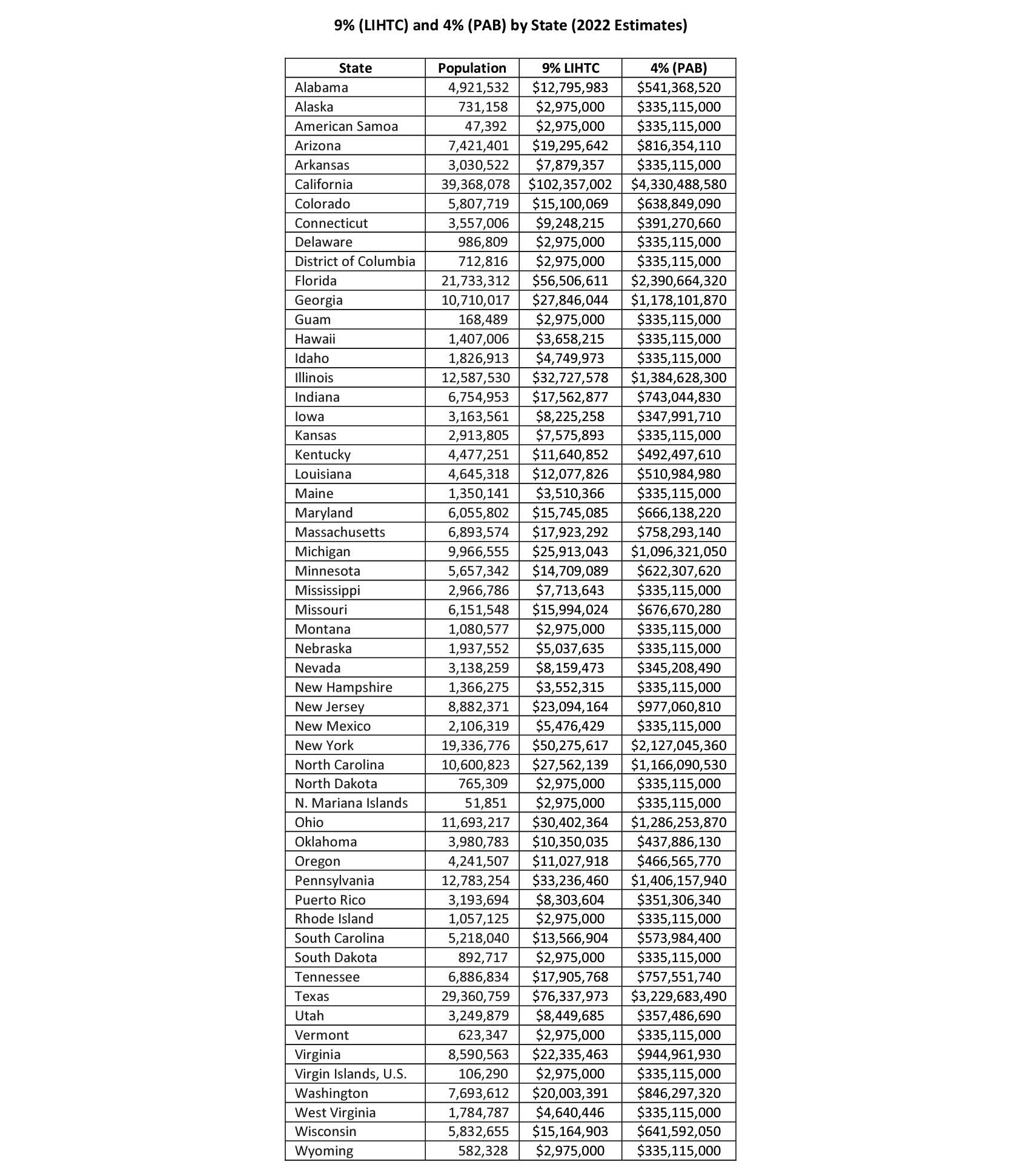

Understanding how LIHTC Amounts are Determined for Each State HDJ - Reducing the 50% test to 25% could finance nearly 1.5 million additional affordable homes through the housing credit and pabs over the next 10 years.1 states could. The failure to meet the 50 percent test significantly reduces the lihtcs available to a project and generally renders the project unviable, as the equity contributed by investors in exchange for. In the. You should also read this: Can Apple Juice Make A Pregnancy Test Positive

Aug. 15, 2023 So You Want to Be a LIHTC Developer 4 Factors to Meet - These funds could be allocated for. The failure to meet the 50 percent test significantly reduces the lihtcs available to a project and generally renders the project unviable, as the equity contributed by investors in exchange for. The includability of investment earnings in the 50 percent test analysis can be a useful tool for deals facing delays and cost overruns. You should also read this: Entry Level Qa Tester Jobs Remote