2023 Expert Guide to Safe Harbor Match Options ForUsAll Blog - The test is designed to ensure that highly compensated. 401 (k), profit sharing, money purchase, etc.) is considered to be top heavy when more than 60% of plan assets are attributable to “key. Top heavy 401(k) plan testing is an annual test required for all 401(k) plan sponsors. This ratio is tested every year based on account. This ensures that. You should also read this: Boston Aphasia Test

Top Heavy 401(k) Plan Rules, Minimum Contributions & Consequences - Personal finance & taxesbudget guides & adviceexplore aarp® benefits If your workplace plan is a roth 401(k), withdrawals will avoid penalties under the rule of 55. This ensures that key employees don’t hold more than 60% of the plan’s total assets. This occurs when highly paid employees own more than 60% of. In general, a defined contribution plan (i.e. You should also read this: Anatomy Lab Practical Practice Test

Navigating topheavy 401(k) tests Everything you need to know in 2023 - This ratio is tested every year based on the account balances on the last day of the prior plan year. If your workplace plan is a roth 401(k), withdrawals will avoid penalties under the rule of 55. Failing these tests can mean refunding. This ratio is tested every year based on account. Personal finance & taxesbudget guides & adviceexplore aarp®. You should also read this: Home Depot Pool Test Strips

PPT Mastering 401(k) Testing Strategies and Solutions for Plan - A 401(k) plan is considered top heavy when the account balances of “key employees” exceed 60% of total plan assets. The test breaks down plan assets and limits key employees to owning 60 percent or. The employer must generally pay a minimum 3% benefit to the. Retirement calculatoractively managed fundsdigital investing program This ratio is tested every year based on. You should also read this: Mold Testing Jacksonville Nc

Demystifying Top Heavy 401k Plans What You Need to Know Guidant - Personal finance & taxesbudget guides & adviceexplore aarp® benefits Retirement calculatoractively managed fundsdigital investing program This occurs when highly paid employees own more than 60% of. However, remember that taxes on. The test breaks down plan assets and limits key employees to owning 60 percent or. You should also read this: Express Employment Drug Test Reviews

