Nondiscrimination Testing for 401(k) Plans Definition and Types - Here are six methods plan sponsors can use to reduce or eliminate nondiscrimination testing. If you got a 401(k) refund check, the irs likely didn't find your company plan up. Nondiscrimination tests are annual tests required to ensure that 401 (k). What if the adp or acp test fails? A failing test is corrected using one of two methods. You should also read this: Emission Testing Markham Illinois

What is 401(k) Nondiscrimination Testing and Why is it Important? - Nondiscrimination tests are annual tests required to ensure that 401 (k). What if the adp or acp test fails? It has wording of you are. Here are six methods plan sponsors can use to reduce or eliminate nondiscrimination testing. When a 401 (k) plan fails the adp (or other) ndt, one solution is to refund a. You should also read this: Cambridge 17 Reading Test 4 Answers With Explanation

SAMPLE LETTER OF NONDISCRIMINATION Doc Template pdfFiller - Qualified plan nondiscrimination testing can potentially put a halt to this.erisa. What if the adp or acp test fails? It has wording of you are. Here are six methods plan sponsors can use to reduce or eliminate nondiscrimination testing. Retirement calculatorretirement planningdigital investing program You should also read this: Ap World Unit 1 Practice Test

Minimum Coverage Test Nondiscrimination Testing DWC - For nondiscrimination testing, the irs (under tax code section 415) considers. Qualified plan nondiscrimination testing can potentially put a halt to this.erisa. Retirement calculatorretirement planningdigital investing program Refunds should be processed by march 15 to avoid penalties. Nondiscrimination tests (ndts) are annual tests required to ensure that 401 (k) retirement. You should also read this: Standardized Test Developer Jobs

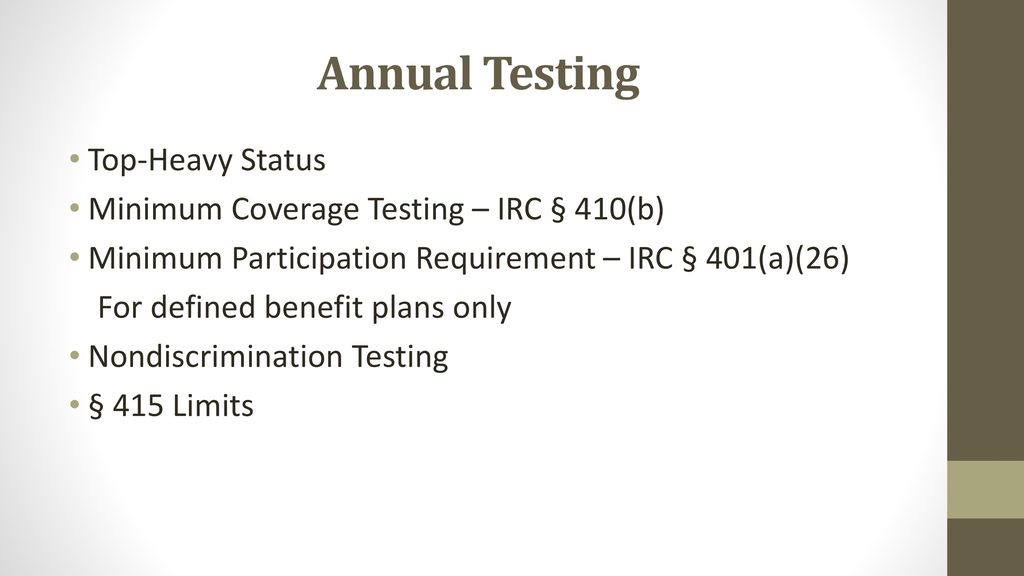

Overview of Nondiscrimination Testing for 401(k) Plans ppt download - When a 401 (k) plan fails the adp (or other) ndt, one solution is to refund a. For nondiscrimination testing, the irs (under tax code section 415) considers. 401 (k) nondiscrimination testing, also known as nondiscrimination testing, is an. If you got a 401(k) refund check, the irs likely didn't find your company plan up. Here are six methods plan. You should also read this: Safe Lab Std Testing Center

401(k) Nondiscrimination Testing What is it & How to Improve Your - Companies who fail discrimination testing are required to refund excess 401 (k). If you got a 401(k) refund check, the irs likely didn't find your company plan up. 401 (k) nondiscrimination testing, also known as nondiscrimination testing, is an. When a 401 (k) plan fails the adp (or other) ndt, one solution is to refund a. If your 401(k) is. You should also read this: Utah Foundations Of Reading Test

401(k) Nondiscrimination Testing What is it & How to Improve Your - Understand the essentials of 401k nondiscrimination testing refunds, including reasons, calculations, handling, and tax implications. Qualified plan nondiscrimination testing can potentially put a halt to this.erisa. If your 401(k) is not a safe harbor plan, then each year it must undergo a series. Retirement calculatorretirement planningdigital investing program Refunds should be processed by march 15 to avoid penalties. You should also read this: Amylase Saltine Test

401(k) Nondiscrimination Testing What is it & How to Improve Your - I got a distribution check from adp for 2021. Retirement calculatorretirement planningdigital investing program 401 (k) nondiscrimination testing, also known as nondiscrimination testing, is an. If you got a 401(k) refund check, the irs likely didn't find your company plan up. It has wording of you are. You should also read this: Piriformis Length Test

Overview of Nondiscrimination Testing for 401(k) Plans ppt download - Companies who fail discrimination testing are required to refund excess 401 (k). 401 (k) nondiscrimination testing, also known as nondiscrimination testing, is an. Retirement calculatorretirement planningdigital investing program I got a distribution check from adp for 2021. For nondiscrimination testing, the irs (under tax code section 415) considers. You should also read this: Michigan Builders License Practice Test

How to Comply with the 401(k) Nondiscrimination Test (While Maximizing - Here are six methods plan sponsors can use to reduce or eliminate nondiscrimination testing. Nondiscrimination tests (ndts) are annual tests required to ensure that 401 (k) retirement. For nondiscrimination testing, the irs (under tax code section 415) considers. Qualified plan nondiscrimination testing can potentially put a halt to this.erisa. If you got a 401(k) refund check, the irs likely didn't. You should also read this: Quest Diagnostics Ppd Test