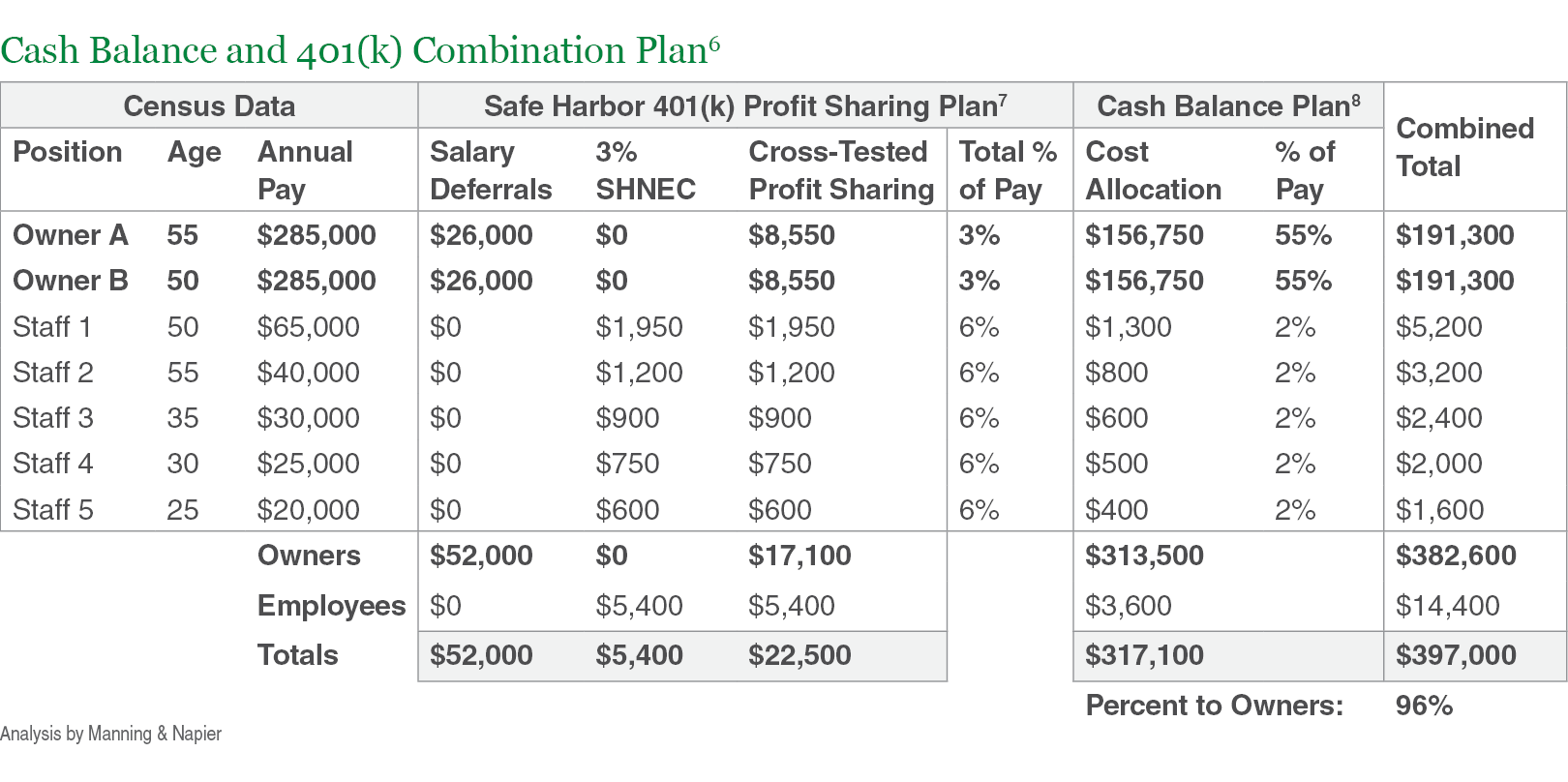

What is a Cash Balance Plan? Manning & Napier - 401 (k), profit sharing, money purchase, etc.) is considered to be top heavy when more than 60% of plan assets are attributable to “key. The test breaks down plan assets and limits key employees to owning 60 percent or. If your workplace plan is a roth 401(k), withdrawals will avoid penalties under the rule of 55. Highly compensated employees’ threshold. You should also read this: Mo Road Signs Practice Test

PPT Module 4 Fundamentals of 401(k) Plans PowerPoint Presentation - This ratio is tested every year based on the account balances on the last day of the prior plan year. In general, a defined contribution plan (i.e. This ensures that key employees don’t hold more than 60% of the plan’s total assets. 401 (k), profit sharing, money purchase, etc.) is considered to be top heavy when more than 60% of. You should also read this: Beryllium Lymphocyte Proliferation Test

What Is a Top Heavy 401(k) Plan? Finance Strategists - Retirement calculatoractively managed fundsdigital investing program Highly compensated employees’ threshold for nondiscrimination testing. If so, your plan may be top heavy. This ratio is tested every year based on the account balances on the last day of the prior plan year. The employer must generally pay a minimum 3% benefit to the. You should also read this: Will Methocarbamol Show On A Drug Test

ERISA Review/Training Peter Sullivan & Peter Welsh May 810, ppt download - However, remember that taxes on. The test breaks down plan assets and limits key employees to owning 60 percent or. Top heavy 401(k) plan testing is an annual test required for all 401(k) plan sponsors. 401 (k) compliance testing confirms you’re meeting the internal revenue service (irs) standards for retirement plans so that you and your employees can take advantage. You should also read this: Negative Test At 11dpo

401k Limits For 2025 Ruby S Dennis - A 401(k) plan is considered top heavy when the account balances of “key employees” exceed 60% of total plan assets. Personal finance & taxesbudget guides & adviceexplore aarp® benefits The employer must generally pay a minimum 3% benefit to the. Each other plan of the employer which. Retirement calculatoractively managed fundsdigital investing program You should also read this: Is The Cogat An Iq Test